XAG/USD: the price is under pressure

04 September 2018, 10:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 14.50, 14.53 |

| Take Profit | 14.70, 14.79 |

| Stop Loss | 14.35 |

| Key Levels | 14.17, 14.24, 14.40, 14.48, 14.60, 14.79, 14.89, 15.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 14.31 |

| Take Profit | 14.17, 14.10 |

| Stop Loss | 14.45, 14.55 |

| Key Levels | 14.17, 14.24, 14.40, 14.48, 14.60, 14.79, 14.89, 15.00 |

Current trend

Yesterday, silver prices declined slightly, renewing a local minimum since August 16. On Monday, the US markets were closed due to the national holiday, so investors fully concentrated on the European and Asian releases.

Monday’s August EU Manufacturing PMI release remained at the same level of 54.6 points. The corresponding German index fell from 56.1 to 55.9 points. The Japanese indicator remained at the same level of 52.5 points, but the Chinese PMI Caixin in August fell from 50.8 to 50.6 points.

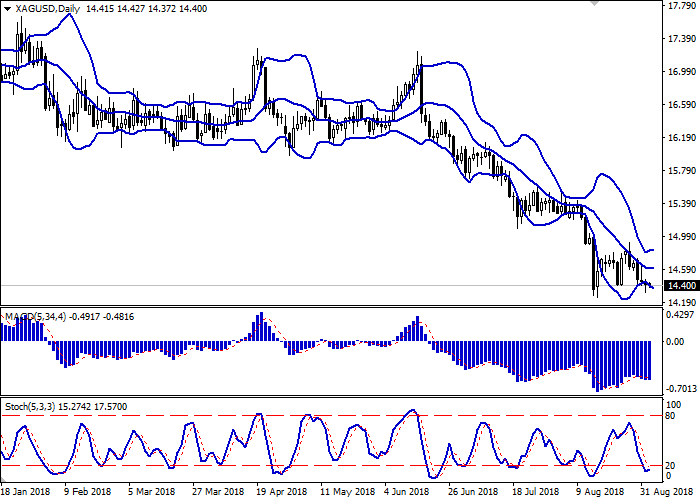

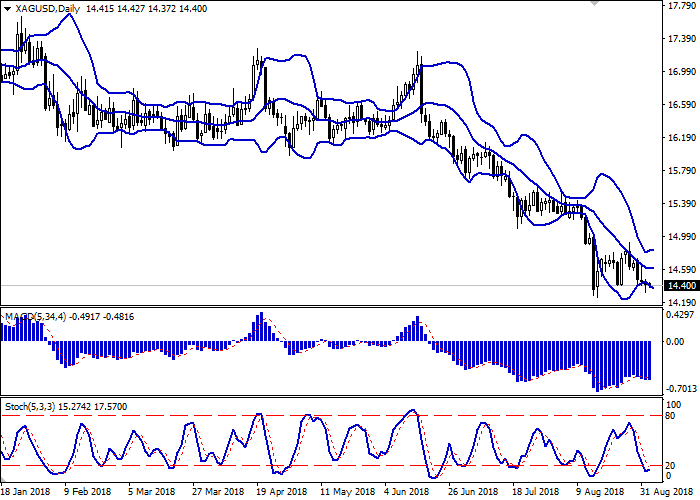

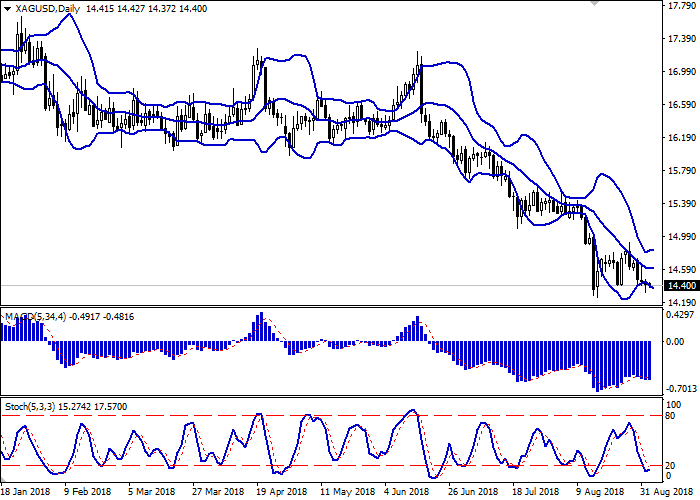

Support and resistance

On the daily chart, Bollinger bands unfold horizontally. The price range is expanding but still remains uncomfortable for the development of downward trend dynamics. MACD indicator decreases, keeping a weak sell signal (the histogram is below the signal line). Stochastic, approaching its lows, reversed horizontally, reflecting the risks of the corrective silver growth in the short and/or ultra-short term.

