USD/CHF: USD strengthens

05 September 2018, 09:54

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9765 |

| Take Profit | 0.9800, 0.9820, 0.9840 |

| Stop Loss | 0.9730, 0.9720 |

| Key Levels | 0.9647, 0.9673, 0.9700, 0.9730, 0.9760, 0.9785, 0.9800, 0.9820 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9725 |

| Take Profit | 0.9673, 0.9647 |

| Stop Loss | 0.9760, 0.9770 |

| Key Levels | 0.9647, 0.9673, 0.9700, 0.9730, 0.9760, 0.9785, 0.9800, 0.9820 |

Current trend

Yesterday, USD rose against CHF, renewing the highs since August 29. CHF is under pressure due to growing trade tensions in EU and the world.

At the end of the week, US President Trump can introduce new increased duties on Chinese goods totaling USD 200 billion. The prospects for the US-Canada negotiations on the new terms of the NAFTA treaty and the US-EU on the car market are still unclear. Some support for EUR is provided by the conciliatory tone of the Italian government. According to La Stampa, Deputy Prime Minister Matteo Salvini supports keeping the deficit of the new Italian budget within 2%, which does not violate the EU budget rules.

Tuesday’s Swiss data did not support CHF. As expected, in August the dynamics of CPI was zero after a decrease of 0.2% MoM in July. The indicators stayed at the level of +1.2% YoY.

Support and resistance

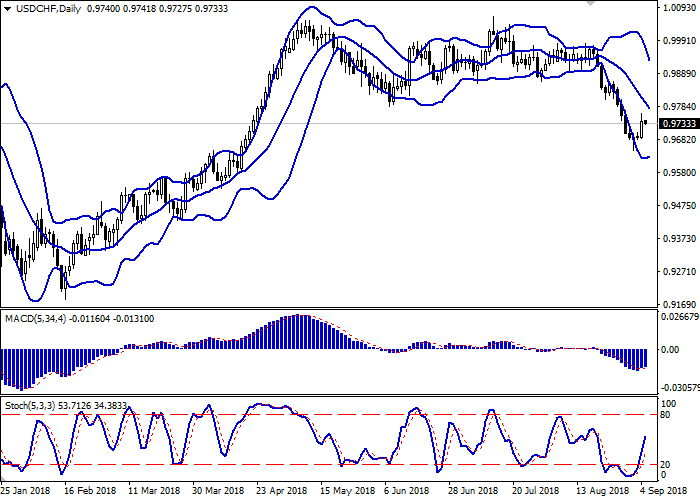

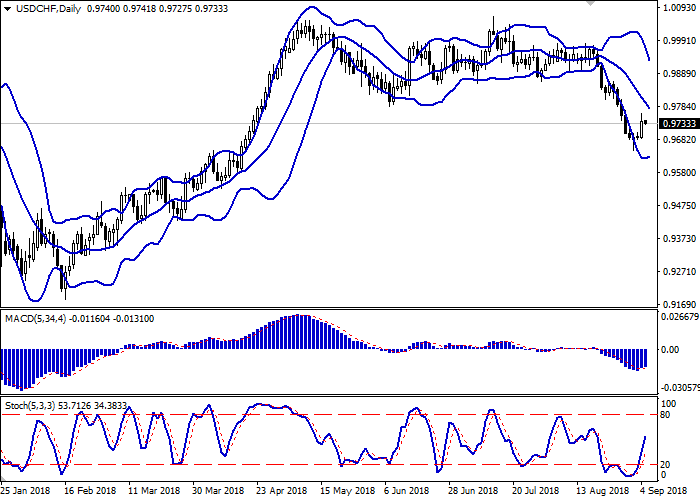

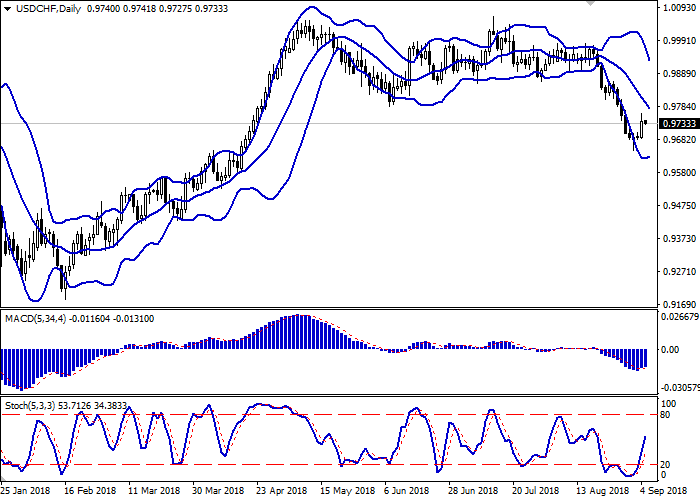

On the daily chart, Bollinger bands are declining. The price range is narrowing, reflecting a change in the trade direction in the short term. MACD reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic grows almost vertically, quickly approaching its highs.

