EUR/USD: consolidation before the fall

04 September 2018, 14:35

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 1.1500 |

| Take Profit | 1.1700 |

| Stop Loss | 1.1440 |

| Key Levels | 1.1000, 1.1300, 1.1320, 1.1350, 1.1400, 1.1430, 1.1500, 1.1530, 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1800 |

Current trend

The euro falls against the US dollar after a significant recovery in the second half of August.

The growth of the pair was due to the change in trade sentiment and the loss of demand for USD amid weak statistics for the United States and positive releases for the Eurozone. In late August and early September, the instrument again went down on strong data on the growth rate of the US economy in Q2 and the labor market. It should be noted that the pair is trading above the key support level of 1.1500 that it tried to overcome several times since May, which indicates its strength.

The main releases are due at the end of the week: data on the labor market, production orders, and major US indices. Europe will publish data on GDP for Q2 2018.

Support and resistance

In the medium term, the pair is expected to decline further within the narrow downward channel to the level of 1.1500. Later, the instrument may again go to the lateral consolidation within the range of 1.1500-1.1700. In the long term, the growth of the US currency is expected to resume, so after a lateral move, the pair may go down to new lows (1.1300, 1.1250, 1.1000).

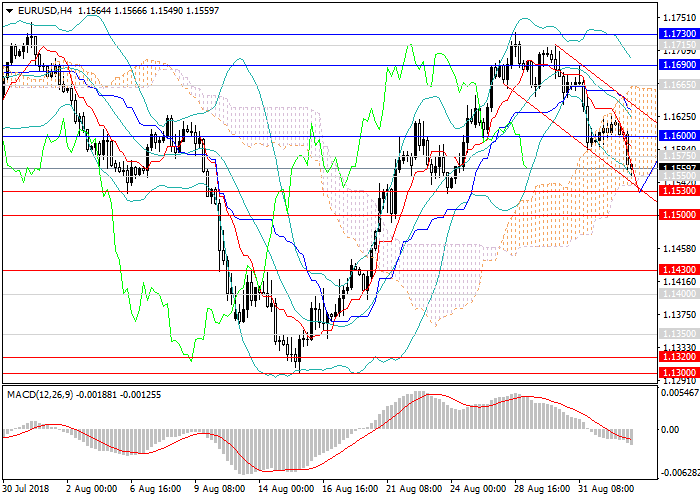

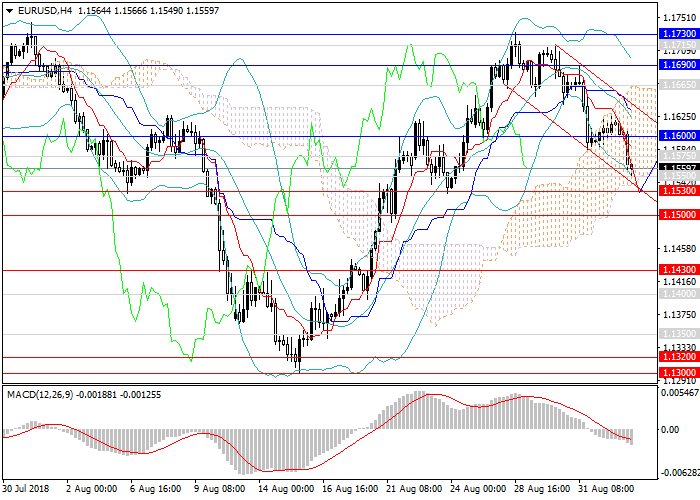

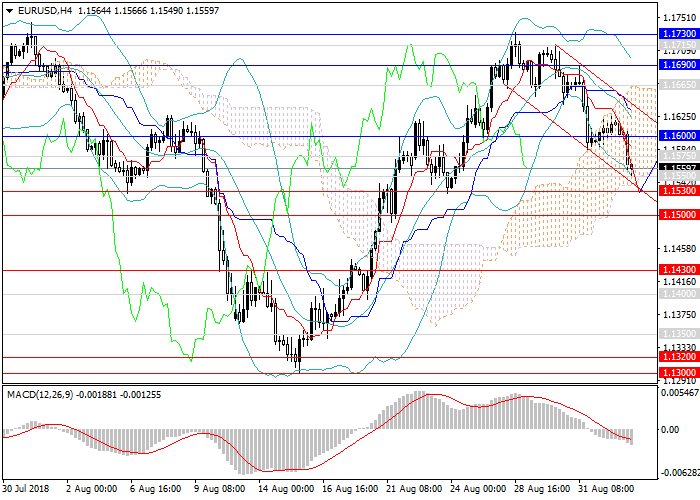

Technical indicators confirm the consolidation outlook: on H4 chart, MACD indicates a decrease in the volume for the pair, and the signal line is near zero.

Support levels: 1.1530, 1.1500, 1.1430, 1.1400, 1.1350, 1.1320, 1.1300, 1.1000.

Resistance levels: 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1800.

Trading tips

Deferred long positions may be opened from the key support level of 1.1500 with the target at 1.1700 and stop loss at 1.1440.

The euro falls against the US dollar after a significant recovery in the second half of August.

The growth of the pair was due to the change in trade sentiment and the loss of demand for USD amid weak statistics for the United States and positive releases for the Eurozone. In late August and early September, the instrument again went down on strong data on the growth rate of the US economy in Q2 and the labor market. It should be noted that the pair is trading above the key support level of 1.1500 that it tried to overcome several times since May, which indicates its strength.

The main releases are due at the end of the week: data on the labor market, production orders, and major US indices. Europe will publish data on GDP for Q2 2018.

Support and resistance

In the medium term, the pair is expected to decline further within the narrow downward channel to the level of 1.1500. Later, the instrument may again go to the lateral consolidation within the range of 1.1500-1.1700. In the long term, the growth of the US currency is expected to resume, so after a lateral move, the pair may go down to new lows (1.1300, 1.1250, 1.1000).

Technical indicators confirm the consolidation outlook: on H4 chart, MACD indicates a decrease in the volume for the pair, and the signal line is near zero.

Support levels: 1.1530, 1.1500, 1.1430, 1.1400, 1.1350, 1.1320, 1.1300, 1.1000.

Resistance levels: 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1800.

Trading tips

Deferred long positions may be opened from the key support level of 1.1500 with the target at 1.1700 and stop loss at 1.1440.

No comments:

Write comments