USD/JPY: the pair is trading in both directions

04 September 2018, 09:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 111.35 |

| Take Profit | 111.65, 111.85 |

| Stop Loss | 111.05 |

| Key Levels | 110.25, 110.45, 110.67, 110.90, 111.16, 111.47, 111.85, 112.13 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 110.85, 110.75 |

| Take Profit | 110.50, 110.45 |

| Stop Loss | 111.10, 111.15 |

| Key Levels | 110.25, 110.45, 110.67, 110.90, 111.16, 111.47, 111.85, 112.13 |

Current trend

USD did not change significantly paired with JPY on Monday.

Published yesterday, August Manufacturing PMI in Japan remained at the same level of 52.5 points. The investors are focused on the statements of the head of the Bank of Japan Haruhiko Kuroda. He noted that the regulator did not intend to raise interest rates and would continue to struggle for achieving a 2.0% inflation target. Kuroda did not even mention the approximate period of rate raise, saying that rates will remain low until the end of uncertainty in the economy.

Today, USD is trading with moderate growth, as investors are gradually returning to the market after the festive start of the week in the US.

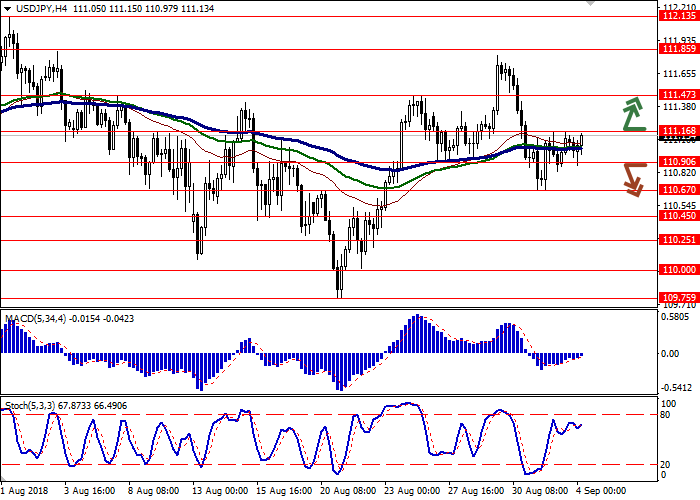

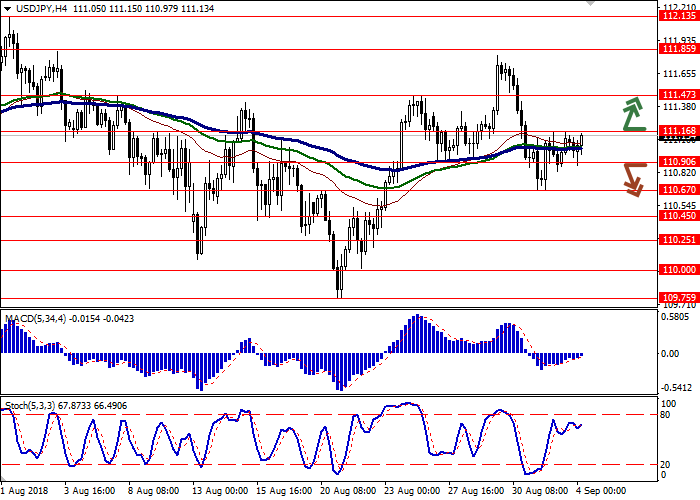

Support and resistance

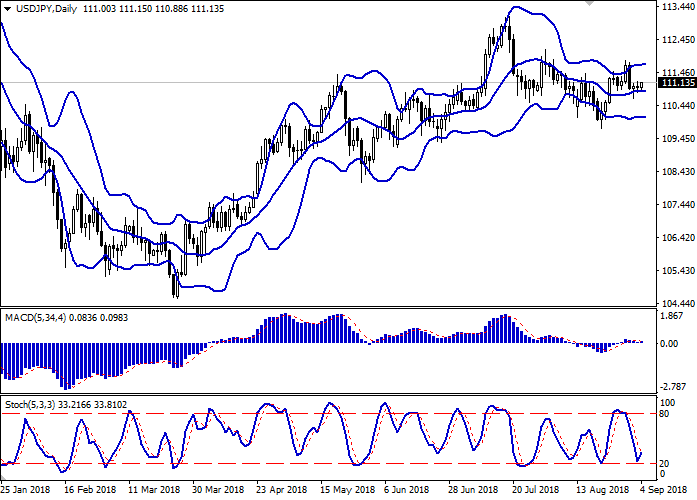

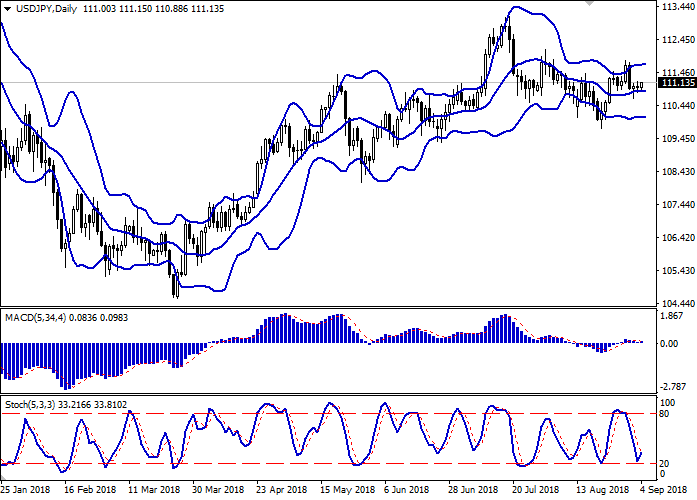

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly widening from above, reflecting a rather spacious flat channel in the short/medium term. MACD has reversed upwards again keeping a previous sell signal (located below the signal line). Stochastic is developing a rebound from the level "20", which can be called a formal margin of oversoldness of USD.

At the moment, one should take a closer look at the possibility of developing a corrective growth of USD in the short and/or ultra-short term.

Resistance levels: 111.16, 111.47, 111.85, 112.13.

Support levels: 110.90, 110.67, 110.45, 110.25.

Trading tips

