USD/CAD: technical analysis

20 August 2018, 11:34

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1.3030 |

| Take Profit | 1.2960 |

| Stop Loss | 1.3060 |

| Key Levels | 1.2928, 1.2960, 1.2998, 1.3050, 1.3100, 1.3175, 1.3287 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.3120 |

| Take Profit | 1.3175 |

| Stop Loss | 1.3090 |

| Key Levels | 1.2928, 1.2960, 1.2998, 1.3050, 1.3100, 1.3175, 1.3287 |

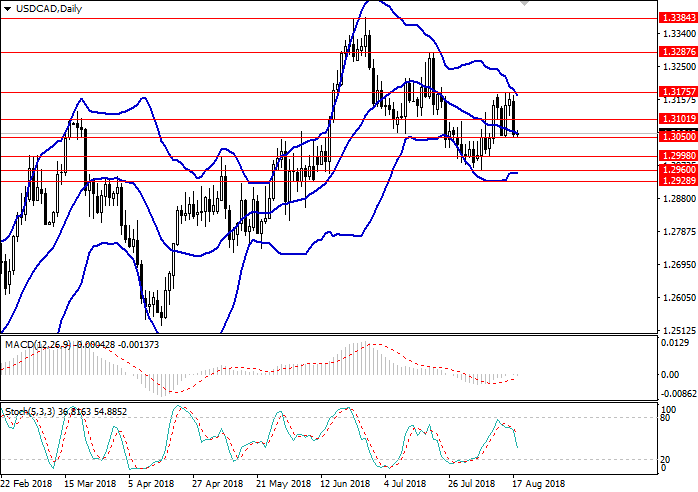

USD/CAD, D1

On the daily chart, the instrument was corrected to the midline of Bollinger bands. MACD histogram is around the zero line, its volumes are minimal. Stochastic is in the neutral region, the oscillator lines are directed downwards.

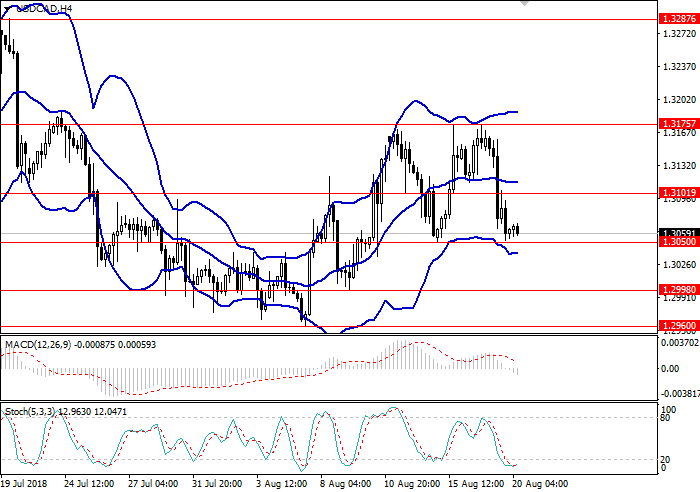

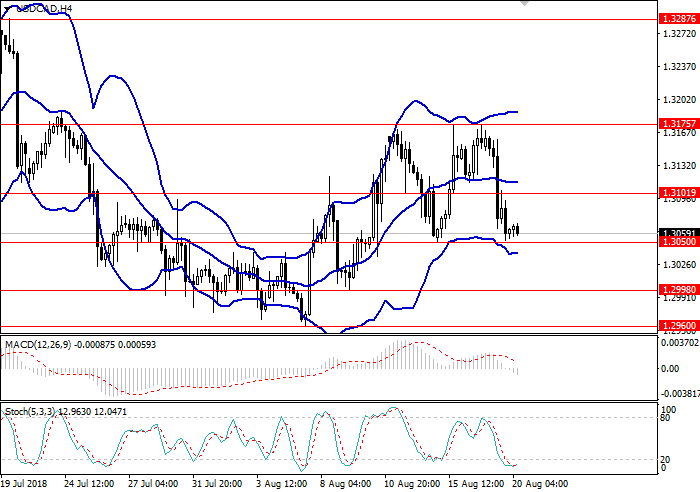

USD/CAD, H4

On the 4-hour chart, the instrument moves sideways within the corridor formed by the borders of Bollinger bands. MACD histogram is in the negative area, its volumes are minimal, the signal line is ready to cross the zero line downwards, after which a signal to open short positions will be received. Stochastic crossed the oversold zone downwards, the oscillator lines move horizontally.

Key Levels

Resistance levels: 1.3100, 1.3175, 1.3287.

Support levels: 1.3050, 1.2998, 1.2960, 1.2928.

Trading tips

Short positions can be opened from the level of 1.3030 with the target at 1.2960 and stop loss 1.3060.

Long positions can be opened from the level of 1.3120 with the target at 1.3175 and stop loss 1.3090.

Implementation period: 1–3 days.

On the daily chart, the instrument was corrected to the midline of Bollinger bands. MACD histogram is around the zero line, its volumes are minimal. Stochastic is in the neutral region, the oscillator lines are directed downwards.

USD/CAD, H4

On the 4-hour chart, the instrument moves sideways within the corridor formed by the borders of Bollinger bands. MACD histogram is in the negative area, its volumes are minimal, the signal line is ready to cross the zero line downwards, after which a signal to open short positions will be received. Stochastic crossed the oversold zone downwards, the oscillator lines move horizontally.

Key Levels

Resistance levels: 1.3100, 1.3175, 1.3287.

Support levels: 1.3050, 1.2998, 1.2960, 1.2928.

Trading tips

Short positions can be opened from the level of 1.3030 with the target at 1.2960 and stop loss 1.3060.

Long positions can be opened from the level of 1.3120 with the target at 1.3175 and stop loss 1.3090.

Implementation period: 1–3 days.

No comments:

Write comments