It is better to wait until the signals are clear and keep current short positions in the short term for some time.

Resistance levels: 14.48, 14.60, 14.79, 14.89, 15.00.

Support levels: 14.40, 14.24, 14.17.

Trading tips

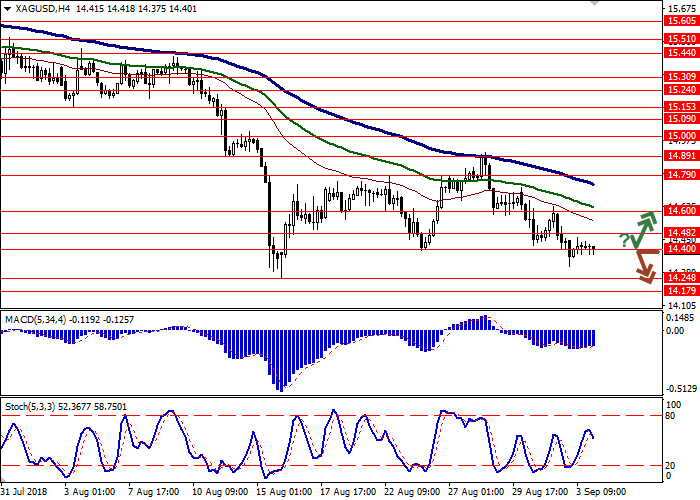

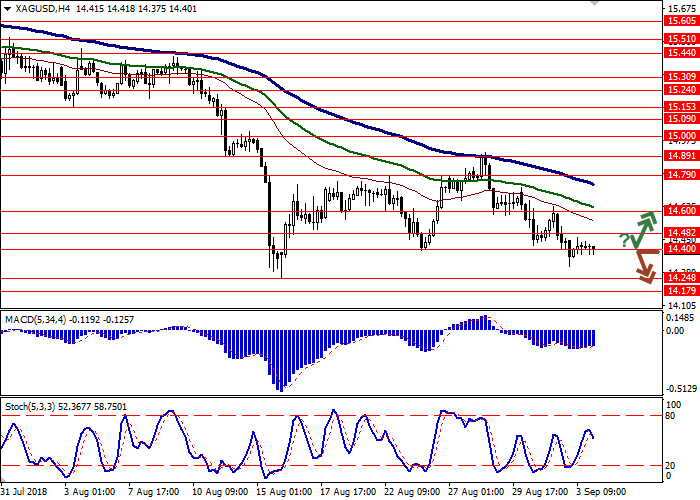

Long positions can be opened after the rebound from the level of 14.40 and breakout of the levels of 14.48–14.50 with the targets at 14.70–14.79 and stop loss 14.35.

Short positions can be opened after the breakdown of the level of 14.40 with the targets at 14.24 or 14.17–14.10 and stop loss 14.45–14.55.

Implementation period: 2–3 days.

Yesterday, silver prices declined slightly, renewing a local minimum since August 16. On Monday, the US markets were closed due to the national holiday, so investors fully concentrated on the European and Asian releases.

Monday’s August EU Manufacturing PMI release remained at the same level of 54.6 points. The corresponding German index fell from 56.1 to 55.9 points. The Japanese indicator remained at the same level of 52.5 points, but the Chinese PMI Caixin in August fell from 50.8 to 50.6 points.

Support and resistance

On the daily chart, Bollinger bands unfold horizontally. The price range is expanding but still remains uncomfortable for the development of downward trend dynamics. MACD indicator decreases, keeping a weak sell signal (the histogram is below the signal line). Stochastic, approaching its lows, reversed horizontally, reflecting the risks of the corrective silver growth in the short and/or ultra-short term.

It is better to wait until the signals are clear and keep current short positions in the short term for some time.

Resistance levels: 14.48, 14.60, 14.79, 14.89, 15.00.

Support levels: 14.40, 14.24, 14.17.

Trading tips

Long positions can be opened after the rebound from the level of 14.40 and breakout of the levels of 14.48–14.50 with the targets at 14.70–14.79 and stop loss 14.35.

Short positions can be opened after the breakdown of the level of 14.40 with the targets at 14.24 or 14.17–14.10 and stop loss 14.45–14.55.

Implementation period: 2–3 days.

No comments:

Write comments