EUR/USD: the euro is growing steadily

21 August 2018, 10:24

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1545 |

| Take Profit | 1.1611, 1.1647 |

| Stop Loss | 1.1500 |

| Key Levels | 1.1400, 1.1446, 1.1473, 1.1500, 1.1539, 1.1573, 1.1611, 1.1647 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1490 |

| Take Profit | 1.1400 |

| Stop Loss | 1.1540, 1.1550 |

| Key Levels | 1.1400, 1.1446, 1.1473, 1.1500, 1.1539, 1.1573, 1.1611, 1.1647 |

Current trend

Yesterday, EUR rose against USD, continuing to develop the upward momentum that emerged in the middle of last week.

European investors are focused on the trade negotiations between the US and China, hoping that they will bring a partial easing of tensions, as well as statistics on business activity indexes in the service sector and industrial production in the EU. The data are expected to be mixed. Service PMI will grow from 54.2% to 55.0%, and Manufacturing PMI may fall from 55.1% to 54.6%.

Monday’s EU July Construction Output data were positive. The YoY indicator rose from 2.0% to 2.6%, but the statistics could not significantly support EUR.

Support and resistance

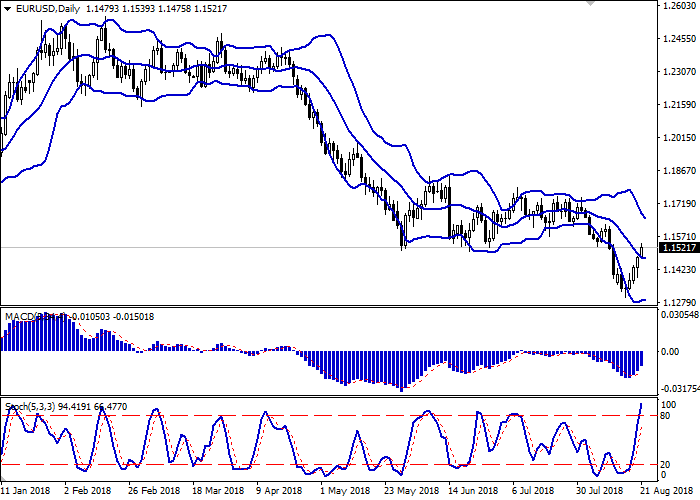

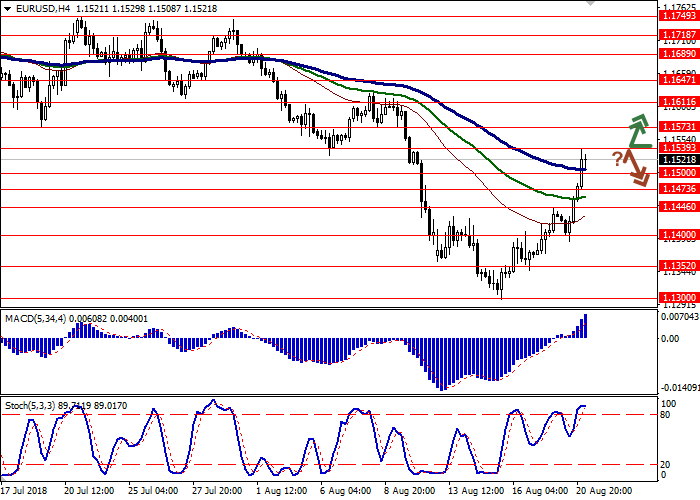

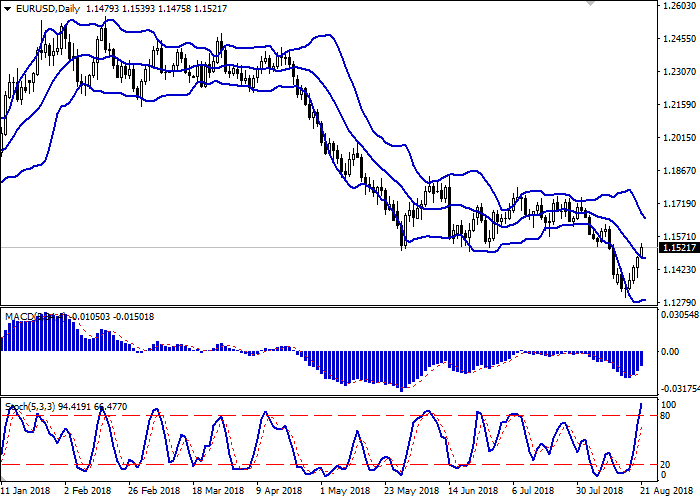

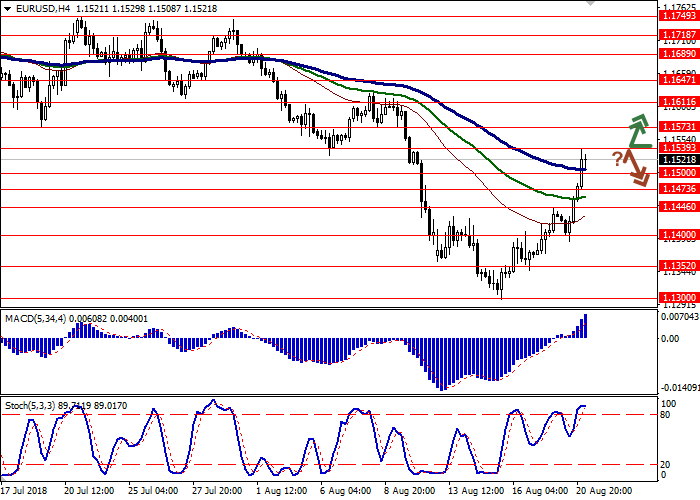

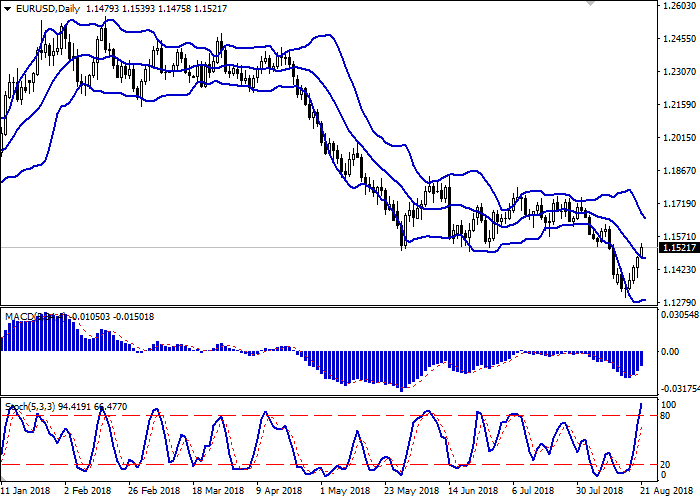

On the daily chart, Bollinger bands reversed horizontally. The price range is narrowing, reflecting a sharp change in the direction of trading in the short term. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic is directed upwards but is close to its highs, which reflects that EUR will be overbought in the short term.

Current indicators’ readings do not contradict the further development of the "bullish" trend in the short and/or ultra-short term. The correction is possible in the next few days.

Resistance levels: 1.1539, 1.1573, 1.1611, 1.1647.

Support levels: 1.1500, 1.1473, 1.1446, 1.1400.

Trading tips

