USD/CHF: technical analysis

20 December 2018, 10:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.9926 |

| Take Profit | 0.9870 |

| Stop Loss | 0.9955 |

| Key Levels | 0.9792, 0.9830, 0.9863, 0.9898, 0.9930, 0.9962, 0.9989, 1.0017, 1.0039, 1.0079, 1.0128 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.9950 |

| Take Profit | 1.0000 |

| Stop Loss | 0.9920 |

| Key Levels | 0.9792, 0.9830, 0.9863, 0.9898, 0.9930, 0.9962, 0.9989, 1.0017, 1.0039, 1.0079, 1.0128 |

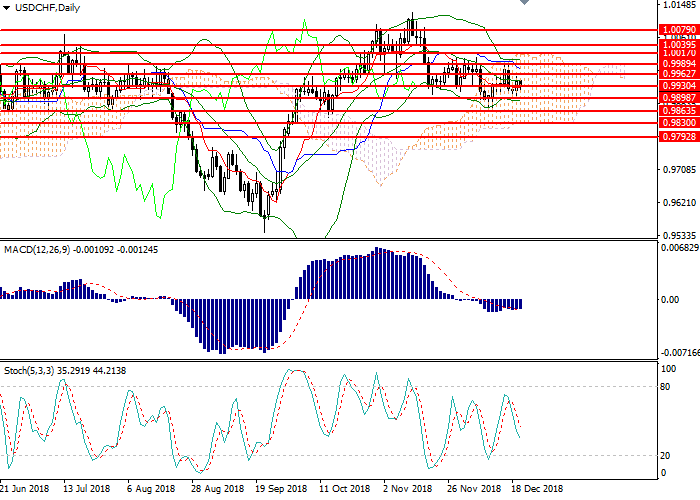

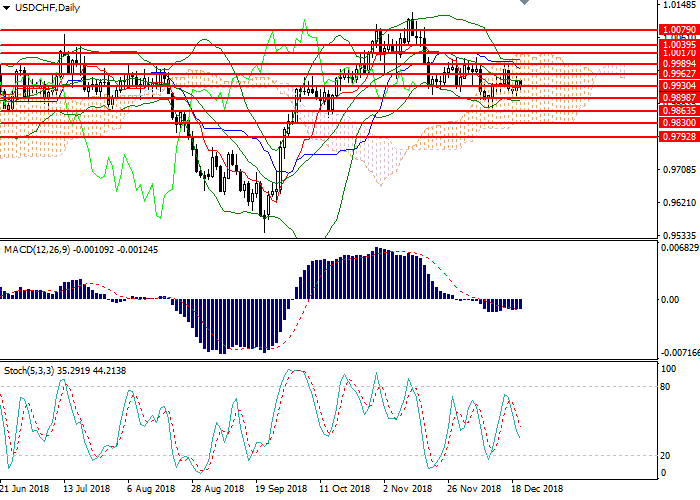

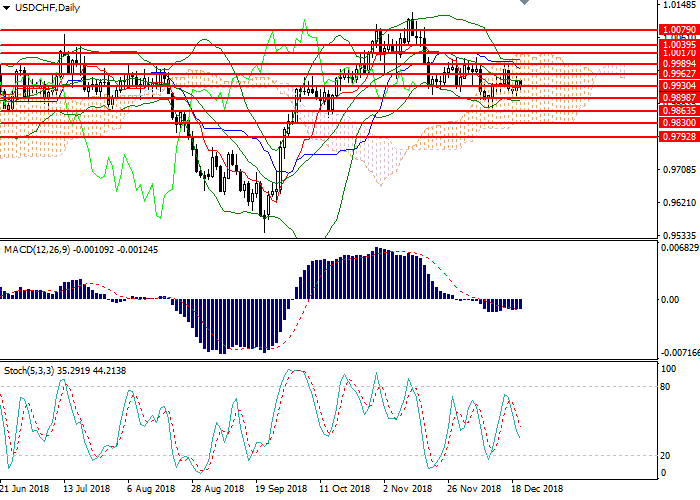

USD/CHF, D1

On the D1 chart the pair consolidated in the lower part of Bollinger Bands. The indicator is directed horizontally and the price range remains limited, which serves as a basis for continuing correctional dynamics. MACD histogram is correcting in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal for opening positions.

