GBP/USD: the pound stays in the downtrend

10 December 2018, 14:42

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.2645 |

| Take Profit | 1.2500 |

| Stop Loss | 1.2790 |

| Key Levels | 1.2300, 1.2450, 1.2470, 1.2510, 1.2550, 1.2620, 1.2660, 1.2720, 1.2770, 1.2800, 1.2850, 1.2930, 1.3050, 1.3170 |

Current trend

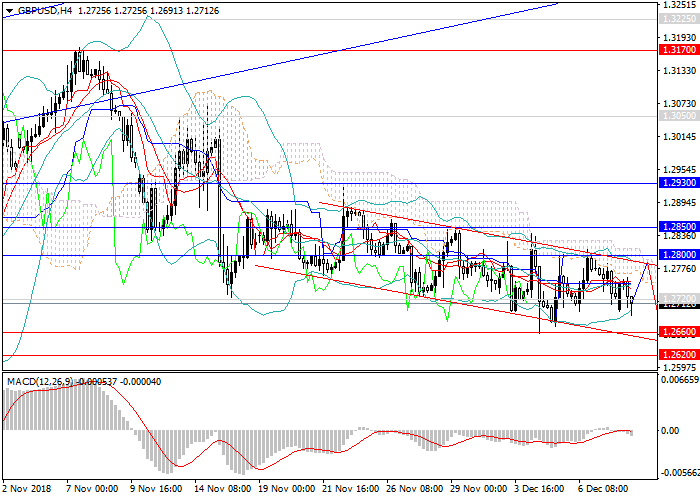

For almost a month the GBP/USD pair has been trading in a narrow downward channel, but couldn’t overcome the key support level of 1.2660 and is still trading around it. The British pound is still under pressure of a tense situation around Brexit. The European Court confirmed Britain’s right to withdraw the notice of intent to leave the EU. According to statistical agencies, the number of speakers against Brexit exceeded the exit supporters.

The US currency continues to gain strength, despite the negative data on Nonfarm Payrolls for November.

At the beginning of the current trading week, special attention should be paid to data on the UK labor market and major indices.

Support and resistance

In the short term, the pair will continue to consolidate. In the future, key supports 1.2675 and 1.2660 will be broken down, and the pair will go lower, to historical lows of 1.1860 and 1.1980. Technical indicators confirm the decline forecast: the MACD histogram is growing in the negative zone, the Bollinger bands are directed downwards.

Support levels: 1.2660, 1.2620, 1.2550, 1.2510, 1.2470, 1.2450, 1.2300.

Resistance levels: 1.2720, 1.2770, 1.2800, 1.2850, 1.2930, 1.3050, 1.3170.

Trading tips

In this situation, the volume of short positions can be increased at the current level, potential profit level would be 1.2500, stop loss can be set at 1.2790.

For almost a month the GBP/USD pair has been trading in a narrow downward channel, but couldn’t overcome the key support level of 1.2660 and is still trading around it. The British pound is still under pressure of a tense situation around Brexit. The European Court confirmed Britain’s right to withdraw the notice of intent to leave the EU. According to statistical agencies, the number of speakers against Brexit exceeded the exit supporters.

The US currency continues to gain strength, despite the negative data on Nonfarm Payrolls for November.

At the beginning of the current trading week, special attention should be paid to data on the UK labor market and major indices.

Support and resistance

In the short term, the pair will continue to consolidate. In the future, key supports 1.2675 and 1.2660 will be broken down, and the pair will go lower, to historical lows of 1.1860 and 1.1980. Technical indicators confirm the decline forecast: the MACD histogram is growing in the negative zone, the Bollinger bands are directed downwards.

Support levels: 1.2660, 1.2620, 1.2550, 1.2510, 1.2470, 1.2450, 1.2300.

Resistance levels: 1.2720, 1.2770, 1.2800, 1.2850, 1.2930, 1.3050, 1.3170.

Trading tips

In this situation, the volume of short positions can be increased at the current level, potential profit level would be 1.2500, stop loss can be set at 1.2790.

No comments:

Write comments