EUR/USD: the euro is in the correction

17 August 2018, 10:20

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1410 |

| Take Profit | 1.1500, 1.1539 |

| Stop Loss | 1.1352 |

| Key Levels | 1.1266, 1.1300, 1.1352, 1.1400, 1.1446, 1.1473, 1.1500 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 1.1400 |

| Take Profit | 1.1300 |

| Stop Loss | 1.1446 |

| Key Levels | 1.1266, 1.1300, 1.1352, 1.1400, 1.1446, 1.1473, 1.1500 |

Current trend

Yesterday, EUR moderately grew against USD, stepping off the local lows, updated the day before.

On Thursday, EUR was supported by news of the upcoming US-PRC trade negotiations and relative stabilization of Turkish financial situation. After the Central Bank announcement of emergency measures to support the national banking system, the lira began to strengthen. Also, EU leaders support Turkey verbally. Recently the German Chancellor Angela Merkel called President Rejep Erdogan and assured him that Germany was interested in a strong Turkish economy.

June Trade Balance data, published on Thursday, were poor. The surplus fell for the fifth consecutive month, from 16.9 billion to 16.7 billion dollars, which may be due to the situation in world trade.

On Friday, investors are waiting for July EU Retail Sales release. The indicators are expected to stay the same. YoY Consumer Price Index will be 2.1%, and the YoY Base CPI will reach 1.1%.

