EUR/USD: general review

10 December 2018, 13:54

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.1418 |

| Take Profit | 1.1474, 1.1535 |

| Stop Loss | 1.1370 |

| Key Levels | 1.1230, 1.1291, 1.1352, 1.1413, 1.1474, 1.1535 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1345 |

| Take Profit | 1.1291, 1.1230 |

| Stop Loss | 1.1380 |

| Key Levels | 1.1230, 1.1291, 1.1352, 1.1413, 1.1474, 1.1535 |

Current trend

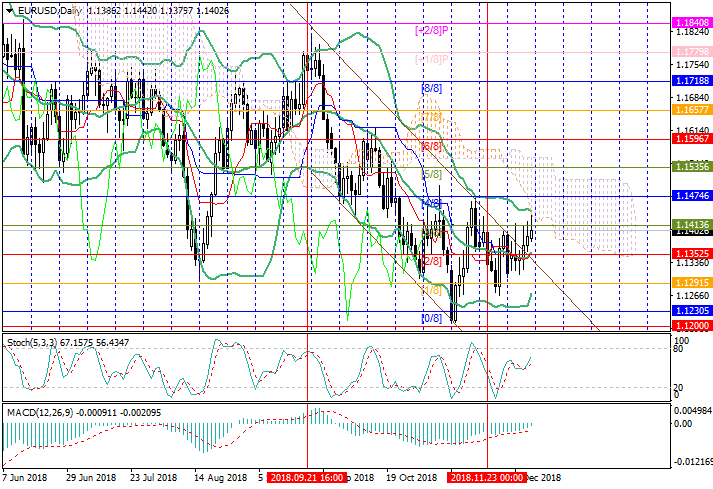

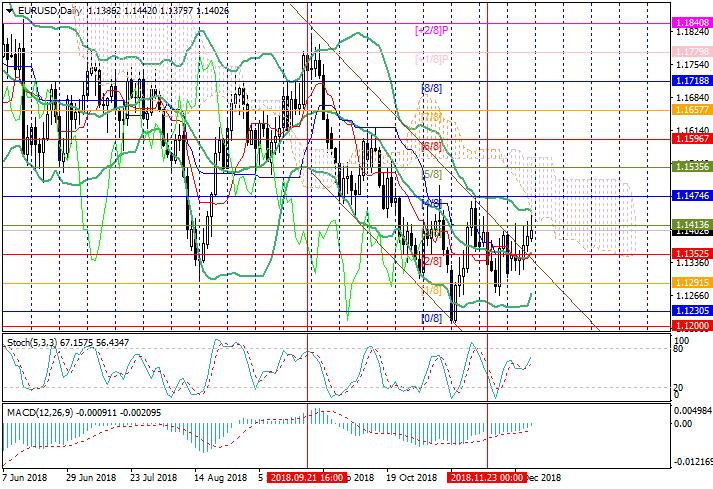

Since last week, the pair has been growing and is currently testing the level of 1.1423 (Murrey [3/8]).

USD is pressured by comments of James Bullard, the head of the FRB of St. Louis. He said that the Fed may refuse to raise interest rates at the December meeting because of the inverted yield curve, which may indicate a near economic recession. According to Bullard, the increase can be postponed until January 2019. Earlier, regulator already hinted at a slowdown but it was believed to happen only next year.

European investors today are generally calm because they expect tomorrow’s vote on the treaty with the EU in the British Parliament. The probability of rejection remains high. The US-Chinese trade relations are also in the focus. Despite market fears, China didn't react harshly to the arrest of Huawei Finance Director Meng Wanzhou. However, US Trade Representative Robert Lighthizer stated that the agreement with Beijing should be concluded before March 1. Ootherwise, a new increase in duties is likely.

Support and resistance

If the instrument consolidates above 1.1413, growth can continue to 1.1474 (Murrey [4/8]) and 1.1535 (Murrey [5/8]). 1.1352 (Murray [2/8], the midline of Bollinger Bands) is seen as key for the "bears". Its breakdown will give the prospect of a further decline to 1.1291 (Murrey [1/8]) and 1.1230 (Murrey [0/8]).

Technical indicators show growth: Stochastic is directed upwards, MACD histogram is about to enter the positive zone and to form a buy signal.

Support levels: 1.1352, 1.1291, 1.1230.

Resistance levels: 1.1413, 1.1474, 1.1535.

Trading tips

Long positions may be opened above 1.1413 with targets at 1.1474, 1.1535 and stop loss at 1.1370.

Short positions may be opened below 1.1352 with targets at 1.1291, 1.1230 and stop loss at 1.1380.

Implementation period: 4-5 days.

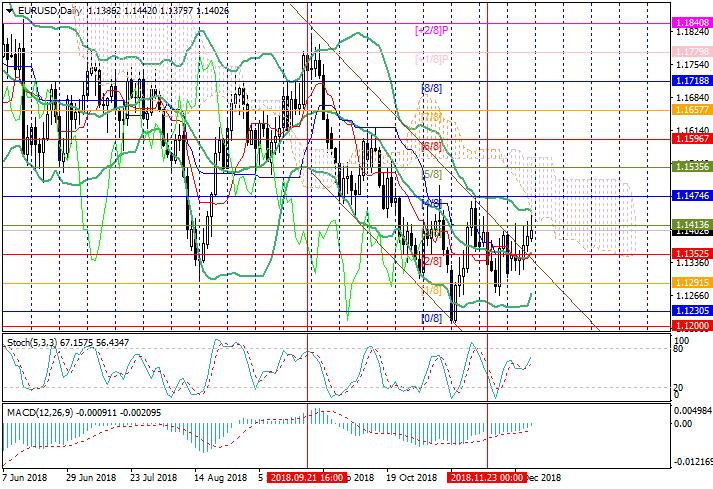

Since last week, the pair has been growing and is currently testing the level of 1.1423 (Murrey [3/8]).

USD is pressured by comments of James Bullard, the head of the FRB of St. Louis. He said that the Fed may refuse to raise interest rates at the December meeting because of the inverted yield curve, which may indicate a near economic recession. According to Bullard, the increase can be postponed until January 2019. Earlier, regulator already hinted at a slowdown but it was believed to happen only next year.

European investors today are generally calm because they expect tomorrow’s vote on the treaty with the EU in the British Parliament. The probability of rejection remains high. The US-Chinese trade relations are also in the focus. Despite market fears, China didn't react harshly to the arrest of Huawei Finance Director Meng Wanzhou. However, US Trade Representative Robert Lighthizer stated that the agreement with Beijing should be concluded before March 1. Ootherwise, a new increase in duties is likely.

Support and resistance

If the instrument consolidates above 1.1413, growth can continue to 1.1474 (Murrey [4/8]) and 1.1535 (Murrey [5/8]). 1.1352 (Murray [2/8], the midline of Bollinger Bands) is seen as key for the "bears". Its breakdown will give the prospect of a further decline to 1.1291 (Murrey [1/8]) and 1.1230 (Murrey [0/8]).

Technical indicators show growth: Stochastic is directed upwards, MACD histogram is about to enter the positive zone and to form a buy signal.

Support levels: 1.1352, 1.1291, 1.1230.

Resistance levels: 1.1413, 1.1474, 1.1535.

Trading tips

Long positions may be opened above 1.1413 with targets at 1.1474, 1.1535 and stop loss at 1.1370.

Short positions may be opened below 1.1352 with targets at 1.1291, 1.1230 and stop loss at 1.1380.

Implementation period: 4-5 days.

No comments:

Write comments