USD/JPY: general analysis

15 August 2018, 12:06

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 111.30 |

| Take Profit | 110.93, 110.54 |

| Stop Loss | 111.45 |

| Key Levels | 110.15, 110.54, 110.93, 111.32, 111.72, 112.10 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 111.40 |

| Take Profit | 111.72, 112.10 |

| Stop Loss | 111.15 |

| Key Levels | 110.15, 110.54, 110.93, 111.32, 111.72, 112.10 |

Current trend

This week the pair is growing, JPY is under pressure of poor statistics. June Industrial Production decreased by 0.9% YoY and by 1.8% MoM. In addition, Retail Sales in China, the leading Japanese trading partner, declined from 9.0% to 8.8%, which also weakened JPY. The trade war between the US and China begins to affect Chinese consumers and reduce purchases, including Japanese goods.

Investors are concerned by the US-Japan trade disagreements. After imposing increased duties on aluminum and steel produced in Japan, the US administration can introduce similar tariffs for Japanese cars and spare parts for them. At the end of last week, the first round of US-Japan trade negotiations took place, but it did not bring any results. The parties only exchanged a vision of the situation and agreed to meet again in September.

Today, US Retail Sales release is expected, which may be poor. In July, it may decline for the third consecutive month from 0.5% to 0.1%, in this case, the pair will be corrected downwards.

Support and resistance

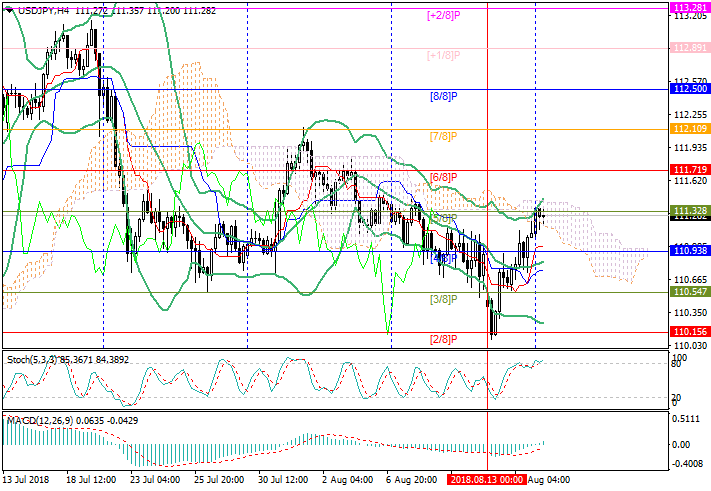

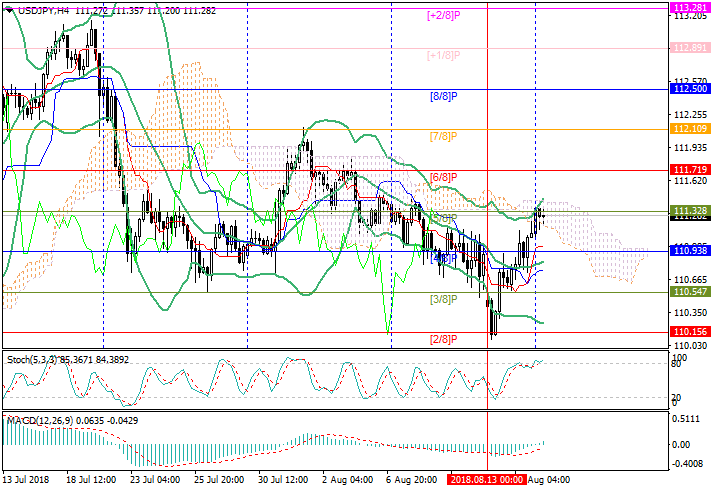

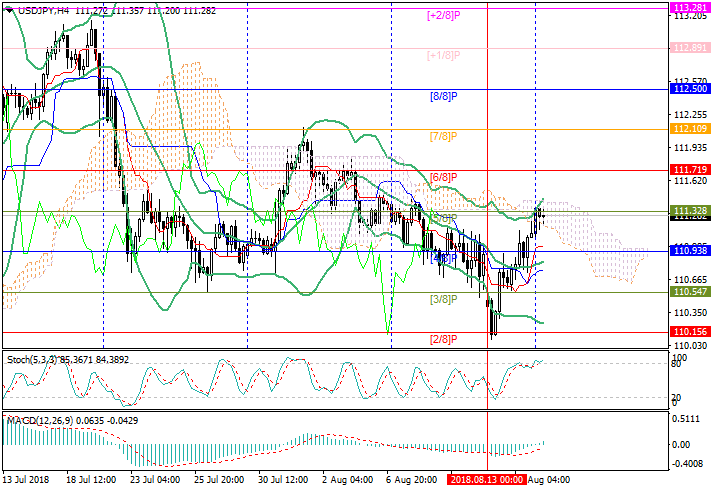

On the 4-hour chart, the price tested the level of 111.32 (Murrey [5/8]) and can fall to 110.93 (Murrey [4/8], middle Bollinger Bands line), 110.54 (Murrey [3/8]) and 110.15 (Murrey [2/8]), which is confirmed by Stochastic, which reverses in the overbought zone. The growth to 111.72 (Murrey [6/8]) and 112.10 (Murrey [7/8]) will be possible if the price is fixed above the level of 111.32.

Resistance levels: 111.32, 111.72, 112.10.

Support levels: 110.93, 110.54, 110.15.

Trading tips

Short positions can be opened from the current level with the targets at 110.93, 110.54 and stop loss 111.45.

Long positions can be opened from 111.40 with the targets at 111.72, 112.10 and stop loss around 111.15.

Implementation period: 3–4 days.

This week the pair is growing, JPY is under pressure of poor statistics. June Industrial Production decreased by 0.9% YoY and by 1.8% MoM. In addition, Retail Sales in China, the leading Japanese trading partner, declined from 9.0% to 8.8%, which also weakened JPY. The trade war between the US and China begins to affect Chinese consumers and reduce purchases, including Japanese goods.

Investors are concerned by the US-Japan trade disagreements. After imposing increased duties on aluminum and steel produced in Japan, the US administration can introduce similar tariffs for Japanese cars and spare parts for them. At the end of last week, the first round of US-Japan trade negotiations took place, but it did not bring any results. The parties only exchanged a vision of the situation and agreed to meet again in September.

Today, US Retail Sales release is expected, which may be poor. In July, it may decline for the third consecutive month from 0.5% to 0.1%, in this case, the pair will be corrected downwards.

Support and resistance

On the 4-hour chart, the price tested the level of 111.32 (Murrey [5/8]) and can fall to 110.93 (Murrey [4/8], middle Bollinger Bands line), 110.54 (Murrey [3/8]) and 110.15 (Murrey [2/8]), which is confirmed by Stochastic, which reverses in the overbought zone. The growth to 111.72 (Murrey [6/8]) and 112.10 (Murrey [7/8]) will be possible if the price is fixed above the level of 111.32.

Resistance levels: 111.32, 111.72, 112.10.

Support levels: 110.93, 110.54, 110.15.

Trading tips

Short positions can be opened from the current level with the targets at 110.93, 110.54 and stop loss 111.45.

Long positions can be opened from 111.40 with the targets at 111.72, 112.10 and stop loss around 111.15.

Implementation period: 3–4 days.

No comments:

Write comments