XAG/USD: silver prices are in the correction

06 September 2018, 10:07

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 14.18, 14.27 |

| Take Profit | 14.48, 14.60 |

| Stop Loss | 14.00 |

| Key Levels | 13.83, 13.92, 13.99, 14.16, 14.24, 14.40, 14.48, 14.60 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 13.97, 13.90 |

| Take Profit | 13.83, 13.70, 13.65 |

| Stop Loss | 14.00, 14.10 |

| Key Levels | 13.83, 13.92, 13.99, 14.16, 14.24, 14.40, 14.48, 14.60 |

Current trend

Yesterday, silver prices grew moderately, being slightly corrected after the renewing of the lows since January 2016 the day before.

Tuesday’s data US ISM Manufacturing PMI data were strong. In August, the indicator rose from 58.1 to 61.3 points (the best value since 2011), which temporarily supported USD. At the same time, USD was under pressure of the Trade Balance data. In July, the balance deficit reached a five-month high of $50.1 billion. Last month, the deficit was only $45.7 billion. The sharp increase is partly due to the trade conflict between the US and China since with China the figure rose by 10% to $36.8 billion.

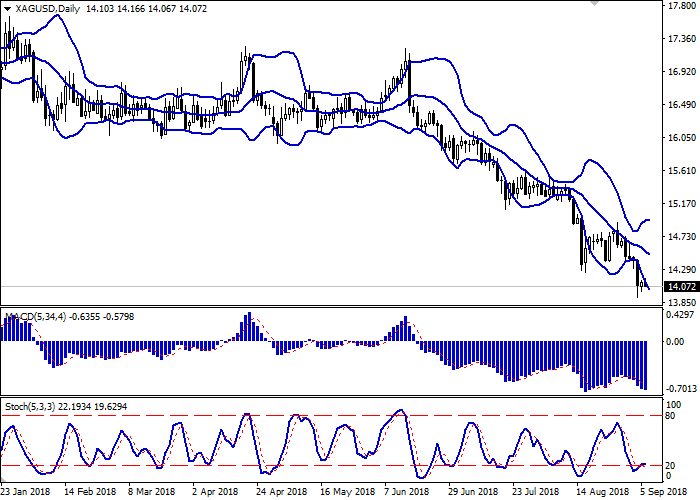

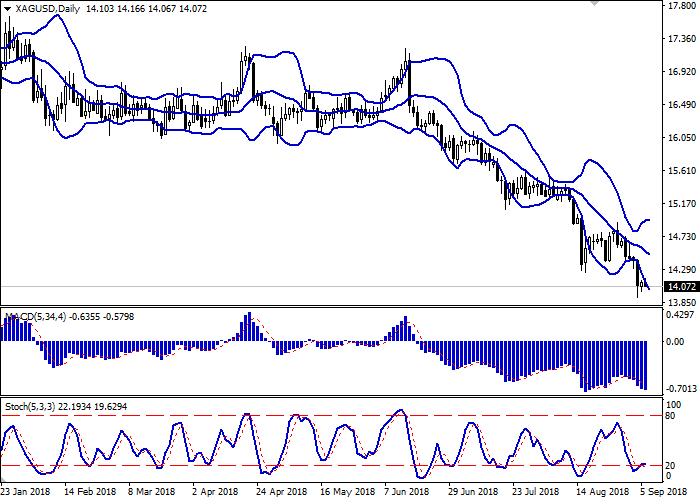

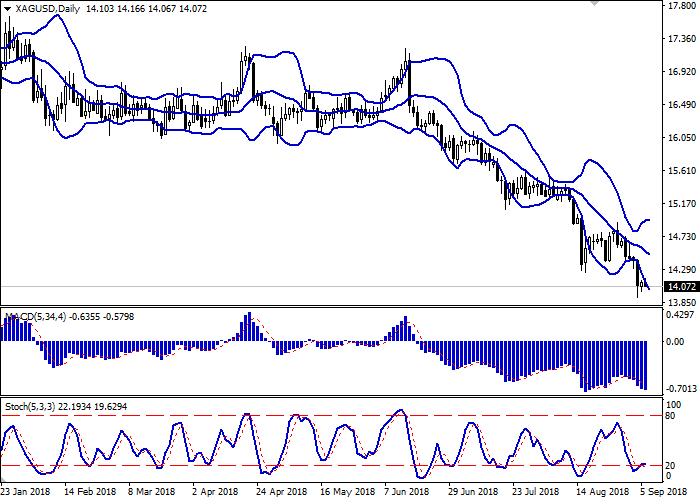

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is widening, but not as fast as the recent "bearish" dynamics is developing. MACD indicator decreases, keeping the sell signal (the histogram is below the signal line). Stochastic is stepping off its lows, indicating that silver is strongly oversold in the short/ultra-short term.

