EUR/USD: when does the consolidation end?

08 August 2018, 14:53

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.1590 |

| Take Profit | 1.1430 |

| Stop Loss | 1.1740 |

| Key Levels | 11310, 1.1370, 1.1430, 1.1500, 1.1510, 1.1530, 1.1550, 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1830 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 1.1665, 1.1690 |

| Take Profit | 1.1430 |

| Stop Loss | 1.1740 |

| Key Levels | 11310, 1.1370, 1.1430, 1.1500, 1.1510, 1.1530, 1.1550, 1.1575, 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1830 |

Current trend

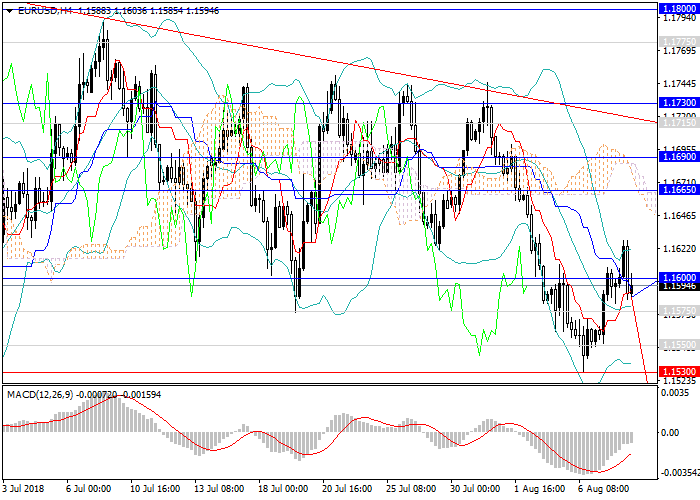

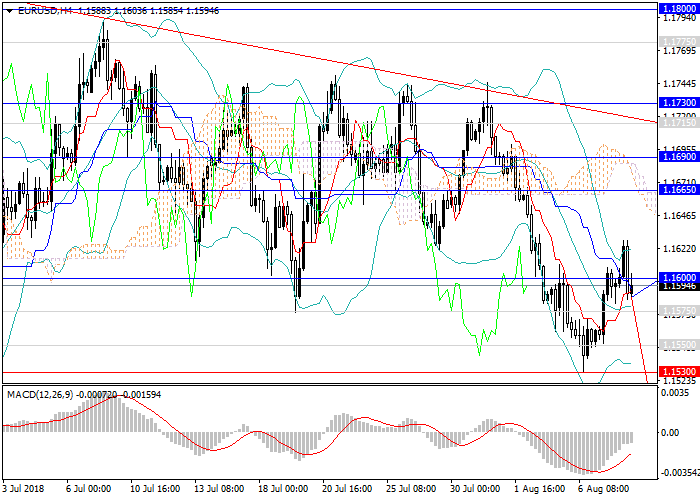

For the pair EUR/USD, the lateral channel continues to narrow. In early August, the instrument fell significantly in view of growing demand for the US currency, after which it stopped near the key support level 1.1530, which is a local minimum since the end of June, and began to form an upward wave.

This week, there were no key releases that could significantly affect the dynamics of the pair, which provided correction within the narrow lateral channel. Important data will appear by the end of the week: there will be releases on inflation, the labor market, and the main indices of the United States.

Support and resistance

In the short term, lateral consolidation within the current channel is expected. There is a high probability of a further decline in the pair within the long-term downtrend, especially in case of breakdown of the strong support level at 1.1430. Despite the release of ambiguous data on the United States, in the short term, one can expect another increase in rates from the Fed amid the improving situation on the labor market, rising inflation, and acceleration of the economy. In this situation, short positions remain relevant.

Technical indicators also confirm this: MACD on the D1 chart indicates the growth in the volume of short positions, and Bollinger Bands are pointing down.

Support levels: 1.1575, 1.1550, 1.1530, 1.1510, 1.1500, 1.1430, 1.1370, 11310.

Resistance levels: 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1830.

Trading tips

In this situation, short positions may be opened from the current level; pending short positions may be opened from the levels of 1.1665, 1.1690 with the target at 1.1430 and the stop loss at 1.1740.

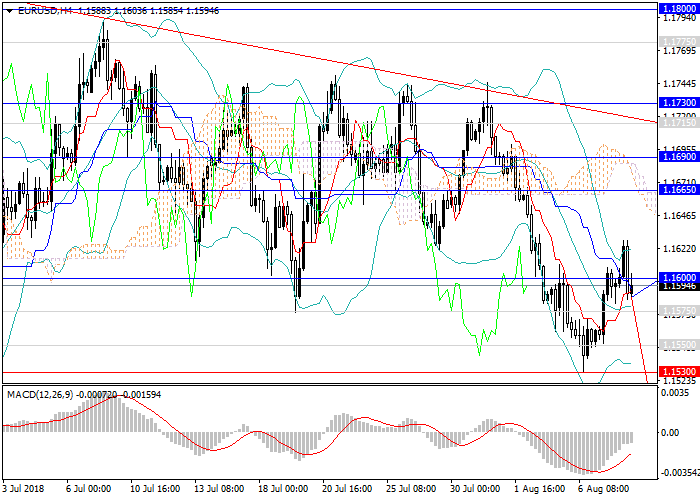

For the pair EUR/USD, the lateral channel continues to narrow. In early August, the instrument fell significantly in view of growing demand for the US currency, after which it stopped near the key support level 1.1530, which is a local minimum since the end of June, and began to form an upward wave.

This week, there were no key releases that could significantly affect the dynamics of the pair, which provided correction within the narrow lateral channel. Important data will appear by the end of the week: there will be releases on inflation, the labor market, and the main indices of the United States.

Support and resistance

In the short term, lateral consolidation within the current channel is expected. There is a high probability of a further decline in the pair within the long-term downtrend, especially in case of breakdown of the strong support level at 1.1430. Despite the release of ambiguous data on the United States, in the short term, one can expect another increase in rates from the Fed amid the improving situation on the labor market, rising inflation, and acceleration of the economy. In this situation, short positions remain relevant.

Technical indicators also confirm this: MACD on the D1 chart indicates the growth in the volume of short positions, and Bollinger Bands are pointing down.

Support levels: 1.1575, 1.1550, 1.1530, 1.1510, 1.1500, 1.1430, 1.1370, 11310.

Resistance levels: 1.1600, 1.1665, 1.1690, 1.1715, 1.1730, 1.1775, 1.1800, 1.1830.

Trading tips

In this situation, short positions may be opened from the current level; pending short positions may be opened from the levels of 1.1665, 1.1690 with the target at 1.1430 and the stop loss at 1.1740.

No comments:

Write comments