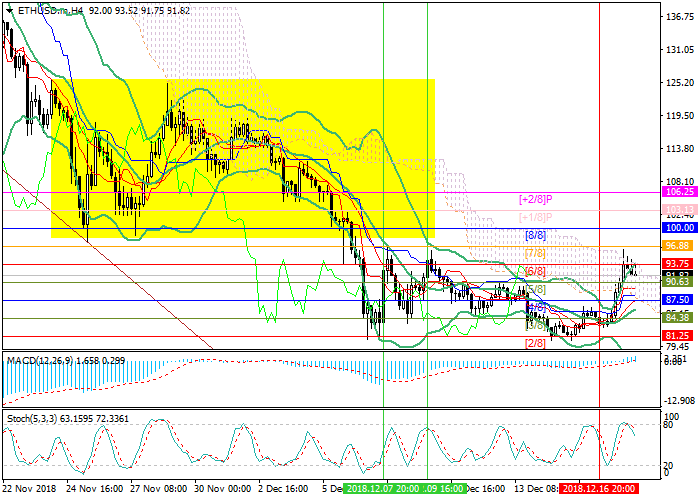

Ethereum: technical analysis

18 December 2018, 12:16

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 90.00 |

| Take Profit | 87.50, 84.38, 81.25 |

| Stop Loss | 94.00 |

| Key Levels | 81.25, 84.38, 87.50, 90.63, 93.75, 96.88, 100.00, 125.00, 150.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 94.20 |

| Take Profit | 100.00 |

| Stop Loss | 90.00 |

| Key Levels | 81.25, 84.38, 87.50, 90.63, 93.75, 96.88, 100.00, 125.00, 150.00 |

Current trend

Ether quotes started the week with significant growth, as did the rest of the cryptocurrency market as a whole. The price rose to 96.24, but has now been adjusted and is trading at 93.75 (Murray [6/8]). If the price consolidates above this level, growth may continue to the level of 100.00 (Murray [8/8]). However, the exit of the Stochastic from the overbought zone indicates a resumption of decline to the levels of 87.50 (Murray [4/8]), 84.38 (Murray [3/8]), 81.25 (Murray [2/8]). In general, the current growth can not be identified with a trend reversal. The price has already risen twice to the area of 95.00 at the beginning of this month, but then returned to fall. The growth will be confirmed above the 100.00 level. In this case, the price may reach 125.00 (Murray [2/8], D1) and 150.00 (Murray [4/8], D1).

Support and resistance

Support levels: 90.63, 87.50, 84.38, 81.25.

Resistance levels: 93.75, 96.88, 100.00, 125.00, 150.00.

Trading tips

Short positions can be opened at 90.00 with targets at 87.50, 84.38, 81.25 and a stop loss around 94.00.

Long positions should be opened above the level of 93.75 with the target of 100.00 and a stop loss around 90.00.

Implementation period: 3-5 days.

Ether quotes started the week with significant growth, as did the rest of the cryptocurrency market as a whole. The price rose to 96.24, but has now been adjusted and is trading at 93.75 (Murray [6/8]). If the price consolidates above this level, growth may continue to the level of 100.00 (Murray [8/8]). However, the exit of the Stochastic from the overbought zone indicates a resumption of decline to the levels of 87.50 (Murray [4/8]), 84.38 (Murray [3/8]), 81.25 (Murray [2/8]). In general, the current growth can not be identified with a trend reversal. The price has already risen twice to the area of 95.00 at the beginning of this month, but then returned to fall. The growth will be confirmed above the 100.00 level. In this case, the price may reach 125.00 (Murray [2/8], D1) and 150.00 (Murray [4/8], D1).

Support and resistance

Support levels: 90.63, 87.50, 84.38, 81.25.

Resistance levels: 93.75, 96.88, 100.00, 125.00, 150.00.

Trading tips

Short positions can be opened at 90.00 with targets at 87.50, 84.38, 81.25 and a stop loss around 94.00.

Long positions should be opened above the level of 93.75 with the target of 100.00 and a stop loss around 90.00.

Implementation period: 3-5 days.

No comments:

Write comments