NZD/USD: technical analysis

06 September 2018, 10:15

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6590 |

| Take Profit | 0.6630 |

| Stop Loss | 0.6570 |

| Key Levels | 0.6531, 0.6560, 0.6580, 0.6627, 0.6662, 0.6702, 0.6736, 0.6789, 0.6848, 0.6893 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6565 |

| Take Profit | 0.6530 |

| Stop Loss | 0.6585 |

| Key Levels | 0.6531, 0.6560, 0.6580, 0.6627, 0.6662, 0.6702, 0.6736, 0.6789, 0.6848, 0.6893 |

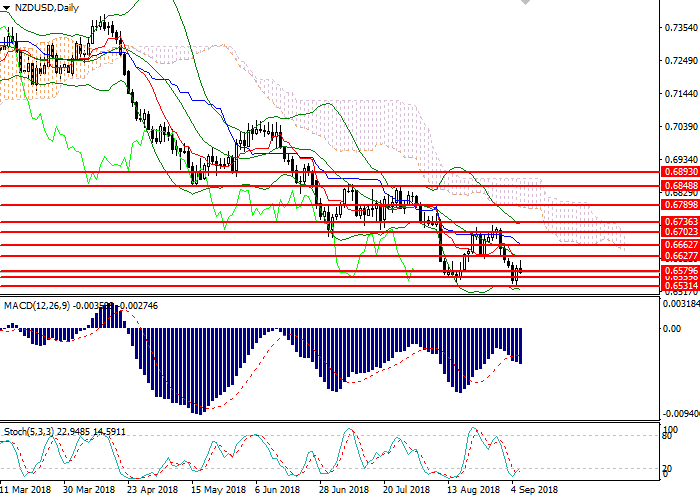

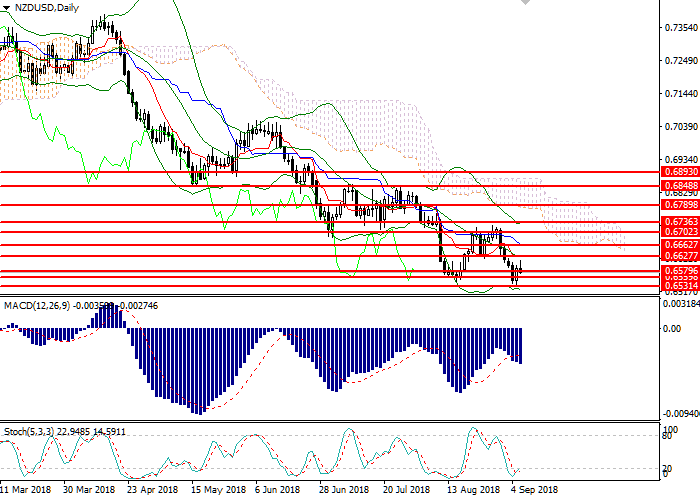

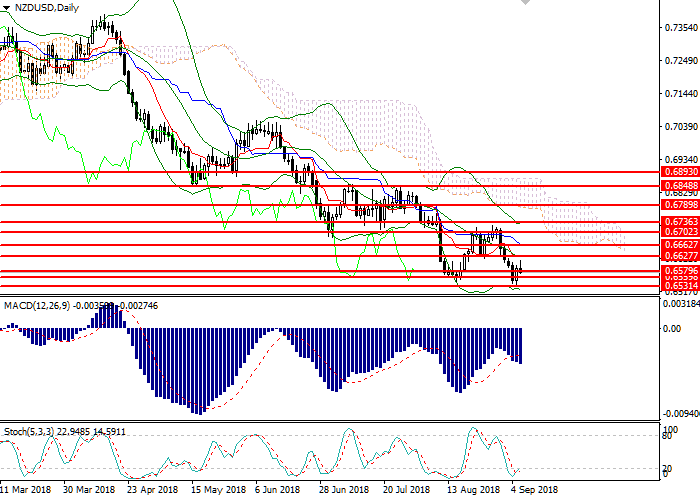

NZD/USD, D1

On the daily chart, the instrument is trading near the lows since February 2016. The key support is the level of 0.6530. Bollinger bands reversed sideways, and the price range remains unchanged, confirming the correction of the downward trend. MACD histogram is in the negative area, holding a strong sell signal. Stochastic leaves the oversold area, forming a strong buy signal.

