WTI Crude Oil: general analysis

08 August 2018, 14:46

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 69.00 |

| Take Profit | 70.31 |

| Stop Loss | 68.70 |

| Key Levels | 64.06, 65.62, 67.18, 68.75, 70.31, 71.87 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 67.18 |

| Take Profit | 65.62, 64.06 |

| Stop Loss | 67.50 |

| Key Levels | 64.06, 65.62, 67.18, 68.75, 70.31, 71.87 |

Current trend

Today, oil quotations are calm and trading within a narrow range of 68.55–68.35.

The price is influenced by opposite factors. On the one hand, the US-PRC trade conflict continues to deepen, which can cause the fall in energy demand in the two world leading economies. Since August 23, the American administration intends to introduce 25% taxes for another 279 items of Chinese goods total worth of $16 billion.

On the other hand, the API and EIA reports won’t let the prices fall. On Tuesday, API recorded a decrease by 6.00 million barrels. At the same time, the EIA decreased the production forecast from 11.8 million barrels to 11.7 million barrels per day.

Also, the implementation of the second part of US anti-Iranian sanctions (against oil and financial sectors), is scheduled for November, and energy supplies can be significantly reduced.

In the evening, EIA Crude Oil Stocks change publication is expected, which can fall by 3.367 million barrels and support the price.

Support and resistance

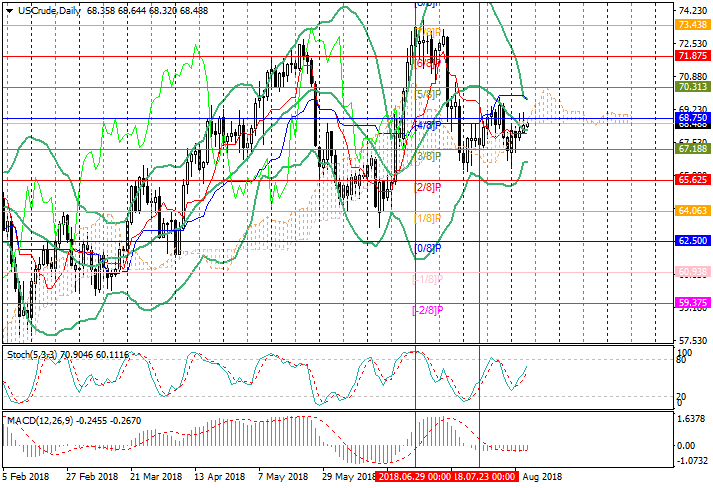

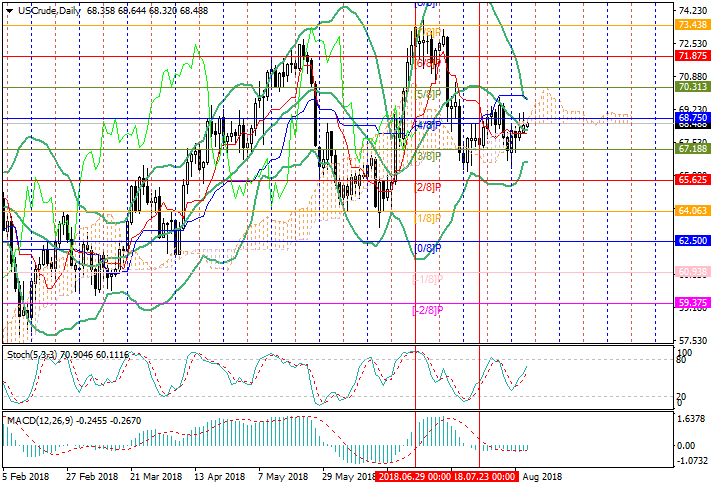

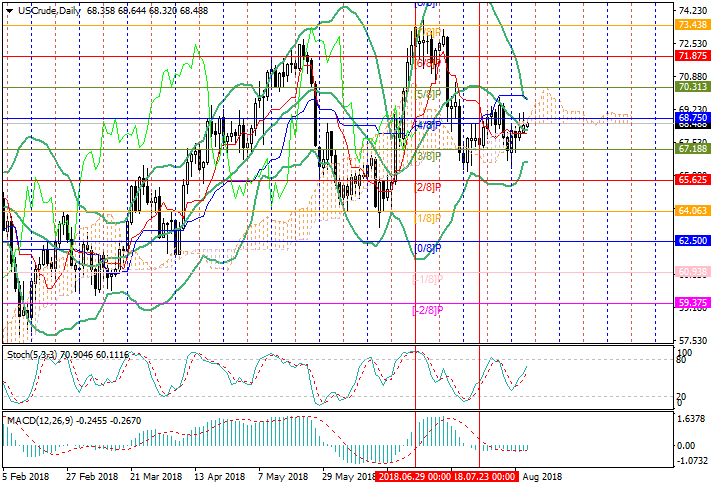

The key "bullish" level is 68.75 (Murrey [4/8]). After its breakout, the price can grow to the level of 70.31 (Murrey [5/8]). The fall to 65.62 (Murrey [2/8]) and 64.06 (Murrey [1/8]) is possible after the breakdown of the level of 67.18 (Murrey [3/8]). Stochastic confirms the possibility of a price increase, reversing upwards.

Resistance levels: 68.75, 70.31, 71.87.

Support levels: 67.18, 65.62, 64.06.

Trading tips

Long positions can be opened from the level of 69.00 with the target at 70.31 and stop loss around 68.70.

Short positions can be opened below the level of 67.18 with the targets at 65.62, 64.06 and stop loss 67.50.

Implementation period: 3–5 days.

Today, oil quotations are calm and trading within a narrow range of 68.55–68.35.

The price is influenced by opposite factors. On the one hand, the US-PRC trade conflict continues to deepen, which can cause the fall in energy demand in the two world leading economies. Since August 23, the American administration intends to introduce 25% taxes for another 279 items of Chinese goods total worth of $16 billion.

On the other hand, the API and EIA reports won’t let the prices fall. On Tuesday, API recorded a decrease by 6.00 million barrels. At the same time, the EIA decreased the production forecast from 11.8 million barrels to 11.7 million barrels per day.

Also, the implementation of the second part of US anti-Iranian sanctions (against oil and financial sectors), is scheduled for November, and energy supplies can be significantly reduced.

In the evening, EIA Crude Oil Stocks change publication is expected, which can fall by 3.367 million barrels and support the price.

Support and resistance

The key "bullish" level is 68.75 (Murrey [4/8]). After its breakout, the price can grow to the level of 70.31 (Murrey [5/8]). The fall to 65.62 (Murrey [2/8]) and 64.06 (Murrey [1/8]) is possible after the breakdown of the level of 67.18 (Murrey [3/8]). Stochastic confirms the possibility of a price increase, reversing upwards.

Resistance levels: 68.75, 70.31, 71.87.

Support levels: 67.18, 65.62, 64.06.

Trading tips

Long positions can be opened from the level of 69.00 with the target at 70.31 and stop loss around 68.70.

Short positions can be opened below the level of 67.18 with the targets at 65.62, 64.06 and stop loss 67.50.

Implementation period: 3–5 days.

No comments:

Write comments