Brent Crude Oil: general review

10 December 2018, 14:17

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 60.45 |

| Take Profit | 58.80 |

| Stop Loss | 61.35 |

| Key Levels | 57.50, 58.95, 60.90, 62.88, 65.04, 66.85, 68.39, 70.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 61.40 |

| Take Profit | 62.90 |

| Stop Loss | 60.80 |

| Key Levels | 57.50, 58.95, 60.90, 62.88, 65.04, 66.85, 68.39, 70.50 |

Current trend

Last week, Brent crude oil was traded in both directions. The long-term pressure on the market persists, but the instrument has kept from falling below the important psychological level of 60.00.

On Friday, quotes strengthened amid OPEC+ agreements to reduce total production by 1.2 million barrels per day. In addition, crude oil stocks in the US domestic market have declined for the first time in 11 weeks. However, on Friday at 21:00 (GMT+2), Baker Hughes report on active oil platforms had a significant but short-term pressure on the instrument, reflecting growth in drilling activity in the United States. Most experts say that the volume of OPEC reduction is insufficient to return the market to a deficit.

Tomorrow (at 23:30 GMT+2), API will publish data on the weekly change in reserves of commercial oil in the US.

Support and resistance

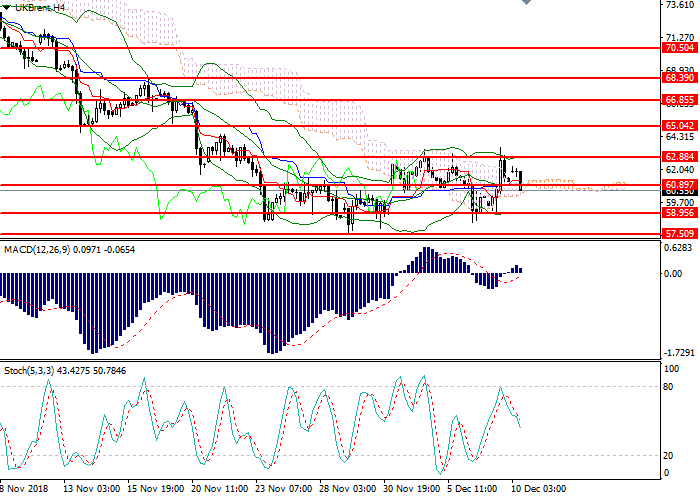

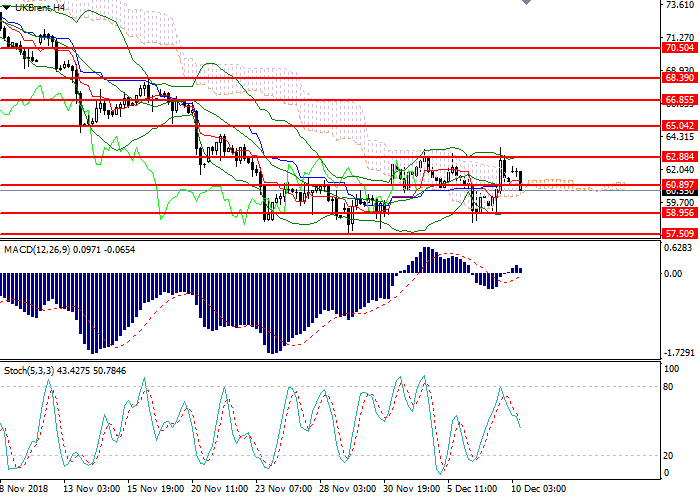

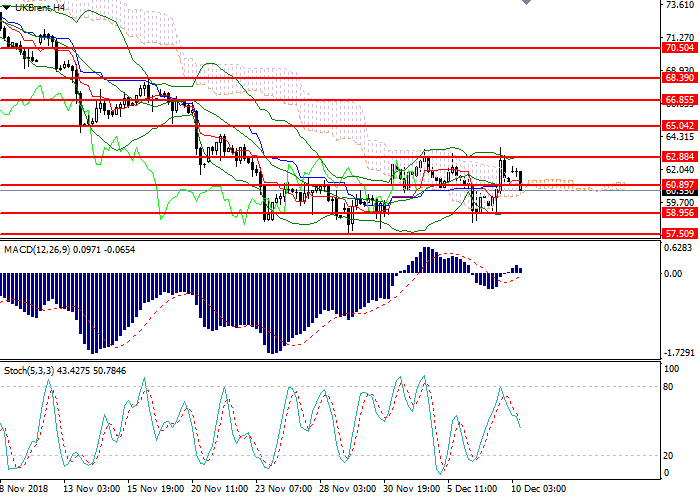

On H4 chart, the instrument is trying to consolidate below the middle line of Bollinger Bands, which is the key support level. The indicator is directed horizontally, and the price range expands, indicating a further fall in the instrument. MACD histogram is correcting in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal to open positions.

Support levels: 60.90, 58.95, 57.50.

Resistance levels: 62.88, 65.04, 66.85, 68.39, 70.50.

Trading tips

Short positions may be opened below the level of 60.50 with the target at 58.80 and stop loss at 61.35.

Long positions may be opened above the level of 61.35 with the target at 62.90 and stop loss at 60.80.

Implementation period: 1-3 days.

Last week, Brent crude oil was traded in both directions. The long-term pressure on the market persists, but the instrument has kept from falling below the important psychological level of 60.00.

On Friday, quotes strengthened amid OPEC+ agreements to reduce total production by 1.2 million barrels per day. In addition, crude oil stocks in the US domestic market have declined for the first time in 11 weeks. However, on Friday at 21:00 (GMT+2), Baker Hughes report on active oil platforms had a significant but short-term pressure on the instrument, reflecting growth in drilling activity in the United States. Most experts say that the volume of OPEC reduction is insufficient to return the market to a deficit.

Tomorrow (at 23:30 GMT+2), API will publish data on the weekly change in reserves of commercial oil in the US.

Support and resistance

On H4 chart, the instrument is trying to consolidate below the middle line of Bollinger Bands, which is the key support level. The indicator is directed horizontally, and the price range expands, indicating a further fall in the instrument. MACD histogram is correcting in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal to open positions.

Support levels: 60.90, 58.95, 57.50.

Resistance levels: 62.88, 65.04, 66.85, 68.39, 70.50.

Trading tips

Short positions may be opened below the level of 60.50 with the target at 58.80 and stop loss at 61.35.

Long positions may be opened above the level of 61.35 with the target at 62.90 and stop loss at 60.80.

Implementation period: 1-3 days.

No comments:

Write comments