WTI Crude Oil: the instrument is consolidating

21 August 2018, 10:13

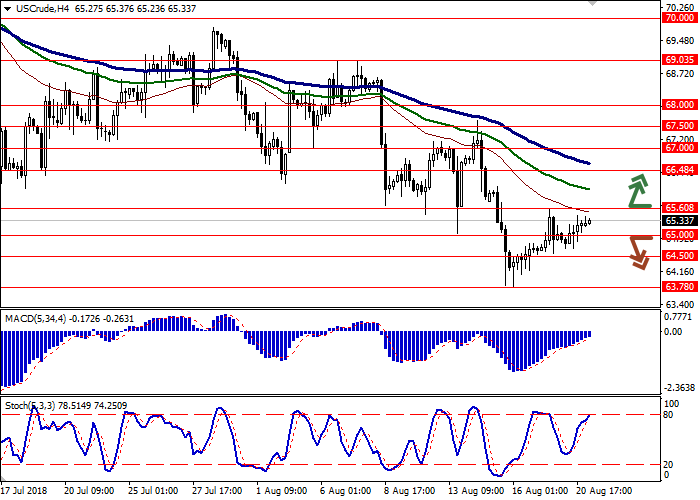

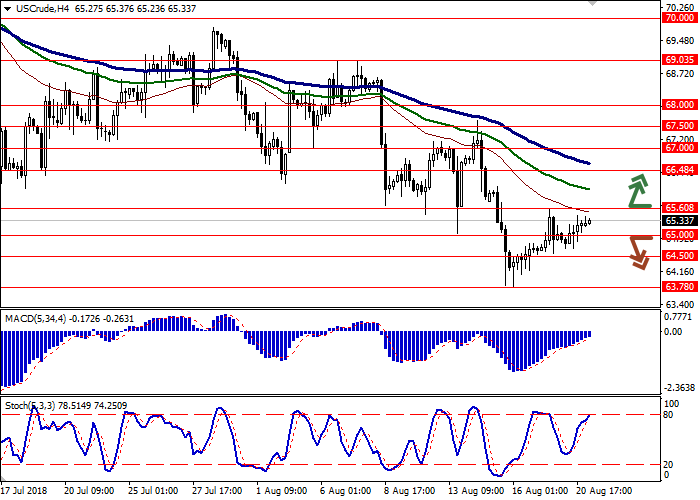

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 65.65 |

| Take Profit | 67.00 |

| Stop Loss | 65.00 |

| Key Levels | 63.78, 64.50, 65.00, 65.60, 66.48, 67.00, 67.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 64.90 |

| Take Profit | 63.78, 63.50 |

| Stop Loss | 65.60 |

| Key Levels | 63.78, 64.50, 65.00, 65.60, 66.48, 67.00, 67.50 |

Current trend

Yesterday, oil prices stayed unchanged against the ambiguous USD dynamics.

The prices were supported by the Baker Hughes US Oil Rig Count index, which stayed at the level of 869 units due to the transportation problems from the Perm oil basin. Also, the prices are positively influenced by the comments of Saudi Energy Minister Khalid Al-Falih, who noted that the state oil company Saudi Aramco is doing its best to meet the growing global demand for oil. The potential for the current growth in oil prices is restricted.

