USD/CAD: USD grows

17 August 2018, 10:44

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3180 |

| Take Profit | 1.3258, 1.3275 |

| Stop Loss | 1.3140, 1.3130 |

| Key Levels | 1.2961, 1.3000, 1.3047, 1.3100, 1.3173, 1.3200, 1.3258, 1.3300 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL |

| Entry Point | 1.3146 |

| Take Profit | 1.3047, 1.3020, 1.3000 |

| Stop Loss | 1.3200 |

| Key Levels | 1.2961, 1.3000, 1.3047, 1.3100, 1.3173, 1.3200, 1.3258, 1.3300 |

Current trend

USD strengthens against CAD, recovering after a decline at the beginning of the week when the instrument stepped off its local highs. Development of the "bullish" dynamics is due to the growth of investors' interest in the USD as a result of tightening relations between Turkey and the USA.

Thursday’s Canadian data moderately supported CAD. July ADP Employment Change grew by 11600 jobs after a decline of 10521 in June. June Manufacturing Shipments increased by 1.1% MoM, slightly worse than last month's data (+1.5% MoM), but better than market expectations (+0.9% MoM).

Today, investors are waiting for the block of Canadian July consumer inflation data. CPI growth is expected to stay at 0.1% MoM and 2.5% YoY. BOC CPI Core is expected to stay at +1.3% YoY.

Support and resistance

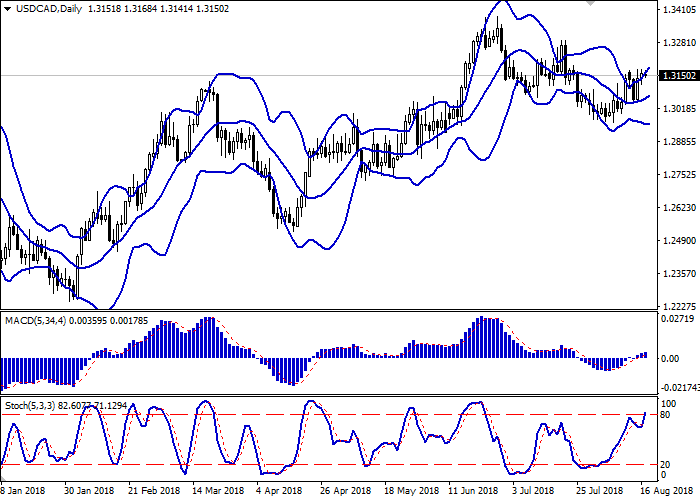

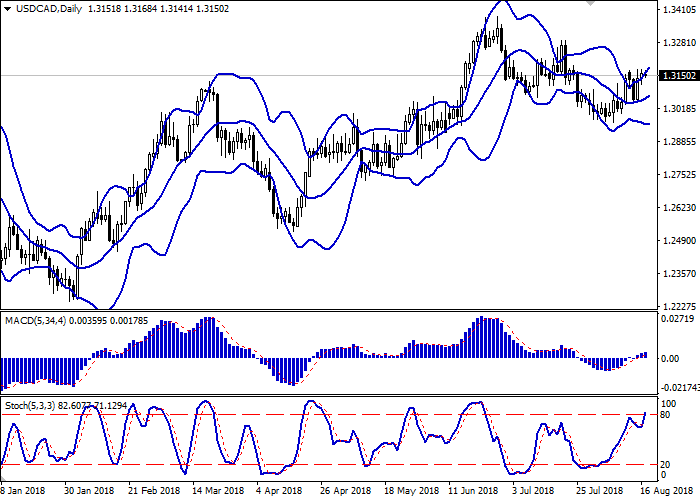

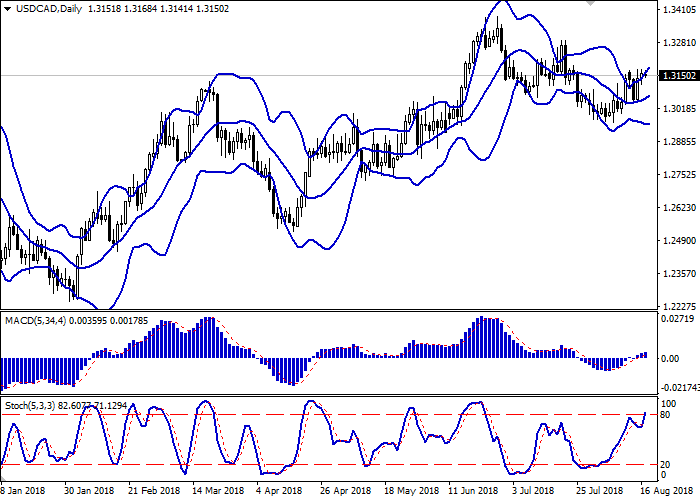

On the daily chart, Bollinger bands are moderately growing. The price range expands, letting the "bulls" renew local highs. MACD is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic is directed upwards but is approaching its highs, which reflects that USD can become overbought in the short term.

