American Express Co.: wave analysis

05 September 2018, 09:38

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 107.03 |

| Take Profit | 111.00, 115.00 |

| Stop Loss | 105.40 |

| Key Levels | 98.55, 100.74, 105.40, 111.00, 115.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 105.30 |

| Take Profit | 100.74, 98.55 |

| Stop Loss | 106.90 |

| Key Levels | 98.55, 100.74, 105.40, 111.00, 115.00 |

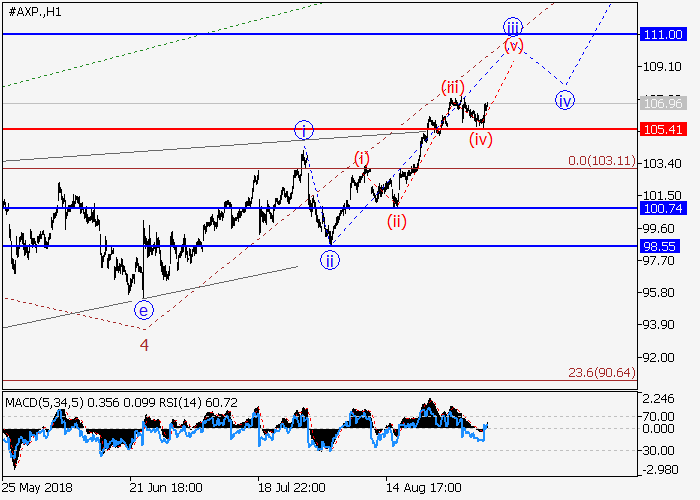

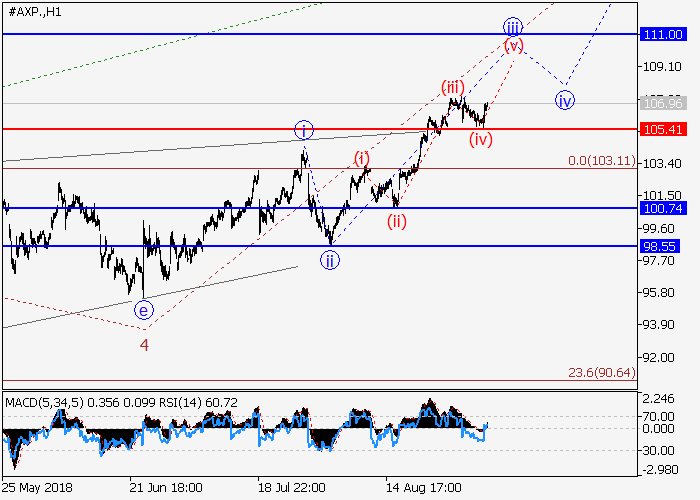

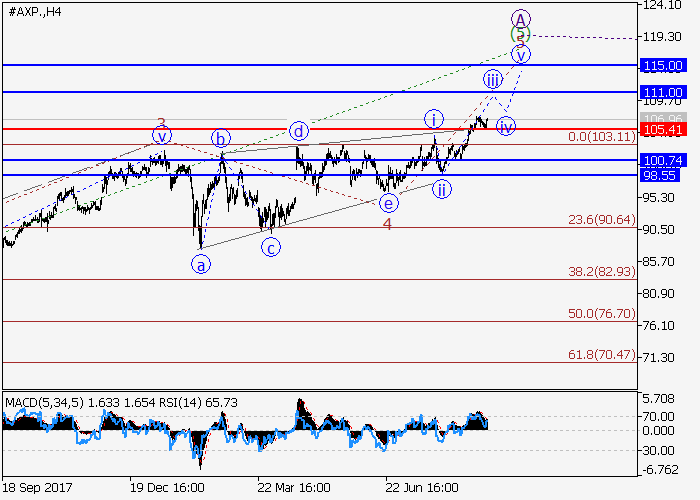

The price can grow.

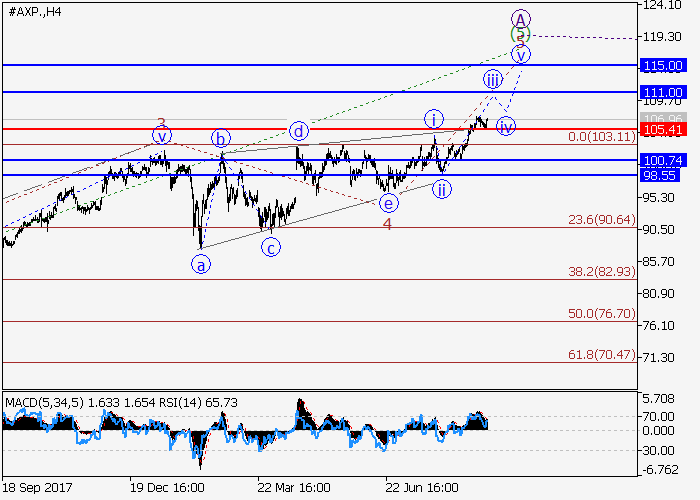

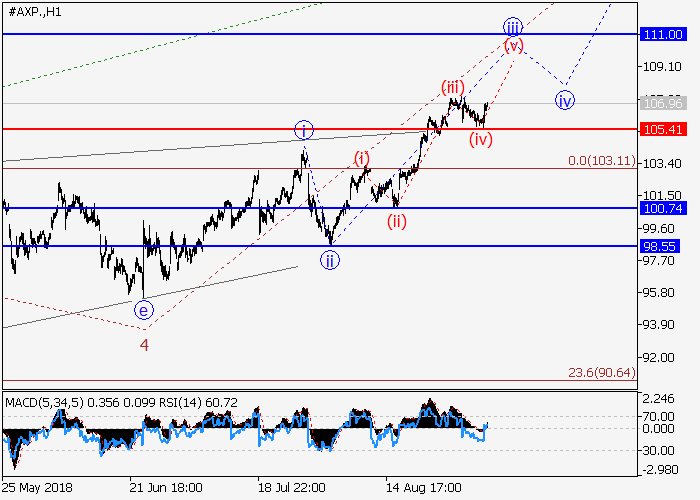

On the 4-hour chart, the fifth wave of the higher level (5) of A forms. Now the fourth wave of the lower level 4 of (5) has developed, shaped as a triangle, and the wave 5 of (5) is forming, within which the wave iii of 5 is developing as a momentum. If the assumption is correct, the price will grow to the levels of 111.00–115.00. In this scenario, critical stop loss level is 105.40.

Main scenario

Long positions will become relevant during the correction, above the level of 105.40 with the targets at 111.00–115.00. Implementation period: 5–7 days.

Alternative scenario

The breakdown and the consolidation of the price below the level of 105.40 will let the price go down to the levels of 100.74–98.55.

On the 4-hour chart, the fifth wave of the higher level (5) of A forms. Now the fourth wave of the lower level 4 of (5) has developed, shaped as a triangle, and the wave 5 of (5) is forming, within which the wave iii of 5 is developing as a momentum. If the assumption is correct, the price will grow to the levels of 111.00–115.00. In this scenario, critical stop loss level is 105.40.

Main scenario

Long positions will become relevant during the correction, above the level of 105.40 with the targets at 111.00–115.00. Implementation period: 5–7 days.

Alternative scenario

The breakdown and the consolidation of the price below the level of 105.40 will let the price go down to the levels of 100.74–98.55.

No comments:

Write comments