Long positions can be opened after the breakout of the level of 1.1539 with the targets at 1.1611–1.1647 and stop loss 1.1500. Implementation period: 1–2 days.

Short positions can be opened after the rebound from the level of 1.1539 and breakdown of the level of 1.1500 with the target at 1.1400 and stop loss 1.1540–1.1550. Implementation period: 2–3 days.

Yesterday, EUR rose against USD, continuing to develop the upward momentum that emerged in the middle of last week.

European investors are focused on the trade negotiations between the US and China, hoping that they will bring a partial easing of tensions, as well as statistics on business activity indexes in the service sector and industrial production in the EU. The data are expected to be mixed. Service PMI will grow from 54.2% to 55.0%, and Manufacturing PMI may fall from 55.1% to 54.6%.

Monday’s EU July Construction Output data were positive. The YoY indicator rose from 2.0% to 2.6%, but the statistics could not significantly support EUR.

Support and resistance

On the daily chart, Bollinger bands reversed horizontally. The price range is narrowing, reflecting a sharp change in the direction of trading in the short term. MACD indicator is growing, keeping a strong buy signal (the histogram is above the signal line). Stochastic is directed upwards but is close to its highs, which reflects that EUR will be overbought in the short term.

Current indicators’ readings do not contradict the further development of the "bullish" trend in the short and/or ultra-short term. The correction is possible in the next few days.

Resistance levels: 1.1539, 1.1573, 1.1611, 1.1647.

Support levels: 1.1500, 1.1473, 1.1446, 1.1400.

Trading tips

Long positions can be opened after the breakout of the level of 1.1539 with the targets at 1.1611–1.1647 and stop loss 1.1500. Implementation period: 1–2 days.

Short positions can be opened after the rebound from the level of 1.1539 and breakdown of the level of 1.1500 with the target at 1.1400 and stop loss 1.1540–1.1550. Implementation period: 2–3 days.

No comments:

Write comments