It is better to open new long positions ones and keep current ones in the short and super short term.

Resistance levels: 0.9760, 0.9785, 0.9800, 0.9820.

Support levels: 0.9730, 0.9700, 0.9673, 0.9647.

Trading tips

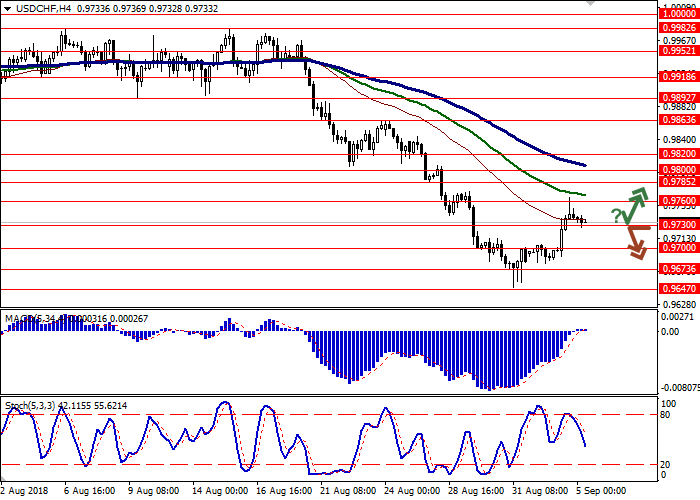

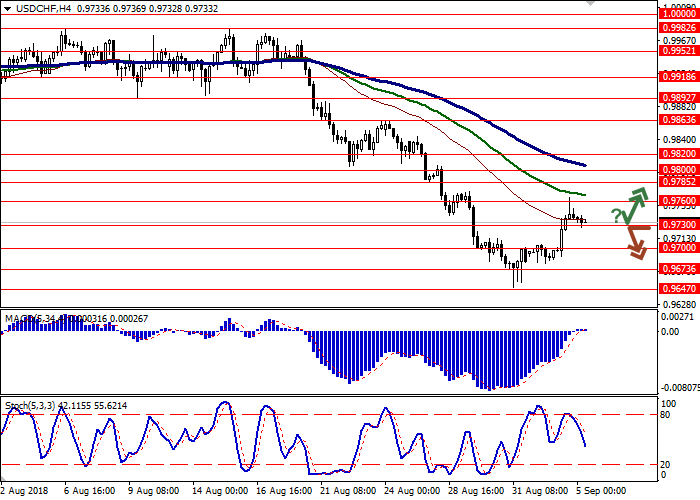

Long positions can be opened after a rebound from the level of 0.9730 and breakout of the level of 0.9760 with the targets at 0.9800 or 0.9820–0.9840 and stop loss 0.9730–0.9720.

Short positions can be opened after the breakdown of the level of 0.9730 with the target at 0.9673 or 0.9647 and stop loss 0.9760–0.9770.

Implementation period: 2–3 days.

Yesterday, USD rose against CHF, renewing the highs since August 29. CHF is under pressure due to growing trade tensions in EU and the world.

At the end of the week, US President Trump can introduce new increased duties on Chinese goods totaling USD 200 billion. The prospects for the US-Canada negotiations on the new terms of the NAFTA treaty and the US-EU on the car market are still unclear. Some support for EUR is provided by the conciliatory tone of the Italian government. According to La Stampa, Deputy Prime Minister Matteo Salvini supports keeping the deficit of the new Italian budget within 2%, which does not violate the EU budget rules.

Tuesday’s Swiss data did not support CHF. As expected, in August the dynamics of CPI was zero after a decrease of 0.2% MoM in July. The indicators stayed at the level of +1.2% YoY.

Support and resistance

On the daily chart, Bollinger bands are declining. The price range is narrowing, reflecting a change in the trade direction in the short term. MACD reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic grows almost vertically, quickly approaching its highs.

It is better to open new long positions ones and keep current ones in the short and super short term.

Resistance levels: 0.9760, 0.9785, 0.9800, 0.9820.

Support levels: 0.9730, 0.9700, 0.9673, 0.9647.

Trading tips

Long positions can be opened after a rebound from the level of 0.9730 and breakout of the level of 0.9760 with the targets at 0.9800 or 0.9820–0.9840 and stop loss 0.9730–0.9720.

Short positions can be opened after the breakdown of the level of 0.9730 with the target at 0.9673 or 0.9647 and stop loss 0.9760–0.9770.

Implementation period: 2–3 days.

No comments:

Write comments