SPX: general analysis

17 August 2018, 10:06

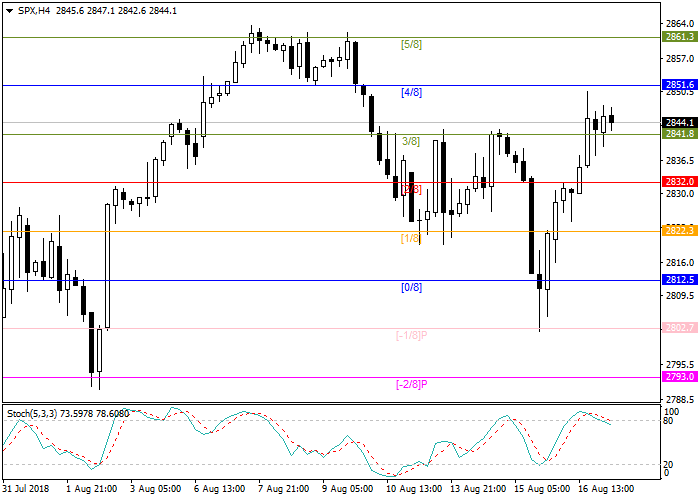

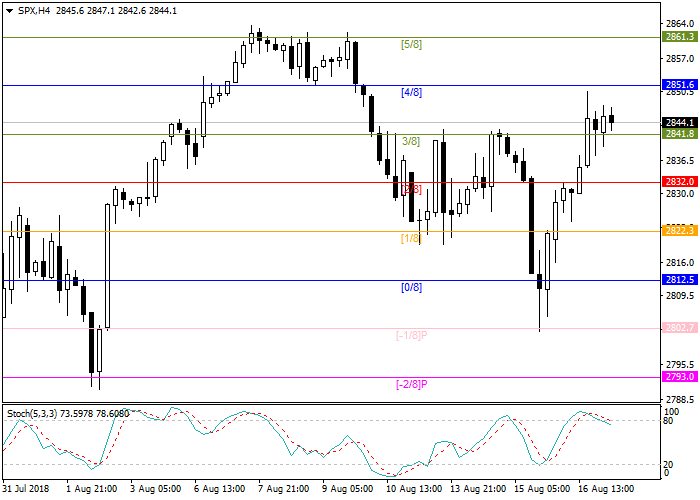

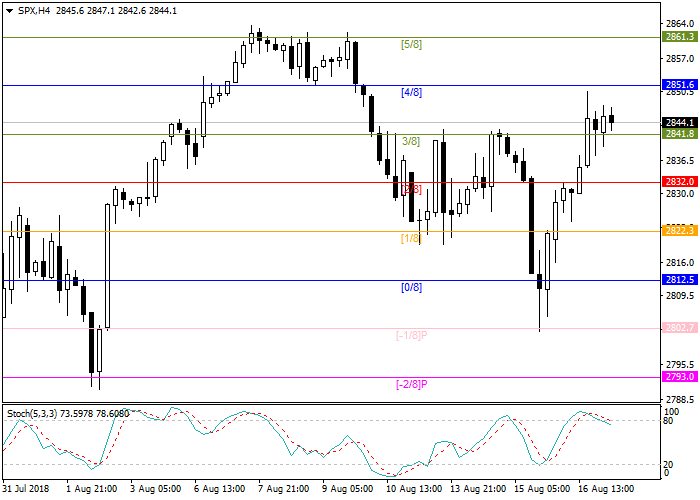

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 2852.0 |

| Take Profit | 2861.5 |

| Stop Loss | 2843.0 |

| Key Levels | 2832.0, 2841.8, 2851.6, 2861.5 |

Current trend

Yesterday, the S&P 500 index regained the losses of previous days and is now trading near the key resistance level of 4/8 Murrey or 2851.6. In case of the breakout, it can renew the historical maximum around 2876.4.

Traders react to positive news regarding the negotiations between the US and China. According to preliminary data, the delegation of the Ministry of Commerce of the PRC plans to visit Washington, and it is likely that countries will be able to overcome differences over trade duties and come to a mutually beneficial agreement.

The second positive factor is strong largest US corporations statistics. Wal-Mart's sales have peaked in the last 10 years due to economic growth and high consumption. The greatest demand was for everyday goods. Cisco's revenue was much better than analysts' forecast and reached the level of 12.99 billion against 12.58 billion dollars, earnings per share were 0.72 cents.

Support and resistance

Stochastic is around 37 points and does not give signals for opening positions.

Resistance levels: 2851.6, 2861.5.

Support levels: 2841.8, 2832.0.

Trading tips

Long positions can be opened after the breakout of the level 2851.6 with the target at 2861.5 and stop loss 2843.0.

Yesterday, the S&P 500 index regained the losses of previous days and is now trading near the key resistance level of 4/8 Murrey or 2851.6. In case of the breakout, it can renew the historical maximum around 2876.4.

Traders react to positive news regarding the negotiations between the US and China. According to preliminary data, the delegation of the Ministry of Commerce of the PRC plans to visit Washington, and it is likely that countries will be able to overcome differences over trade duties and come to a mutually beneficial agreement.

The second positive factor is strong largest US corporations statistics. Wal-Mart's sales have peaked in the last 10 years due to economic growth and high consumption. The greatest demand was for everyday goods. Cisco's revenue was much better than analysts' forecast and reached the level of 12.99 billion against 12.58 billion dollars, earnings per share were 0.72 cents.

Support and resistance

Stochastic is around 37 points and does not give signals for opening positions.

Resistance levels: 2851.6, 2861.5.

Support levels: 2841.8, 2832.0.

Trading tips

Long positions can be opened after the breakout of the level 2851.6 with the target at 2861.5 and stop loss 2843.0.

No comments:

Write comments