USD/CAD: US dollar strengthens

04 September 2018, 10:10

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3140 |

| Take Profit | 1.3200 |

| Stop Loss | 1.3100 |

| Key Levels | 1.2961, 1.3000, 1.3055, 1.3100, 1.3134, 1.3173, 1.3200 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3090, 1.3075 |

| Take Profit | 1.3000 |

| Stop Loss | 1.3130, 1.3140 |

| Key Levels | 1.2961, 1.3000, 1.3055, 1.3100, 1.3134, 1.3173, 1.3200 |

Current trend

Yesterday, USD rose slightly against CAD, renewing a maximum since August 24.

On Monday, USD was moving according to EU releases due to US holidays. President Trump's comments on the future of NAFTA, the new terms for which the US and Mexico developed last week, affect USD negatively. Canada was expected to join the treaty, but on the weekend Trump said on Twitter that there is no political need in the presence of Canada in a new NAFTA deal, and can be excluded from the treaty. Moreover, the president threatened to liquidate NAFTA if Congress tries to interfere in the negotiations.

On Tuesday, August US Manufacturing PMI release is expected to fall from 58.1 to 57.7 points, which will affect USD negatively. Today, the corresponding Canadian indicator is expected to reach 57.1 points against 56.9.

Support and resistance

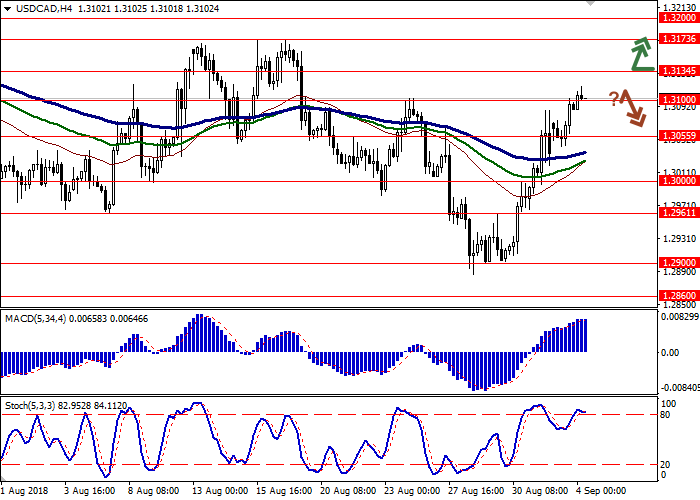

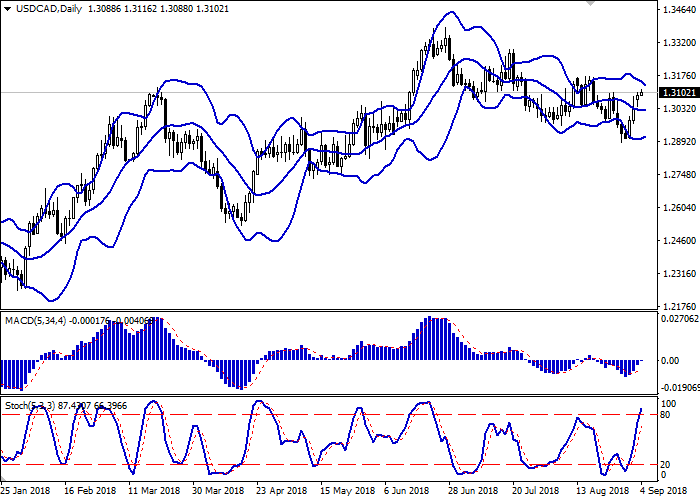

On the daily chart, Bollinger bands reverse horizontally. The price range is narrowing, reflecting a sharp change in the direction of trading in the middle of the last trading week. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line) and preparing to test the zero line. Stochastic is directed upwards, reaching its highs, which indicates the overbought dollar in the short term.

The current indicators’ readings do not contradict the further growth of the instrument.

Resistance levels: 1.3134, 1.3173, 1.3200.

Support levels: 1.3100, 1.3055, 1.3000, 1.2961.

Trading tips

Long positions can be opened after the breakdown of 1.3134 upwards with the target at 1.3200 and the stop loss 1.3100. Implementation period: 1–2 days.