The indicators’ readings do not contradict the further development of the "bullish" trend in the short term.

Resistance levels: 1.3173, 1.3200, 1.3258, 1.3300.

Support levels: 1.3100, 1.3047, 1.3000, 1.2961.

Trading tips

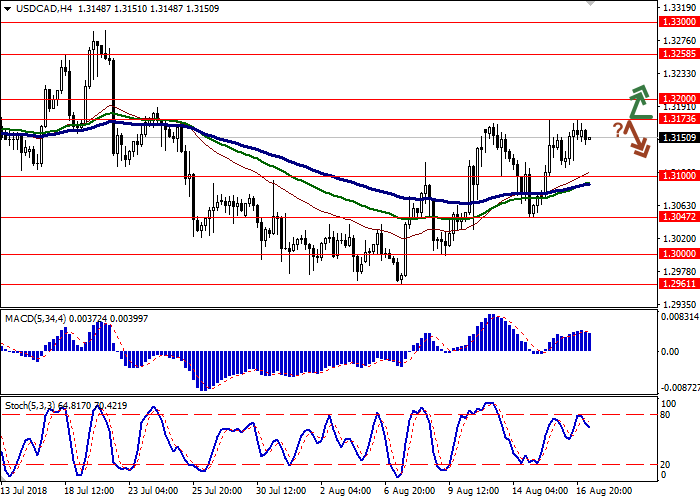

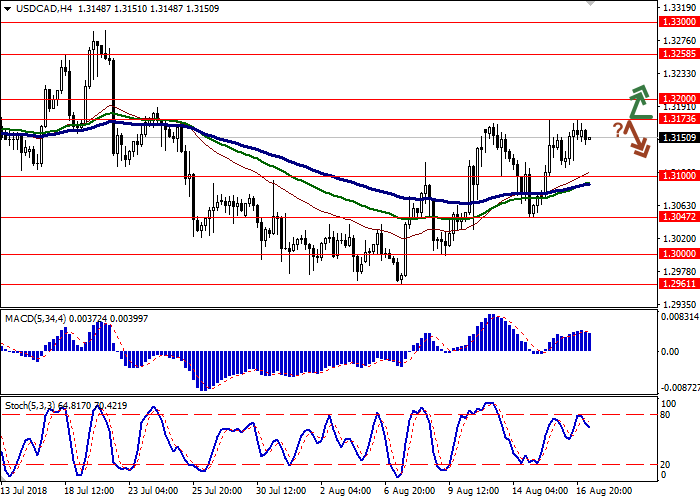

Long positions can be opened after the breakout of the level of 1.3173 with the targets at 1.3258–1.3275 and stop loss 1.3140–1.3130.

Short positions can be opened after the rebound from the level of 1.3173 and breakdown of the level of 1.3150 with the targets at 1.3047 or 1.3020–1.3000. Stop loss is no further than 1.3200.

Implementation period: 2–3 days.

USD strengthens against CAD, recovering after a decline at the beginning of the week when the instrument stepped off its local highs. Development of the "bullish" dynamics is due to the growth of investors' interest in the USD as a result of tightening relations between Turkey and the USA.

Thursday’s Canadian data moderately supported CAD. July ADP Employment Change grew by 11600 jobs after a decline of 10521 in June. June Manufacturing Shipments increased by 1.1% MoM, slightly worse than last month's data (+1.5% MoM), but better than market expectations (+0.9% MoM).

Today, investors are waiting for the block of Canadian July consumer inflation data. CPI growth is expected to stay at 0.1% MoM and 2.5% YoY. BOC CPI Core is expected to stay at +1.3% YoY.

Support and resistance

On the daily chart, Bollinger bands are moderately growing. The price range expands, letting the "bulls" renew local highs. MACD is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic is directed upwards but is approaching its highs, which reflects that USD can become overbought in the short term.

The indicators’ readings do not contradict the further development of the "bullish" trend in the short term.

Resistance levels: 1.3173, 1.3200, 1.3258, 1.3300.

Support levels: 1.3100, 1.3047, 1.3000, 1.2961.

Trading tips

Long positions can be opened after the breakout of the level of 1.3173 with the targets at 1.3258–1.3275 and stop loss 1.3140–1.3130.

Short positions can be opened after the rebound from the level of 1.3173 and breakdown of the level of 1.3150 with the targets at 1.3047 or 1.3020–1.3000. Stop loss is no further than 1.3200.

Implementation period: 2–3 days.

No comments:

Write comments