Support and resistance

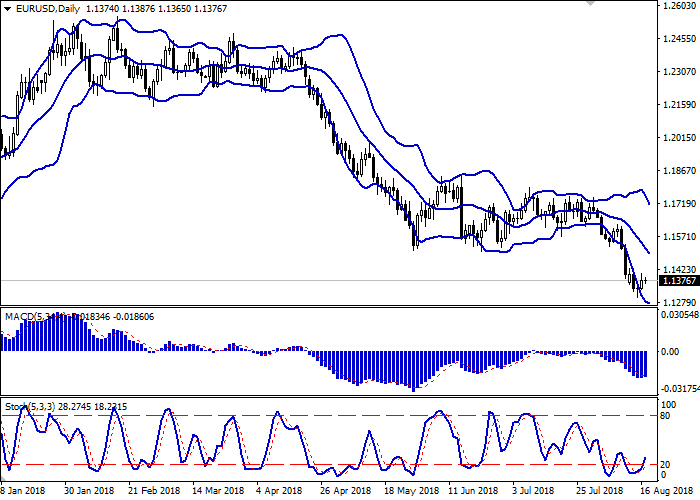

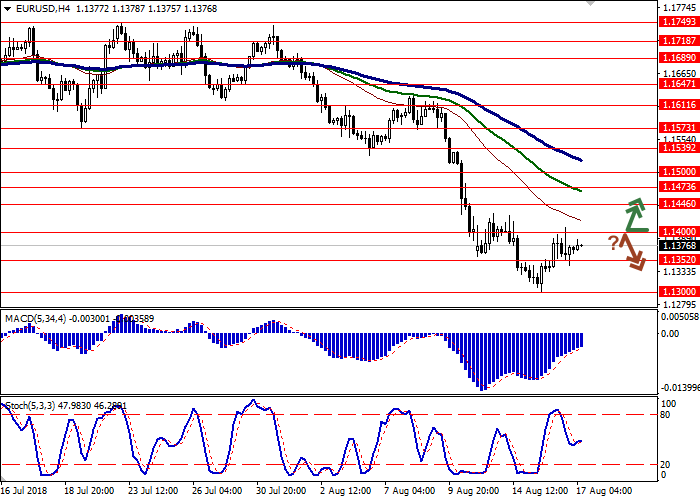

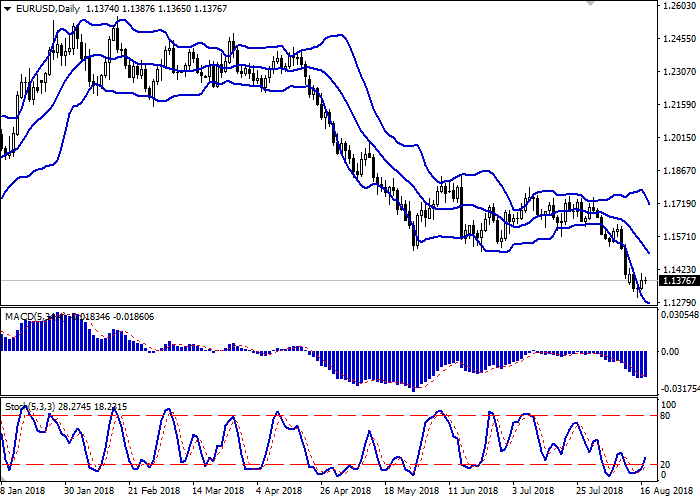

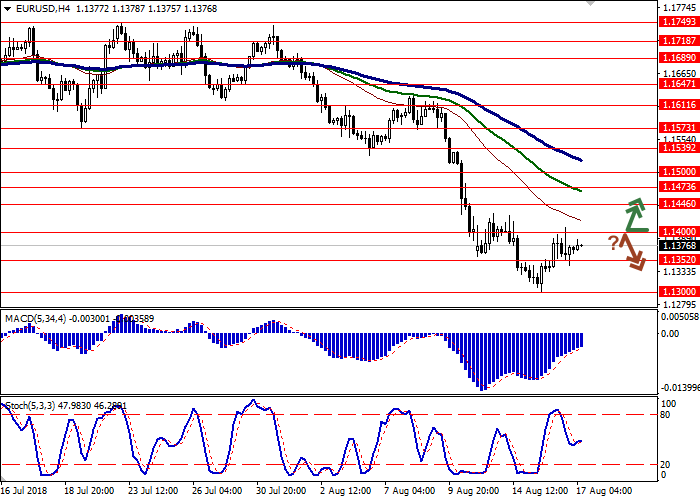

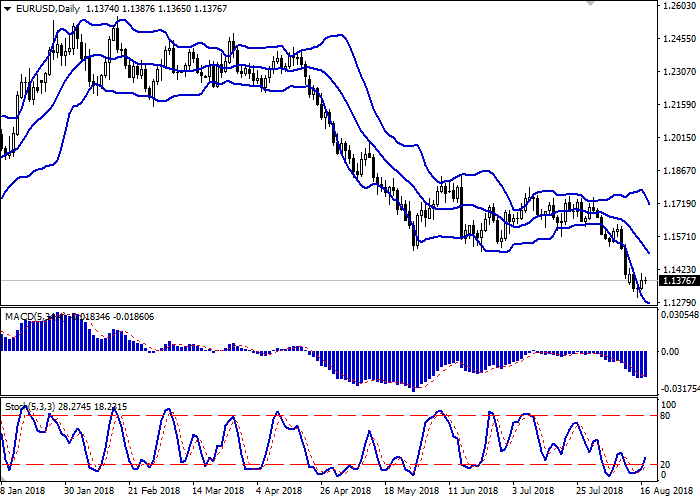

On the daily chart, Bollinger bands are steadily declining. The price range is narrowing, reflecting a change in the trade direction in the short term. MACD grows, preparing to generate a new buy signal (the histogram should consolidate above the signal line). Stochastic strongly grows, quickly stepping off its lows.

Further development of the corrective growth is possible in the short and/or ultra-short term.

Resistance levels: 1.1400, 1.1446, 1.1473, 1.1500.

Support levels: 1.1352, 1.1300, 1.1266.

Trading tips

Long positions can be opened after the breakout of the level of 1.1400 with the target at 1.1500 or 1.1539 and stop loss 1.1352. Implementation period: 2–3 days.

Short positions can be opened after the rebound from level 1.1400 with the target at 1.1300. Stop loss is 1.1446. Implementation period: 1–2 days.

Yesterday, EUR moderately grew against USD, stepping off the local lows, updated the day before.

On Thursday, EUR was supported by news of the upcoming US-PRC trade negotiations and relative stabilization of Turkish financial situation. After the Central Bank announcement of emergency measures to support the national banking system, the lira began to strengthen. Also, EU leaders support Turkey verbally. Recently the German Chancellor Angela Merkel called President Rejep Erdogan and assured him that Germany was interested in a strong Turkish economy.

June Trade Balance data, published on Thursday, were poor. The surplus fell for the fifth consecutive month, from 16.9 billion to 16.7 billion dollars, which may be due to the situation in world trade.

On Friday, investors are waiting for July EU Retail Sales release. The indicators are expected to stay the same. YoY Consumer Price Index will be 2.1%, and the YoY Base CPI will reach 1.1%.

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is narrowing, reflecting a change in the trade direction in the short term. MACD grows, preparing to generate a new buy signal (the histogram should consolidate above the signal line). Stochastic strongly grows, quickly stepping off its lows.

Further development of the corrective growth is possible in the short and/or ultra-short term.

Resistance levels: 1.1400, 1.1446, 1.1473, 1.1500.

Support levels: 1.1352, 1.1300, 1.1266.

Trading tips

Long positions can be opened after the breakout of the level of 1.1400 with the target at 1.1500 or 1.1539 and stop loss 1.1352. Implementation period: 2–3 days.

Short positions can be opened after the rebound from level 1.1400 with the target at 1.1300. Stop loss is 1.1446. Implementation period: 1–2 days.

No comments:

Write comments