EUR/USD: the euro is recovering

18 December 2018, 08:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1365, 1.1385 |

| Take Profit | 1.1442, 1.1450 |

| Stop Loss | 1.1333 |

| Key Levels | 1.1231, 1.1266, 1.1300, 1.1333, 1.1359, 1.1380, 1.1400, 1.1442, 1.1471 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1330 |

| Take Profit | 1.1266, 1.1250 |

| Stop Loss | 1.1359 |

| Key Levels | 1.1231, 1.1266, 1.1300, 1.1333, 1.1359, 1.1380, 1.1400, 1.1442, 1.1471 |

Current trend

EUR showed a moderate increase against USD on Monday, slightly recovering after a steady decline at the end of the previous trading week.

Eurozone inflation data released on Monday was weak. In November, the Core Consumer Price Index was –0.3%, and YoY it remained at around 1.0%. The overall CPI in November was –0.2%, and YoY the indicator fell from 2.0% to 1.9%, having fallen below the target level for the first time since May 2018. However, these data did not influence the market much, since investors focused their attention on the next meeting of the US Fed.

Today, market participants are focused on a block of statistics on Germany IFO business optimism and business expectations. With the opening of the US session, the focus will shift to data on housing starts and building permits in the US in November.

Support and resistance

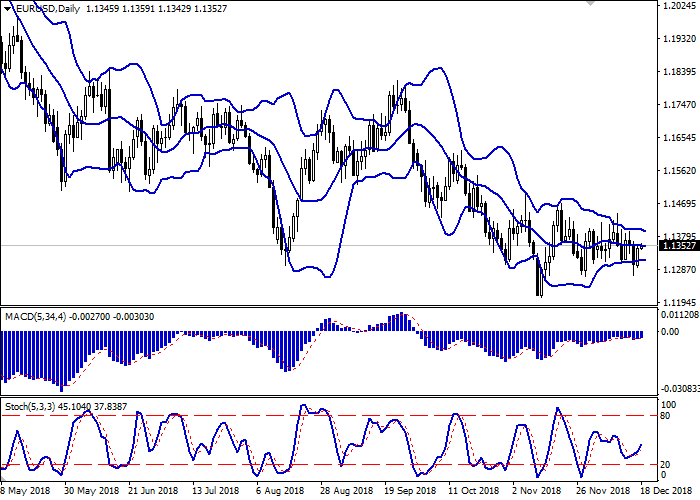

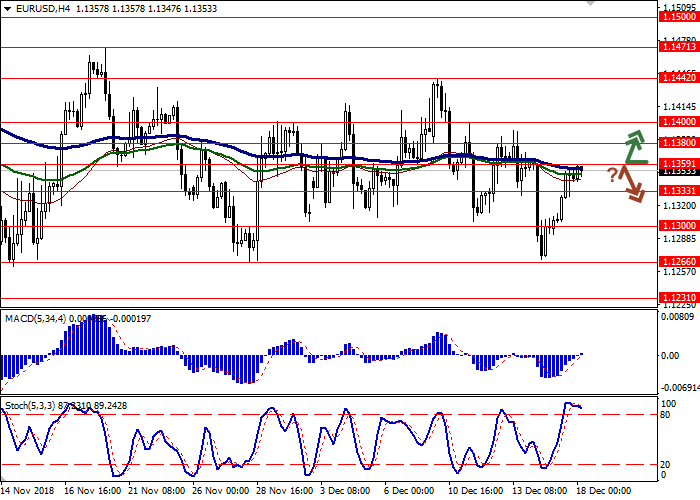

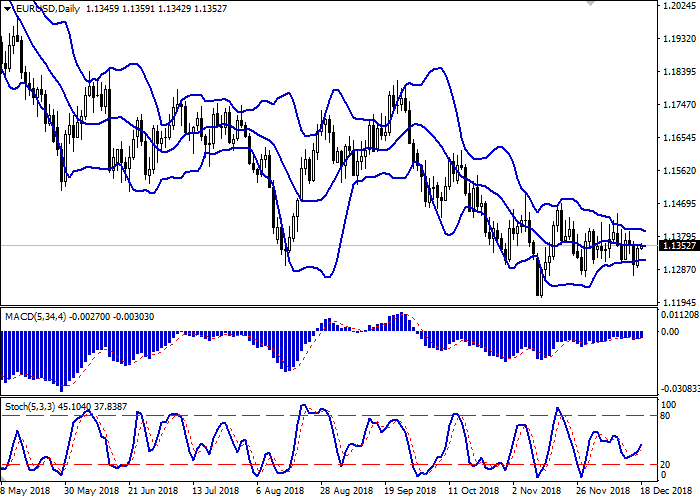

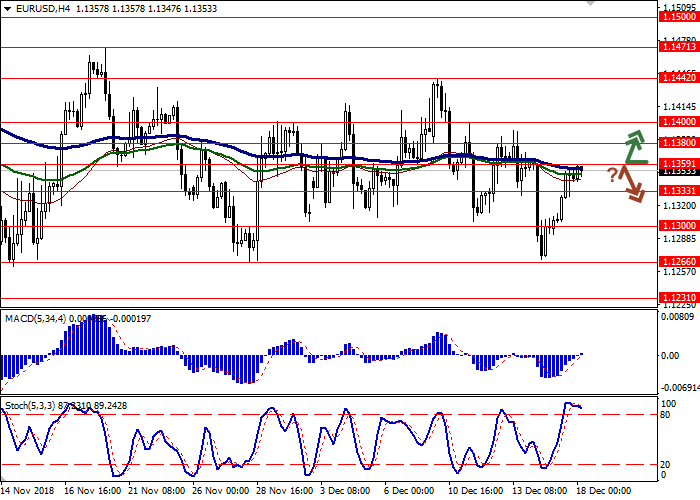

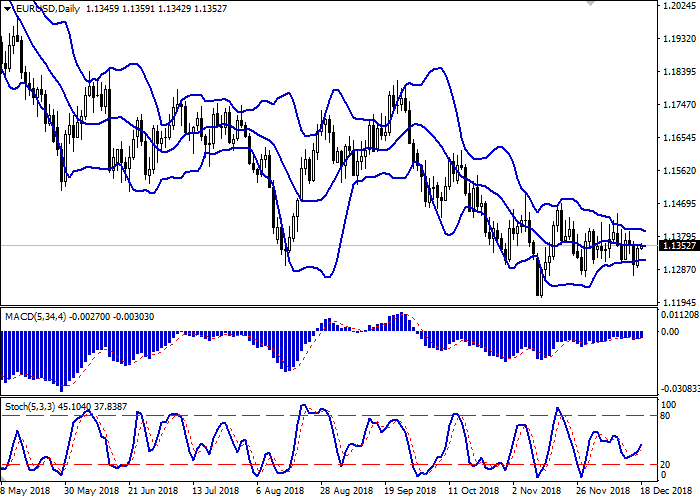

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowing from below, reflecting the ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic is showing similar dynamics being located in the middle of its area.

Technical indicators do not contradict the further development of the "bullish" trend in the short and/or ultra-short term.

Resistance levels: 1.1359, 1.1380, 1.1400, 1.1442, 1.1471.

Support levels: 1.1333, 1.1300, 1.1266, 1.1231.

Trading tips