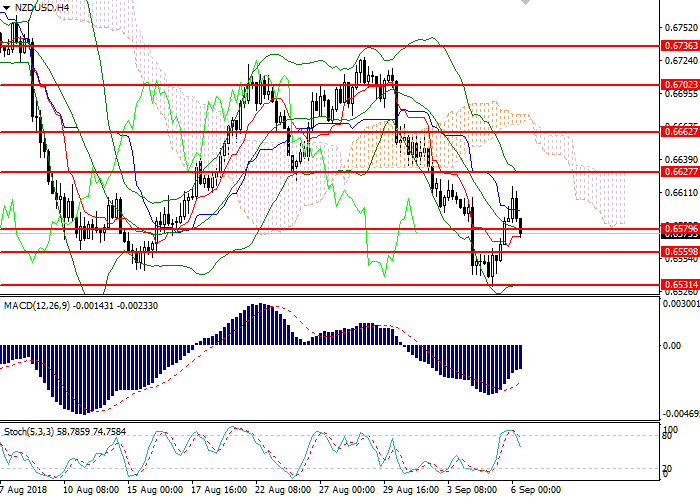

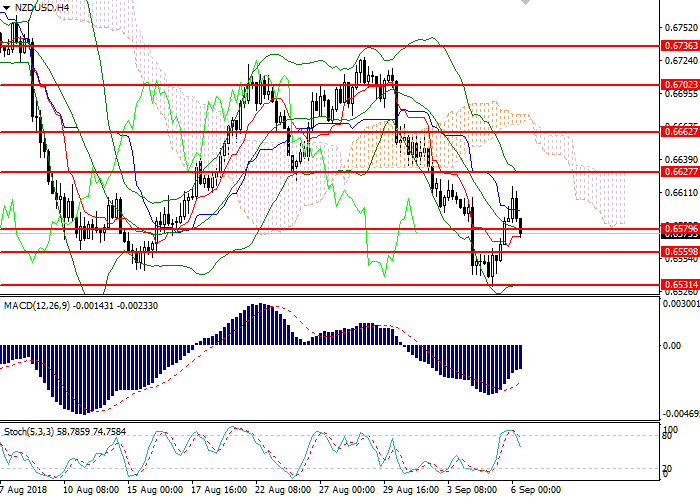

NZD/USD, H4

On the 4-hour chart, the instrument is testing the support level of 0.6580. Bollinger bands are reversing sideways, the price range remains wide enough, indicating the continuation of intraday correction. MACD histogram is in the negative zone, keeping the sell signal. Stochastic left the overbought area, forming a strong sell signal.

Key Levels

Resistance levels: 0.6627, 0.6662, 0.6702, 0.6736, 0.6789, 0.6848, 0.6893.

Support levels: 0.6580, 0.6560, 0.6531.

Trading tips

Long positions can be opened above the level of 0.6585 with the target at 0.6630 and stop loss 0.6570.

Short positions can be opened below the level of 0.6570 with the target at 0.6530 and stop loss 0.6585.

Implementation period: 1 day.

On the daily chart, the instrument is trading near the lows since February 2016. The key support is the level of 0.6530. Bollinger bands reversed sideways, and the price range remains unchanged, confirming the correction of the downward trend. MACD histogram is in the negative area, holding a strong sell signal. Stochastic leaves the oversold area, forming a strong buy signal.

NZD/USD, H4

On the 4-hour chart, the instrument is testing the support level of 0.6580. Bollinger bands are reversing sideways, the price range remains wide enough, indicating the continuation of intraday correction. MACD histogram is in the negative zone, keeping the sell signal. Stochastic left the overbought area, forming a strong sell signal.

Key Levels

Resistance levels: 0.6627, 0.6662, 0.6702, 0.6736, 0.6789, 0.6848, 0.6893.

Support levels: 0.6580, 0.6560, 0.6531.

Trading tips

Long positions can be opened above the level of 0.6585 with the target at 0.6630 and stop loss 0.6570.

Short positions can be opened below the level of 0.6570 with the target at 0.6530 and stop loss 0.6585.

Implementation period: 1 day.

No comments:

Write comments