AUD/USD: general review

20 December 2018, 09:24

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.7098 |

| Take Profit | 0.7015 |

| Stop Loss | 0.7070 |

| Key Levels | 0.7017, 0.7036, 0.7064, 0.7110, 0.7142, 0.7172, 0.7197, 0.7232, 0.7266, 0.7292 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7115 |

| Take Profit | 0.7175 |

| Stop Loss | 0.7090 |

| Key Levels | 0.7017, 0.7036, 0.7064, 0.7110, 0.7142, 0.7172, 0.7197, 0.7232, 0.7266, 0.7292 |

Current trend

Yesterday, the pair lost about 50 points after the announcement of the Fed's decision on the interest rate.

The US regulator raised the rate by 0.25%, lowering the forecast for the number of increases in 2019 from three to two. In addition, Fed Chairman Jerome Powell said that the regulator is satisfied with the balance reduction program and does not plan to retreat from it in the future, which is an argument in favor of further tightening of monetary policy. Unexpected for investors was the intention of the FOMC to stick to the "hawkish" course, not relying entirely on macroeconomic statistics.

At the same time, the market practically ignored data on the Australian labor market. Participation rate rose by 0.1% in November. Part-time employment rose significantly, while the November data on full employment were negative, which was the reason for the rise in unemployment rate by 0.1%.

The data on initial jobless claims in the US are due today at 15:30 (GMT+2). Tomorrow, a large number of macroeconomic publications from the US are expected, which may cause strong market volatility.

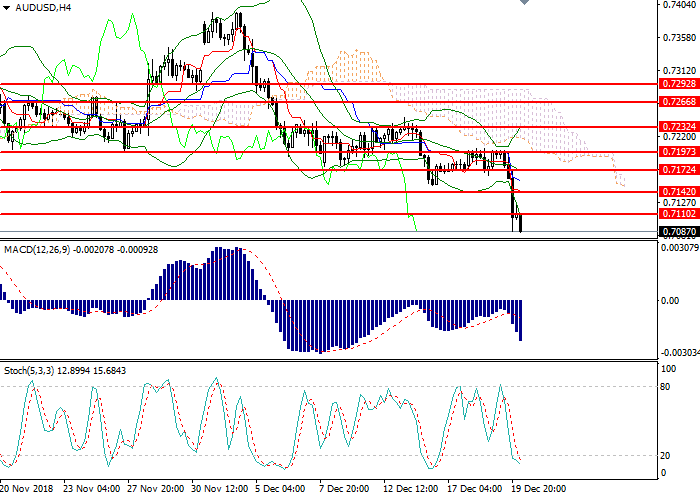

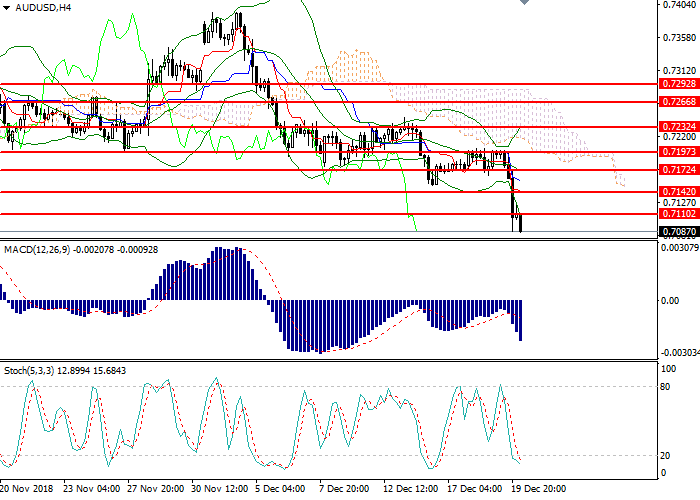

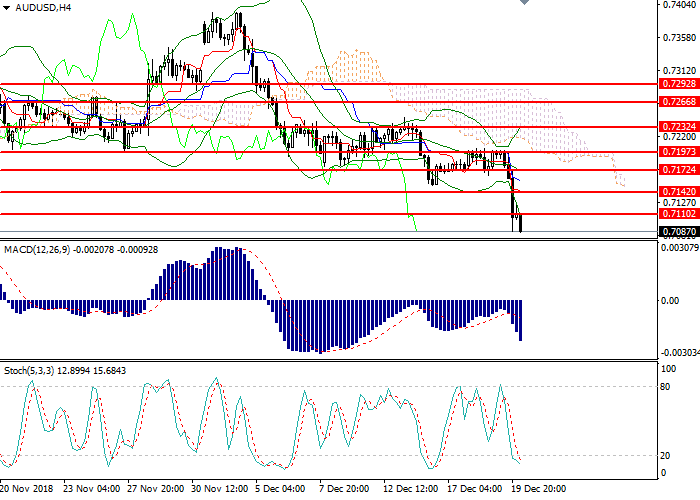

Support and resistance

On the H4 chart, the instrument consolidated below the strong level of 0.7110. Bollinger Bands reverse downwards, and the price range widened significantly, which indicates the continuation of the downtrend. MACD histogram is in the negative zone keeping a strong sell signal. Stochastic has entered the oversold zone.

Resistance levels: 0.7110, 0.7142, 0.7172, 0.7197, 0.7232, 0.7266, 0.7292.

Support levels: 0.7064, 0.7036, 0.7017.

Trading tips

Short positions may be opened from the current level with target at 0.7015 and stop loss at 0.7070. Implementation time: 1 day.

Long positions may be opened above 0.7110 with target at 0.7175 and stop loss at 0.7090. Implementation time: 1-2 days.

Yesterday, the pair lost about 50 points after the announcement of the Fed's decision on the interest rate.

The US regulator raised the rate by 0.25%, lowering the forecast for the number of increases in 2019 from three to two. In addition, Fed Chairman Jerome Powell said that the regulator is satisfied with the balance reduction program and does not plan to retreat from it in the future, which is an argument in favor of further tightening of monetary policy. Unexpected for investors was the intention of the FOMC to stick to the "hawkish" course, not relying entirely on macroeconomic statistics.

At the same time, the market practically ignored data on the Australian labor market. Participation rate rose by 0.1% in November. Part-time employment rose significantly, while the November data on full employment were negative, which was the reason for the rise in unemployment rate by 0.1%.

The data on initial jobless claims in the US are due today at 15:30 (GMT+2). Tomorrow, a large number of macroeconomic publications from the US are expected, which may cause strong market volatility.

Support and resistance

On the H4 chart, the instrument consolidated below the strong level of 0.7110. Bollinger Bands reverse downwards, and the price range widened significantly, which indicates the continuation of the downtrend. MACD histogram is in the negative zone keeping a strong sell signal. Stochastic has entered the oversold zone.

Resistance levels: 0.7110, 0.7142, 0.7172, 0.7197, 0.7232, 0.7266, 0.7292.

Support levels: 0.7064, 0.7036, 0.7017.

Trading tips

Short positions may be opened from the current level with target at 0.7015 and stop loss at 0.7070. Implementation time: 1 day.

Long positions may be opened above 0.7110 with target at 0.7175 and stop loss at 0.7090. Implementation time: 1-2 days.

No comments:

Write comments