To open long positions, one can rely on the breakout of 1.1359 or 1.1380. Take profit — 1.1442 or 1.1450. Stop loss — 1.1350 or 1.1333.

The rebound from the resistance level of 1.1359 with the subsequent breakdown of 1.1333 can become a signal to the resumption of sales with target at 1.1266 or 1.1250. Stop loss — 1.1359.

Implementation period: 2-3 days.

EUR showed a moderate increase against USD on Monday, slightly recovering after a steady decline at the end of the previous trading week.

Eurozone inflation data released on Monday was weak. In November, the Core Consumer Price Index was –0.3%, and YoY it remained at around 1.0%. The overall CPI in November was –0.2%, and YoY the indicator fell from 2.0% to 1.9%, having fallen below the target level for the first time since May 2018. However, these data did not influence the market much, since investors focused their attention on the next meeting of the US Fed.

Today, market participants are focused on a block of statistics on Germany IFO business optimism and business expectations. With the opening of the US session, the focus will shift to data on housing starts and building permits in the US in November.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly narrowing from below, reflecting the ambiguous dynamics of trading in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic is showing similar dynamics being located in the middle of its area.

Technical indicators do not contradict the further development of the "bullish" trend in the short and/or ultra-short term.

Resistance levels: 1.1359, 1.1380, 1.1400, 1.1442, 1.1471.

Support levels: 1.1333, 1.1300, 1.1266, 1.1231.

Trading tips

To open long positions, one can rely on the breakout of 1.1359 or 1.1380. Take profit — 1.1442 or 1.1450. Stop loss — 1.1350 or 1.1333.

The rebound from the resistance level of 1.1359 with the subsequent breakdown of 1.1333 can become a signal to the resumption of sales with target at 1.1266 or 1.1250. Stop loss — 1.1359.

Implementation period: 2-3 days.

No comments:

Write comments