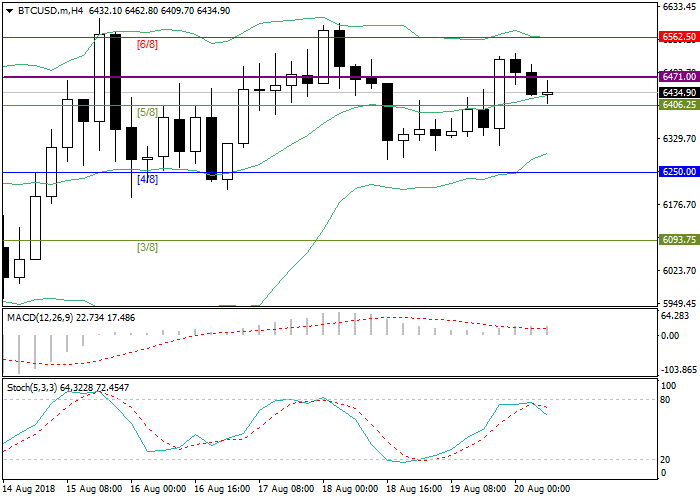

Bitcoin: technical analysis

20 August 2018, 11:16

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 6400.00 |

| Take Profit | 6250.00 |

| Stop Loss | 6450.00 |

| Key Levels | 6093.75, 6250.00, 6406.25, 6471.00, 6562.50, 6718.75 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 6480.00 |

| Take Profit | 6562.50 |

| Stop Loss | 6400.00 |

| Key Levels | 6093.75, 6250.00, 6406.25, 6471.00, 6562.50, 6718.75 |

Current trend

Due to the poor trading activity, Bitcoin prices were corrected to the mid-range of Bollinger bands 6406.25 (Murrey [5/8]), where they are consolidating now. Technical indicators mainly reflect the preservation of the sideways trend. Bollinger bands are directed sideways. The volumes of MACD are in the positive zone and move along the zero line. Stochastic reversed down, signaling the possibility of a downward trend development. If sellers manage to drop the rate below the level of 6406.25, then the downward trend towards the lower border of Bollinger bands at 6250.00 level (Murrey [4/8]) may develop.

A rebound from level 6406.25 will let the price a return to the upper border of Bollinger bands 6562.50 (Murrey [6/8]).

Support and resistance

Resistance levels: 6471.00, 6562.50, 6718.75.

Support levels: 6406.25, 6250.00, 6093.75.

Trading tips

Short positions can be opened below the level of 6406.25 with the target around 6250.00 and stop loss at the level of 6450.00.

Long positions can be opened above the level of 6471.00 with the target around 6562.50 and stop loss 6400.00.

Due to the poor trading activity, Bitcoin prices were corrected to the mid-range of Bollinger bands 6406.25 (Murrey [5/8]), where they are consolidating now. Technical indicators mainly reflect the preservation of the sideways trend. Bollinger bands are directed sideways. The volumes of MACD are in the positive zone and move along the zero line. Stochastic reversed down, signaling the possibility of a downward trend development. If sellers manage to drop the rate below the level of 6406.25, then the downward trend towards the lower border of Bollinger bands at 6250.00 level (Murrey [4/8]) may develop.

A rebound from level 6406.25 will let the price a return to the upper border of Bollinger bands 6562.50 (Murrey [6/8]).

Support and resistance

Resistance levels: 6471.00, 6562.50, 6718.75.

Support levels: 6406.25, 6250.00, 6093.75.

Trading tips

Short positions can be opened below the level of 6406.25 with the target around 6250.00 and stop loss at the level of 6450.00.

Long positions can be opened above the level of 6471.00 with the target around 6562.50 and stop loss 6400.00.

No comments:

Write comments