FDAX: technical analysis

06 September 2018, 11:29

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL LIMIT |

| Entry Point | 12110.0 |

| Take Profit | 11950.0, 11860.0, 11700.0 |

| Stop Loss | 12220.0 |

| Key Levels | 11700.0, 11860.0, 11950.0, 12110.0, 12220.0, 12340.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 12340.0 |

| Take Profit | 12500.0 |

| Stop Loss | 12250.0 |

| Key Levels | 11700.0, 11860.0, 11950.0, 12110.0, 12220.0, 12340.0 |

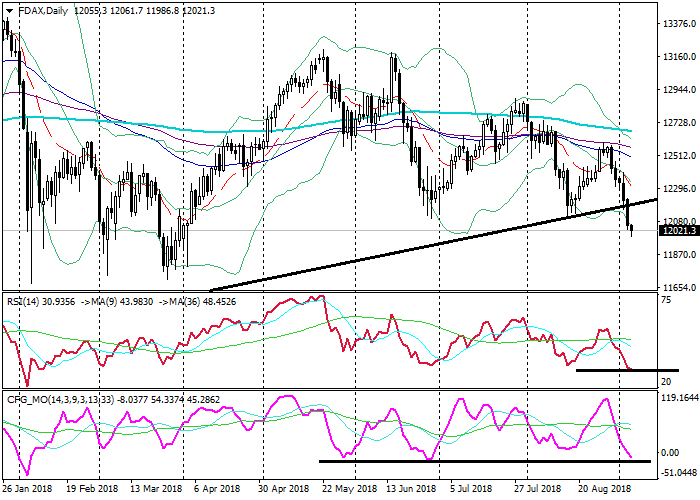

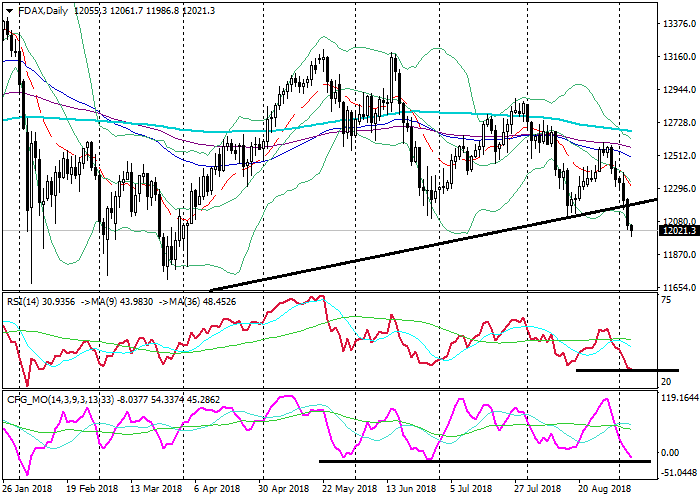

FDAX, D1

On the daily chart, the instrument is trading below the lower line of the Bollinger Bands. The price remains below its moving averages that are directed down. The RSI is testing the border of the oversold zone. The Composite is testing its quite strong support.

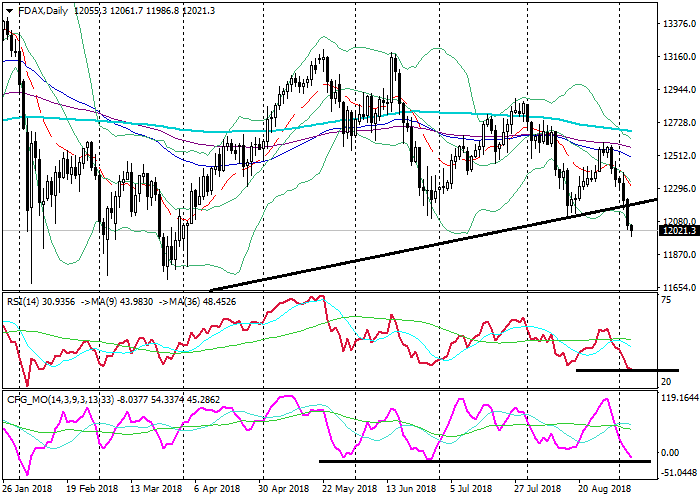

FDAX, H4

On the 4-hour chart, the instrument is falling along the lower line of the Bollinger Bands. The price remains below its moving averages that are directed down. The RSI keeps falling, having entered the oversold zone. The Composite is about to test its strong support.

Key levels

Support levels: 11950.0 (April 2017 lows), 11860.0 (August 2017 lows), 11700.0 (March lows).

Resistance levels: 12110.0 (June lows), 12220.0 (local highs), 12340.0 (local highs).

Trading tips

The price has broken down its long-term ascending trendline. There is a chance of a short-term upward correction, after which the fall will continue.

Pending sell order can be placed at the level of 12110.0 with targets at 11950.0, 11860.0, 11700.0 and stop-loss at 12220.0. Validity – 3-5 days.

Long positions can be opened from the level of 12340.0 with the target at 12500.0 and stop-loss at 12250.0. Validity – 3-5 days.

On the daily chart, the instrument is trading below the lower line of the Bollinger Bands. The price remains below its moving averages that are directed down. The RSI is testing the border of the oversold zone. The Composite is testing its quite strong support.

FDAX, H4

On the 4-hour chart, the instrument is falling along the lower line of the Bollinger Bands. The price remains below its moving averages that are directed down. The RSI keeps falling, having entered the oversold zone. The Composite is about to test its strong support.

Key levels

Support levels: 11950.0 (April 2017 lows), 11860.0 (August 2017 lows), 11700.0 (March lows).

Resistance levels: 12110.0 (June lows), 12220.0 (local highs), 12340.0 (local highs).

Trading tips

The price has broken down its long-term ascending trendline. There is a chance of a short-term upward correction, after which the fall will continue.

Pending sell order can be placed at the level of 12110.0 with targets at 11950.0, 11860.0, 11700.0 and stop-loss at 12220.0. Validity – 3-5 days.

Long positions can be opened from the level of 12340.0 with the target at 12500.0 and stop-loss at 12250.0. Validity – 3-5 days.

No comments:

Write comments