YM: general review

08 August 2018, 15:21

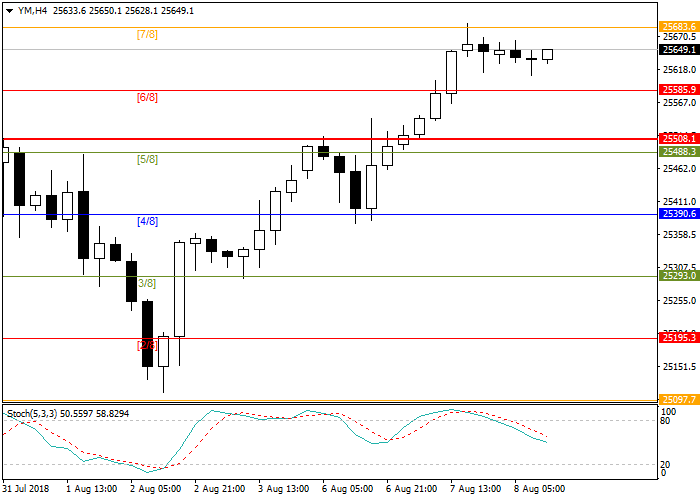

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 25684.6 |

| Take Profit | 25781.3 |

| Stop Loss | 25585.9 |

| Key Levels | 25508.1, 25585.9, 25683.6, 25781.3 |

Current trend

The Dow Jones index continues to trade with positive dynamics: the price is near the important resistance level of 7/8 Murrey or 25683.6.

US indices were significantly supported by the growth of shares of telecommunication companies. So, Sprint added 9.96% and T-Mobile 7.72% because of information about a possible merger. Berkshire Hathaway shares also grew, after the giant's operating profit exceeded the forecast and reached USD 6.89 billion. The former outsider, Facebook, yesterday also significantly added in capitalization (by 4%) after the news on an agreement with large banks to obtain more detailed information about customers who are users of the social network. Thereby, the company plans to use the network not only for communication but also for the sale of goods.

Today, investors will focus on the speech of the Richmond's FRB head Thomas Barkin, as well as the data on the change in oil reserves.

Support and resistance

Stochastic is at 49 points and does not provide a signal for the opening of positions.

Resistance levels: 25683.6, 25781.3.

Support levels: 25585.9, 25508.1.

Trading tips

Long positions may be opened after breaking through the level of 25683.6 with take profit at 25781.3 and stop loss at 25585.9.

The Dow Jones index continues to trade with positive dynamics: the price is near the important resistance level of 7/8 Murrey or 25683.6.

US indices were significantly supported by the growth of shares of telecommunication companies. So, Sprint added 9.96% and T-Mobile 7.72% because of information about a possible merger. Berkshire Hathaway shares also grew, after the giant's operating profit exceeded the forecast and reached USD 6.89 billion. The former outsider, Facebook, yesterday also significantly added in capitalization (by 4%) after the news on an agreement with large banks to obtain more detailed information about customers who are users of the social network. Thereby, the company plans to use the network not only for communication but also for the sale of goods.

Today, investors will focus on the speech of the Richmond's FRB head Thomas Barkin, as well as the data on the change in oil reserves.

Support and resistance

Stochastic is at 49 points and does not provide a signal for the opening of positions.

Resistance levels: 25683.6, 25781.3.

Support levels: 25585.9, 25508.1.

Trading tips

Long positions may be opened after breaking through the level of 25683.6 with take profit at 25781.3 and stop loss at 25585.9.

No comments:

Write comments