The development of the upward correction is possible at the end of the current trading week.

Resistance levels: 14.16, 14.24, 14.40, 14.48, 14.60.

Support levels: 13.99, 13.92, 13.83.

Trading tips

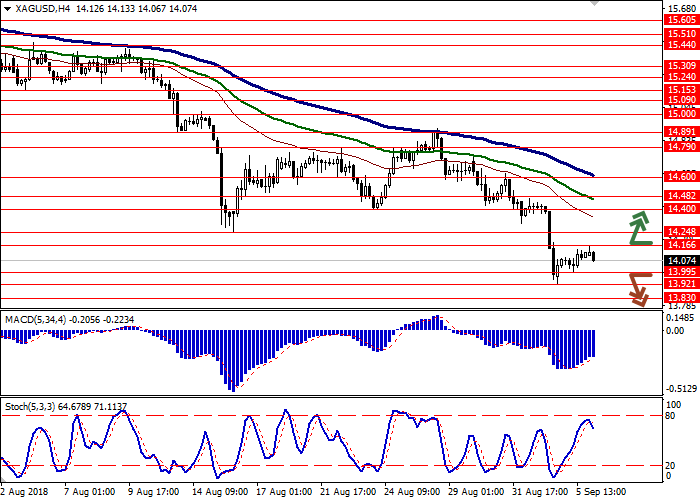

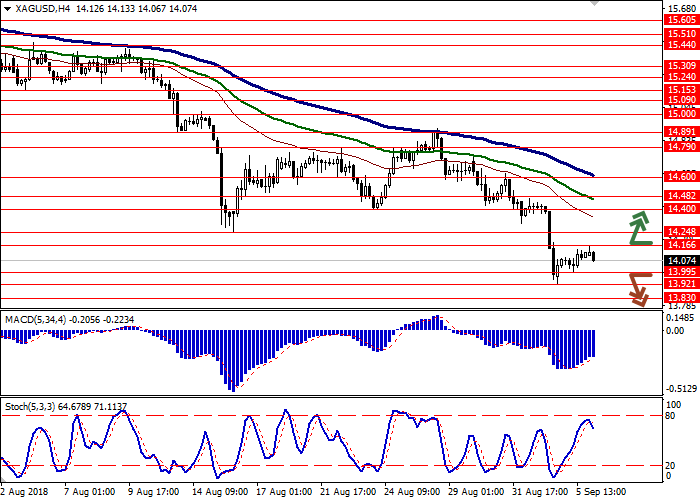

Long positions can be opened after the breakout of level 14.16 or 14.24 with the target at 14.48 or 14.60 and stop loss 14.00.

Short positions can be opened after a breakdown of the level of 13.99 or 13.92 with the targets at 13.83 or 13.70–13.65 and stop loss 14.00–14.10.

Implementation period: 2–3 days.

Yesterday, silver prices grew moderately, being slightly corrected after the renewing of the lows since January 2016 the day before.

Tuesday’s data US ISM Manufacturing PMI data were strong. In August, the indicator rose from 58.1 to 61.3 points (the best value since 2011), which temporarily supported USD. At the same time, USD was under pressure of the Trade Balance data. In July, the balance deficit reached a five-month high of $50.1 billion. Last month, the deficit was only $45.7 billion. The sharp increase is partly due to the trade conflict between the US and China since with China the figure rose by 10% to $36.8 billion.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is widening, but not as fast as the recent "bearish" dynamics is developing. MACD indicator decreases, keeping the sell signal (the histogram is below the signal line). Stochastic is stepping off its lows, indicating that silver is strongly oversold in the short/ultra-short term.

The development of the upward correction is possible at the end of the current trading week.

Resistance levels: 14.16, 14.24, 14.40, 14.48, 14.60.

Support levels: 13.99, 13.92, 13.83.

Trading tips

Long positions can be opened after the breakout of level 14.16 or 14.24 with the target at 14.48 or 14.60 and stop loss 14.00.

Short positions can be opened after a breakdown of the level of 13.99 or 13.92 with the targets at 13.83 or 13.70–13.65 and stop loss 14.00–14.10.

Implementation period: 2–3 days.

No comments:

Write comments