EUR/USD: general review

30 November 2018, 12:33

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1400 |

| Take Profit | 1.1460 |

| Stop Loss | 1.1362 |

| Key Levels | 1.1265, 1.1300, 1.1330, 1.1348, 1.1362, 1.1400, 1.1415, 1.1433, 1.1460, 1.1491 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1330 |

| Take Profit | 1.1265 |

| Stop Loss | 1.1362 |

| Key Levels | 1.1265, 1.1300, 1.1330, 1.1348, 1.1362, 1.1400, 1.1415, 1.1433, 1.1460, 1.1491 |

Current trend

EUR strengthened against USD on Thursday amid a refutation regarding the introduction of US tariffs on cars from the EU before Christmas made by the European Commission.

The single currency was also supported by positive labor market statistics from Germany. Macroeconomic data from the US was mixed and did not support the USD. Private spending increased to 0.6% in October from 0.2% a month earlier. Personal income also showed a positive trend and amounted to 0.5% in October from 0.2% a month earlier. The FOMC protocol published last night confirmed the Fed’s intention to raise the key rate in December. At the same time, the regulator believes that in the future it is necessary to carefully approach the issue of tightening monetary policy after the December round of rate hikes. Investors reacted to these statements by selling the US currency.

Today, the publication of the consumer price index in the Eurozone (12:00 GMT+3) may influence the pair; high volatility is expected in the market.

Support and resistance

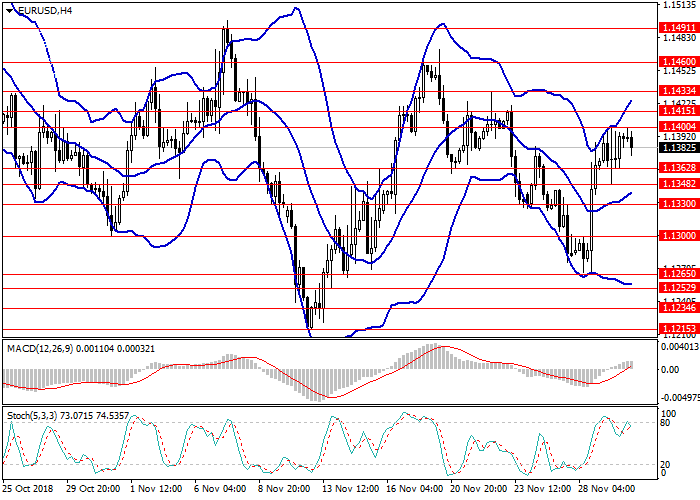

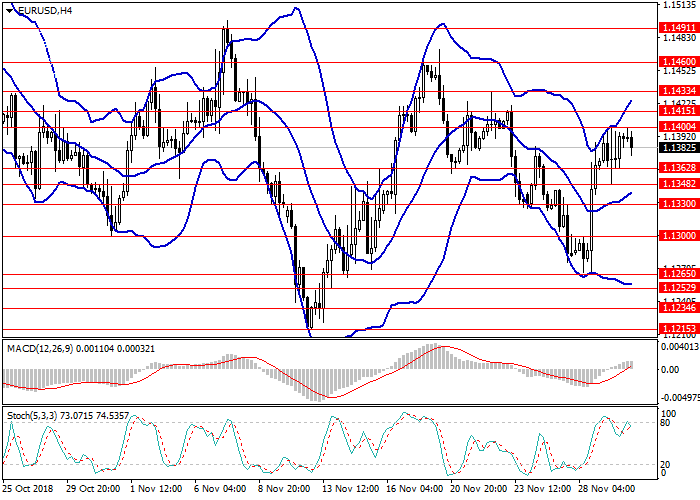

On the H4 chart, there is an upward correction, the instrument is traded near the upper border of Bollinger Bands, the price range is expanded, which indicates a possible continuation of the upward movement. MACD histogram is in the positive area, gradually increasing volumes, the signal line crosses the zero mark and the body of the histogram from the bottom up, which is a signal to open long positions.

Support levels: 1.1362, 1.1348, 1.1330, 1.1300, 1.1265.

Resistance levels: 1.1400, 1.1415, 1.1433, 1.1460, 1.1491.

Trading tips

Long position may be opened from 1.1400 with the target at 1.1460 and stop loss at 1.1362.

Short positions may be opened from 1.1330 with the target at 1.1265 and stop loss at 1.1362.

Implementation period: 1-3 days.

EUR strengthened against USD on Thursday amid a refutation regarding the introduction of US tariffs on cars from the EU before Christmas made by the European Commission.

The single currency was also supported by positive labor market statistics from Germany. Macroeconomic data from the US was mixed and did not support the USD. Private spending increased to 0.6% in October from 0.2% a month earlier. Personal income also showed a positive trend and amounted to 0.5% in October from 0.2% a month earlier. The FOMC protocol published last night confirmed the Fed’s intention to raise the key rate in December. At the same time, the regulator believes that in the future it is necessary to carefully approach the issue of tightening monetary policy after the December round of rate hikes. Investors reacted to these statements by selling the US currency.

Today, the publication of the consumer price index in the Eurozone (12:00 GMT+3) may influence the pair; high volatility is expected in the market.

Support and resistance

On the H4 chart, there is an upward correction, the instrument is traded near the upper border of Bollinger Bands, the price range is expanded, which indicates a possible continuation of the upward movement. MACD histogram is in the positive area, gradually increasing volumes, the signal line crosses the zero mark and the body of the histogram from the bottom up, which is a signal to open long positions.

Support levels: 1.1362, 1.1348, 1.1330, 1.1300, 1.1265.

Resistance levels: 1.1400, 1.1415, 1.1433, 1.1460, 1.1491.

Trading tips

Long position may be opened from 1.1400 with the target at 1.1460 and stop loss at 1.1362.

Short positions may be opened from 1.1330 with the target at 1.1265 and stop loss at 1.1362.

Implementation period: 1-3 days.

No comments:

Write comments