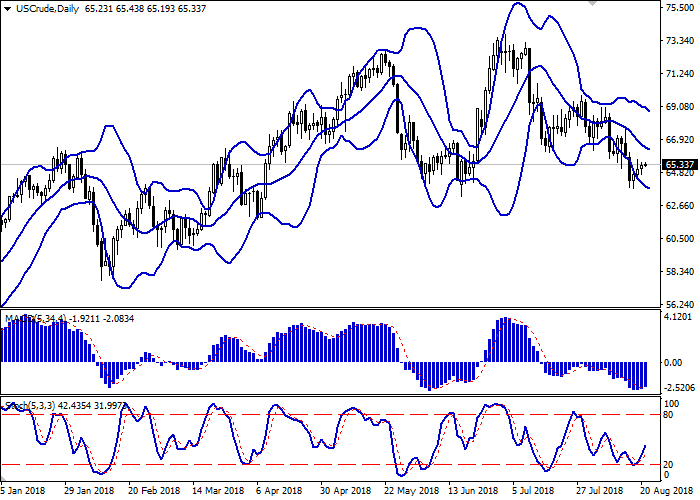

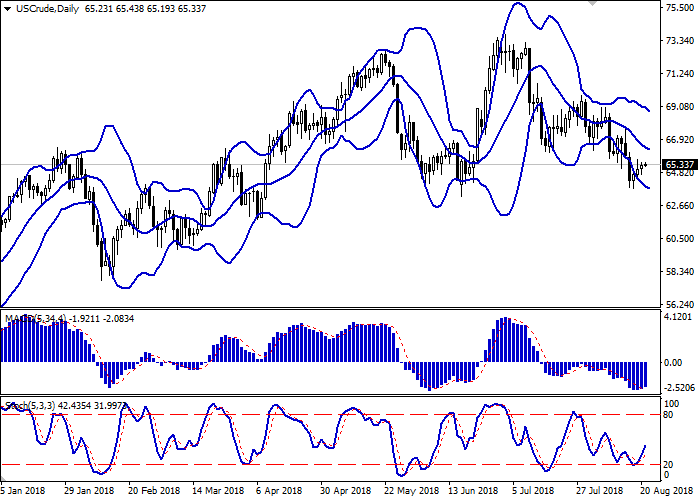

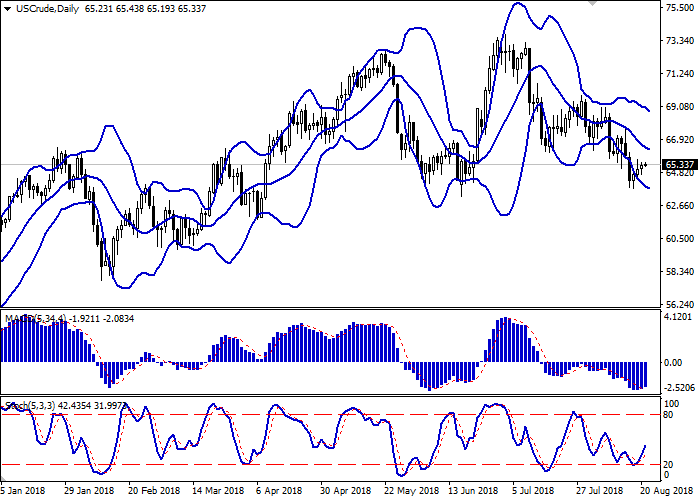

Support and resistance

On the daily chart, Bollinger bands are moderately falling. The price does not change, practically not reacting to the attempt of growth of the instrument in the short/ultra-short term. MACD indicator reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic is directed upwards and is approximately in the center of its working area.

The current indicators’ readings do not contradict the further development of corrective growth in the short and/or ultra-short term.

Resistance levels: 65.60, 66.48, 67.00, 67.50.

Support levels: 65.00, 64.50, 63.78.

Trading tips

Long positions can be opened after the breakout of the level of 65.60 with the target at 67.00 and stop loss 65.00.

Short positions can be opened after the breakdown of the level of 65.00 with the at targets 63.78–63.50 and stop loss 65.60.

Implementation period: 2–3 days.

Yesterday, oil prices stayed unchanged against the ambiguous USD dynamics.

The prices were supported by the Baker Hughes US Oil Rig Count index, which stayed at the level of 869 units due to the transportation problems from the Perm oil basin. Also, the prices are positively influenced by the comments of Saudi Energy Minister Khalid Al-Falih, who noted that the state oil company Saudi Aramco is doing its best to meet the growing global demand for oil. The potential for the current growth in oil prices is restricted.

Support and resistance

On the daily chart, Bollinger bands are moderately falling. The price does not change, practically not reacting to the attempt of growth of the instrument in the short/ultra-short term. MACD indicator reversed upwards, forming a new buy signal (the histogram is above the signal line). Stochastic is directed upwards and is approximately in the center of its working area.

The current indicators’ readings do not contradict the further development of corrective growth in the short and/or ultra-short term.

Resistance levels: 65.60, 66.48, 67.00, 67.50.

Support levels: 65.00, 64.50, 63.78.

Trading tips

Long positions can be opened after the breakout of the level of 65.60 with the target at 67.00 and stop loss 65.00.

Short positions can be opened after the breakdown of the level of 65.00 with the at targets 63.78–63.50 and stop loss 65.60.

Implementation period: 2–3 days.

No comments:

Write comments