To open long positions one can rely on the breakout of 111.16, while maintaining and strengthening of "bullish" signals from technical indicators. Take profit — 111.65 or 111.85. Stop loss — 111.05.

The return of "bearish" trend with the breakdown of 110.90 or 110.80 may become a signal for new sales with the target at 110.50 or 110.45. Stop loss — 111.10 or 111.15.

Implementation period: 2-3 days.

USD did not change significantly paired with JPY on Monday.

Published yesterday, August Manufacturing PMI in Japan remained at the same level of 52.5 points. The investors are focused on the statements of the head of the Bank of Japan Haruhiko Kuroda. He noted that the regulator did not intend to raise interest rates and would continue to struggle for achieving a 2.0% inflation target. Kuroda did not even mention the approximate period of rate raise, saying that rates will remain low until the end of uncertainty in the economy.

Today, USD is trading with moderate growth, as investors are gradually returning to the market after the festive start of the week in the US.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is slightly widening from above, reflecting a rather spacious flat channel in the short/medium term. MACD has reversed upwards again keeping a previous sell signal (located below the signal line). Stochastic is developing a rebound from the level "20", which can be called a formal margin of oversoldness of USD.

At the moment, one should take a closer look at the possibility of developing a corrective growth of USD in the short and/or ultra-short term.

Resistance levels: 111.16, 111.47, 111.85, 112.13.

Support levels: 110.90, 110.67, 110.45, 110.25.

Trading tips

To open long positions one can rely on the breakout of 111.16, while maintaining and strengthening of "bullish" signals from technical indicators. Take profit — 111.65 or 111.85. Stop loss — 111.05.

The return of "bearish" trend with the breakdown of 110.90 or 110.80 may become a signal for new sales with the target at 110.50 or 110.45. Stop loss — 111.10 or 111.15.

Implementation period: 2-3 days.

No comments:

Write comments