Short positions can be opened after a reversal near the current price with a breakdown of 1.3100 or 1.3080 and target at 1.3000. Stop loss is 1.3130–1.3140. Implementation period: 2–3 days.

Yesterday, USD rose slightly against CAD, renewing a maximum since August 24.

On Monday, USD was moving according to EU releases due to US holidays. President Trump's comments on the future of NAFTA, the new terms for which the US and Mexico developed last week, affect USD negatively. Canada was expected to join the treaty, but on the weekend Trump said on Twitter that there is no political need in the presence of Canada in a new NAFTA deal, and can be excluded from the treaty. Moreover, the president threatened to liquidate NAFTA if Congress tries to interfere in the negotiations.

On Tuesday, August US Manufacturing PMI release is expected to fall from 58.1 to 57.7 points, which will affect USD negatively. Today, the corresponding Canadian indicator is expected to reach 57.1 points against 56.9.

Support and resistance

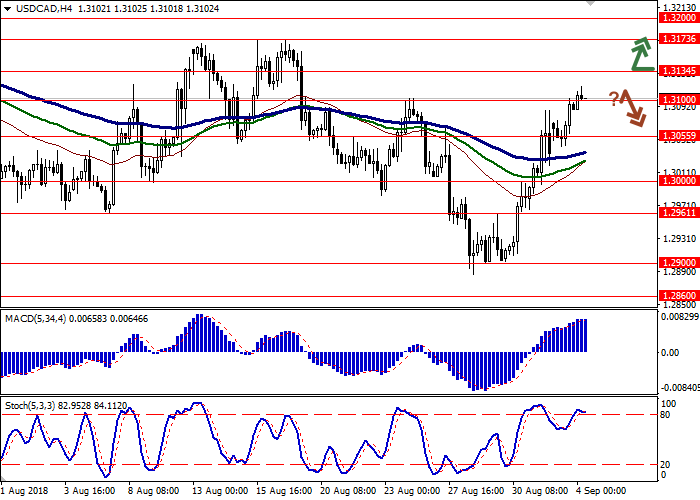

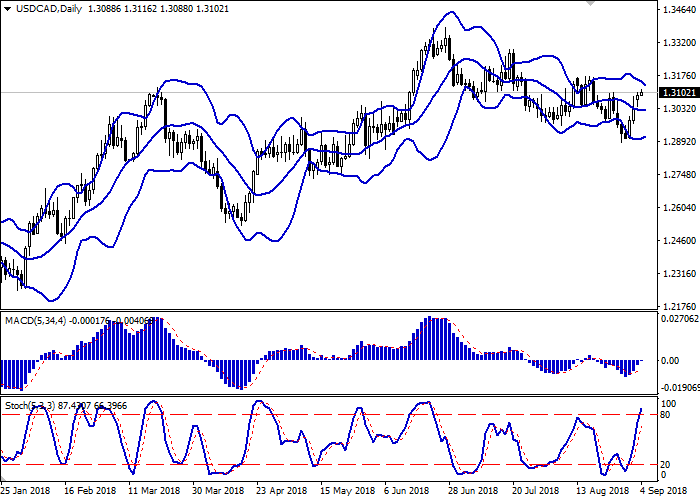

On the daily chart, Bollinger bands reverse horizontally. The price range is narrowing, reflecting a sharp change in the direction of trading in the middle of the last trading week. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line) and preparing to test the zero line. Stochastic is directed upwards, reaching its highs, which indicates the overbought dollar in the short term.

The current indicators’ readings do not contradict the further growth of the instrument.

Resistance levels: 1.3134, 1.3173, 1.3200.

Support levels: 1.3100, 1.3055, 1.3000, 1.2961.

Trading tips

Long positions can be opened after the breakdown of 1.3134 upwards with the target at 1.3200 and the stop loss 1.3100. Implementation period: 1–2 days.

Short positions can be opened after a reversal near the current price with a breakdown of 1.3100 or 1.3080 and target at 1.3000. Stop loss is 1.3130–1.3140. Implementation period: 2–3 days.

No comments:

Write comments