GBP/USD: general analysis

04 September 2018, 13:44

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.2800 |

| Take Profit | 1.2695 |

| Stop Loss | 1.2840 |

| Key Levels | 1.2695, 1.2817, 1.2940, 1.3061 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2945 |

| Take Profit | 1.3061 |

| Stop Loss | 1.2900 |

| Key Levels | 1.2695, 1.2817, 1.2940, 1.3061 |

Current trend

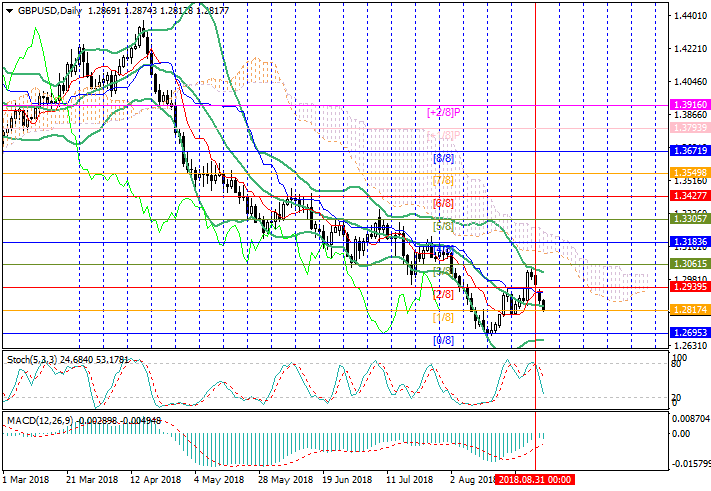

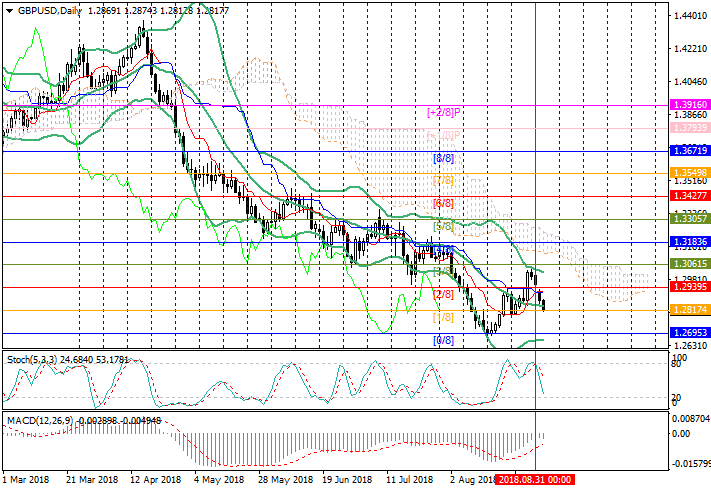

The GBP/USD pair fell to the level of 1.2817 in the mid-range of Bollinger bands under the pressure of a number of negative factors.

At the weekend, the Brexit EU negotiator, Michel Barnier, criticized the plan of British Prime Minister Therese May to control the movement of goods on the borders of Great Britain, which weakened GBP.

The price was also influenced by poor British PMI releases. August Manufacturing PMI fell from 53.8 to 52.8 points (the minimum since mid-2016) due to a fall in export orders volumes. August Construction PMI declined from 55.8 to 52.9 points (the minimum since May). According to BRC, August Retail Sales grew by only 0.2% instead of the expected 1.2%. The increase in online sales by 7.5% compensated for a decrease of 2.1% of outlet sales.

The uncertainty about the head of the Bank of England, Mark Carney, who should retire in June 2019, affects GBP negatively. The Ministry of Finance is negotiating with Carney to extend his term for another year, in order not to change the head during a tough Brexit situation. The agreement has not been reached yet.

Support and resistance

The price tests the level of 1.2817 (Murrey [1/8], the middle line of Bollinger bands) and after its breakdown may drop to 1.2695 (Murrey [0/8]). Otherwise, growth to 1.2940 (Murrey [2/8]) and 1.3061 (Murrey [3/8]) is possible. However, the decrease seems more likely, as Stochastic reversed downwards, and MACD increases in the negative zone.

Resistance levels: 1.2940, 1.3061.

Support levels: 1.2817, 1.2695.

Trading tips

Short positions can be opened from 1.2800 with the target at 1.2695 and a stop loss around 1.2840.

Long positions can be opened above 1.2940 with the target at 1.3061 and stop loss 1.2900.

Implementation period: 4–5 days.

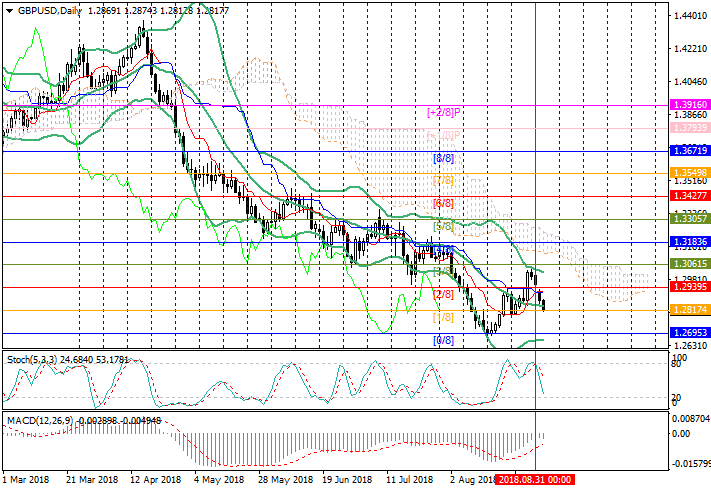

The GBP/USD pair fell to the level of 1.2817 in the mid-range of Bollinger bands under the pressure of a number of negative factors.

At the weekend, the Brexit EU negotiator, Michel Barnier, criticized the plan of British Prime Minister Therese May to control the movement of goods on the borders of Great Britain, which weakened GBP.

The price was also influenced by poor British PMI releases. August Manufacturing PMI fell from 53.8 to 52.8 points (the minimum since mid-2016) due to a fall in export orders volumes. August Construction PMI declined from 55.8 to 52.9 points (the minimum since May). According to BRC, August Retail Sales grew by only 0.2% instead of the expected 1.2%. The increase in online sales by 7.5% compensated for a decrease of 2.1% of outlet sales.

The uncertainty about the head of the Bank of England, Mark Carney, who should retire in June 2019, affects GBP negatively. The Ministry of Finance is negotiating with Carney to extend his term for another year, in order not to change the head during a tough Brexit situation. The agreement has not been reached yet.

Support and resistance

The price tests the level of 1.2817 (Murrey [1/8], the middle line of Bollinger bands) and after its breakdown may drop to 1.2695 (Murrey [0/8]). Otherwise, growth to 1.2940 (Murrey [2/8]) and 1.3061 (Murrey [3/8]) is possible. However, the decrease seems more likely, as Stochastic reversed downwards, and MACD increases in the negative zone.

Resistance levels: 1.2940, 1.3061.

Support levels: 1.2817, 1.2695.

Trading tips

Short positions can be opened from 1.2800 with the target at 1.2695 and a stop loss around 1.2840.

Long positions can be opened above 1.2940 with the target at 1.3061 and stop loss 1.2900.

Implementation period: 4–5 days.

No comments:

Write comments