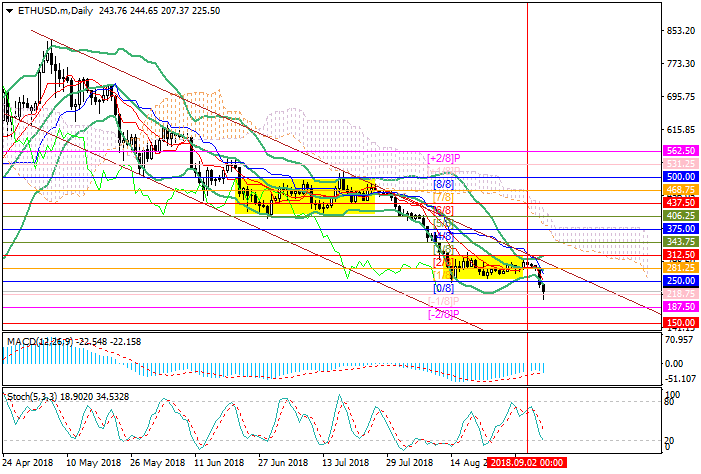

Ethereum: general analysis

06 September 2018, 11:39

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 212.00 |

| Take Profit | 187.50, 150.00 |

| Stop Loss | 225.00 |

| Key Levels | 150.00, 187.50, 218.75, 250.00, 281.25, 312.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 255.00 |

| Take Profit | 281.25, 312.50 |

| Stop Loss | 220.00 |

| Key Levels | 150.00, 187.50, 218.75, 250.00, 281.25, 312.50 |

Current trend

On Wednesday, Ether quotes along with the entire market began a downward correction and tested the level of 218.75 (Murrey [–1/8]) due to the actions of speculators, as well as media reports that Goldman Sachs bank will not create a department specializing in trading crypto-currencies in the near future. The reason for this step is the current uncertainty in the regulation of digital assets. Earlier it was believed that Goldman Sachs was preparing to provide its customers with access to trading in the cryptocurrency market, but now, it is likely that the bank will limit itself to creating a digital currency storage system for large institutional investors. Perhaps, Goldman Sachs will change its position in case of SEC approval bitcoin-ETF, which may take place this month.

Support and resistance

Now the price is trading around 218.75 (Murrey [–1/8]) and may drop to the levels of 187.50 (Murrey [–2/8]) and 150.00 (July 2017 lows). The downwards scenario is confirmed by Stochastic reversing downwards, and Bollinger bands, which began to diverge. On the other hand, the price broke the lower border of Bollinger bands, which does not exclude a possible correction to 281.25 (Murrey [1/8], the middle line of Bollinger bands) and 312.50 (Murrey [2/8]).

Resistance levels: 250.00, 281.25, 312.50.

Support levels: 218.75, 187.50, 150.00.

Trading tips

Short positions can be opened from the level of 212.00 with the targets at 187.50, 150.00 and stop loss 225.00.

Long positions can be opened above the level of 250.00 with the targets at 281.25, 312.50 and stop loss around 220.00.

Implementation period: 3–5 days.

On Wednesday, Ether quotes along with the entire market began a downward correction and tested the level of 218.75 (Murrey [–1/8]) due to the actions of speculators, as well as media reports that Goldman Sachs bank will not create a department specializing in trading crypto-currencies in the near future. The reason for this step is the current uncertainty in the regulation of digital assets. Earlier it was believed that Goldman Sachs was preparing to provide its customers with access to trading in the cryptocurrency market, but now, it is likely that the bank will limit itself to creating a digital currency storage system for large institutional investors. Perhaps, Goldman Sachs will change its position in case of SEC approval bitcoin-ETF, which may take place this month.

Support and resistance

Now the price is trading around 218.75 (Murrey [–1/8]) and may drop to the levels of 187.50 (Murrey [–2/8]) and 150.00 (July 2017 lows). The downwards scenario is confirmed by Stochastic reversing downwards, and Bollinger bands, which began to diverge. On the other hand, the price broke the lower border of Bollinger bands, which does not exclude a possible correction to 281.25 (Murrey [1/8], the middle line of Bollinger bands) and 312.50 (Murrey [2/8]).

Resistance levels: 250.00, 281.25, 312.50.

Support levels: 218.75, 187.50, 150.00.

Trading tips

Short positions can be opened from the level of 212.00 with the targets at 187.50, 150.00 and stop loss 225.00.

Long positions can be opened above the level of 250.00 with the targets at 281.25, 312.50 and stop loss around 220.00.

Implementation period: 3–5 days.

No comments:

Write comments