Brent Crude Oil: general review

18 December 2018, 11:47

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 57.75 |

| Take Profit | 56.20, 53.30, 51.35 |

| Stop Loss | 58.75 |

| Key Levels | 48.85, 51.35, 53.30, 54.35, 56.20, 57.10, 57.90, 59.50, 60.75, 63.35, 64.10, 66.75, 68.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 60.75, 63.35 |

| Take Profit | 56.20, 53.30, 51.35 |

| Stop Loss | 64.30 |

| Key Levels | 48.85, 51.35, 53.30, 54.35, 56.20, 57.10, 57.90, 59.50, 60.75, 63.35, 64.10, 66.75, 68.00 |

Current trend

Oil quotes continue to decline after a slight correction in early December.

The price has moved to the lateral consolidation and continues to test the local minimum at 57.90. The drop in demand, the growth of oil production in the United States, and the strengthening of USD remain the main catalysts for the decline. Now quotes consolidated within the range of 57.90–63.35. This week, data on changes in oil reserves from the US Department of Energy, the Fed's decision on interest rates, and the following press conference can give an impulse to the instrument. It is quite possible that the downward impulse may intensify amid the Fed interest rate increase. At the same time, US oil reserves may show growth compared with the previous month.

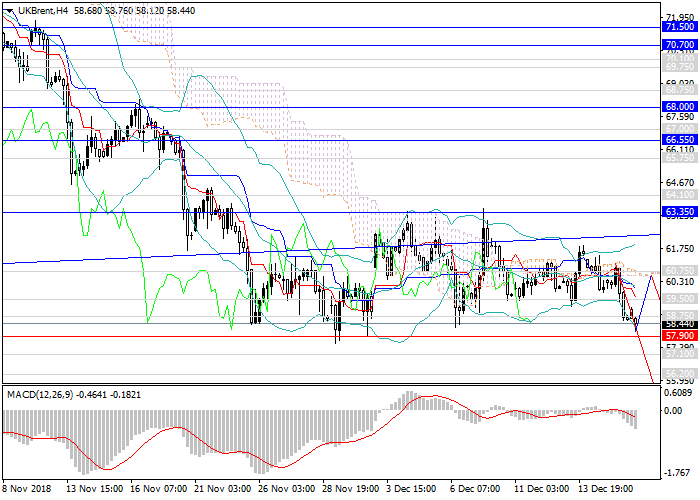

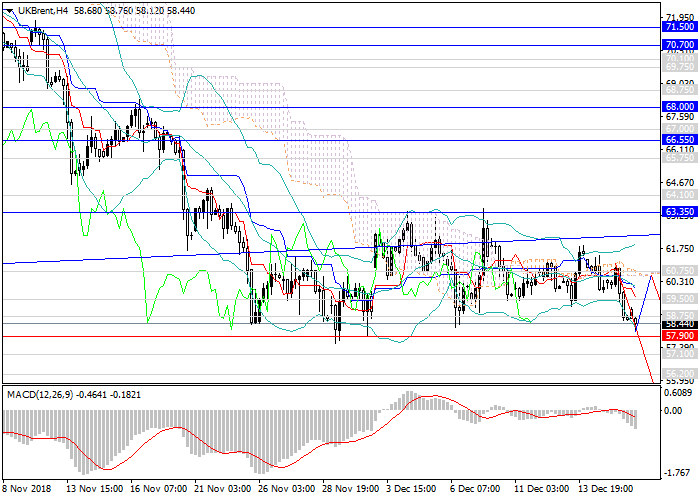

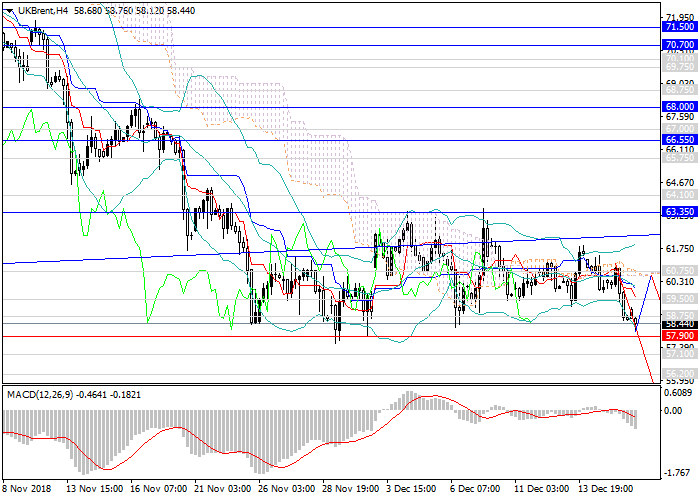

Support and resistance

Technically, the pair remains in a downward range, and after taking the key support level of 57.90, the price may fall to USD 53–55 per barrel. In the long term, one can consider levels of 50.50, 48.85. Technical indicators on H4 chart and above confirm downward trend forecast: MACD shows the growth of the volume of short positions, and Bollinger Bands are pointing downwards.

Resistance levels: 59.50, 60.75, 63.35, 64.10, 66.75, 68.00.

Support levels: 57.90, 57.10, 56.20, 54.35, 53.30, 51.35, 48.85.

Trading tips

Short positions may be opened from the current level; deferred short positions may be opened from the nearest resistance levels of 60.75, 63.35 with targets at 56.20, 53.30, 51.35 and stop loss at 64.30.

Oil quotes continue to decline after a slight correction in early December.

The price has moved to the lateral consolidation and continues to test the local minimum at 57.90. The drop in demand, the growth of oil production in the United States, and the strengthening of USD remain the main catalysts for the decline. Now quotes consolidated within the range of 57.90–63.35. This week, data on changes in oil reserves from the US Department of Energy, the Fed's decision on interest rates, and the following press conference can give an impulse to the instrument. It is quite possible that the downward impulse may intensify amid the Fed interest rate increase. At the same time, US oil reserves may show growth compared with the previous month.

Support and resistance

Technically, the pair remains in a downward range, and after taking the key support level of 57.90, the price may fall to USD 53–55 per barrel. In the long term, one can consider levels of 50.50, 48.85. Technical indicators on H4 chart and above confirm downward trend forecast: MACD shows the growth of the volume of short positions, and Bollinger Bands are pointing downwards.

Resistance levels: 59.50, 60.75, 63.35, 64.10, 66.75, 68.00.

Support levels: 57.90, 57.10, 56.20, 54.35, 53.30, 51.35, 48.85.

Trading tips

Short positions may be opened from the current level; deferred short positions may be opened from the nearest resistance levels of 60.75, 63.35 with targets at 56.20, 53.30, 51.35 and stop loss at 64.30.

No comments:

Write comments