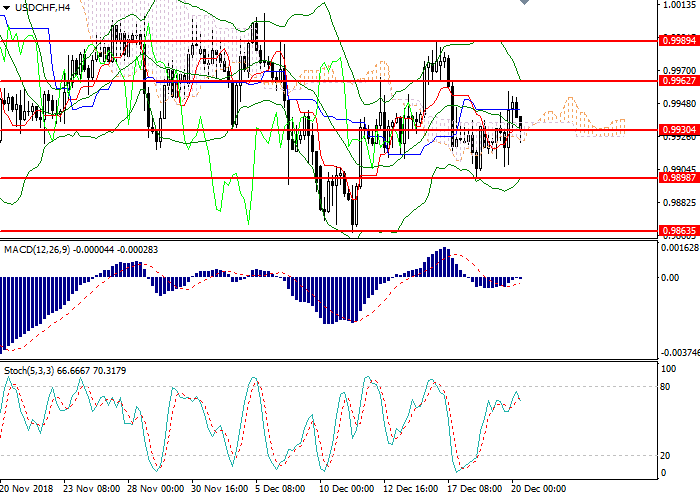

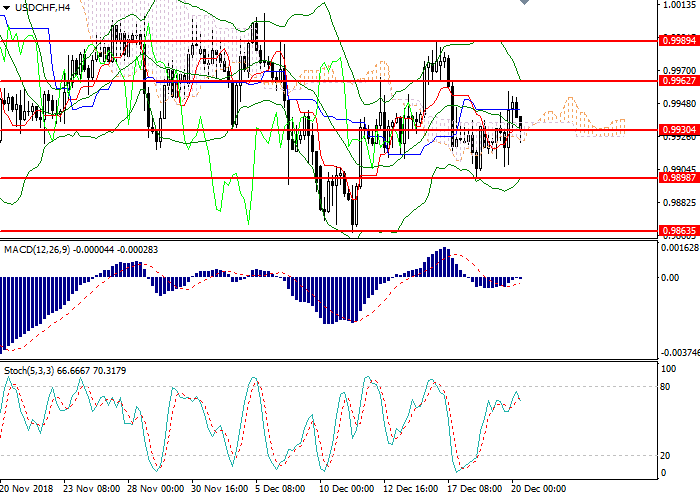

USD/CHF, H4

On the H4 chart the instrument is testing the moving average of Bollinger Bands. The indicator is reversing downwards, and the price range has decreased, indicating a change of the downtrend to an uptrend during the day. MACD histogram is corrected at the zero level; the signal for entering the market is not formed. Stochastic has reversed downwards at the border with the overbought zone.

Key levels

Resistance levels: 0.9962, 0.9989, 1.0017, 1.0039, 1.0079, 1.0128.

Support levels: 0.9930, 0.9898, 0.9863, 0.9830, 0.9792.

Trading tips

Short positions may be opened from the current level with target at 0.9870 and stop loss at 0.9955.

Long positions may be opened above 0.9945 with target at 1.0000 and stop loss at 0.9920.

Implementation period: 1-2 days.

On the D1 chart the pair consolidated in the lower part of Bollinger Bands. The indicator is directed horizontally and the price range remains limited, which serves as a basis for continuing correctional dynamics. MACD histogram is correcting in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal for opening positions.

USD/CHF, H4

On the H4 chart the instrument is testing the moving average of Bollinger Bands. The indicator is reversing downwards, and the price range has decreased, indicating a change of the downtrend to an uptrend during the day. MACD histogram is corrected at the zero level; the signal for entering the market is not formed. Stochastic has reversed downwards at the border with the overbought zone.

Key levels

Resistance levels: 0.9962, 0.9989, 1.0017, 1.0039, 1.0079, 1.0128.

Support levels: 0.9930, 0.9898, 0.9863, 0.9830, 0.9792.

Trading tips

Short positions may be opened from the current level with target at 0.9870 and stop loss at 0.9955.

Long positions may be opened above 0.9945 with target at 1.0000 and stop loss at 0.9920.

Implementation period: 1-2 days.

No comments:

Write comments