EUR/USD: the euro is declining

13 August 2018, 10:06

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1410 |

| Take Profit | 1.1500 |

| Stop Loss | 1.1352, 1.1345 |

| Key Levels | 1.1266, 1.1300, 1.1352, 1.1400, 1.1446, 1.1473, 1.1500 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1345 |

| Take Profit | 1.1266, 1.1250 |

| Stop Loss | 1.1400 |

| Key Levels | 1.1266, 1.1300, 1.1352, 1.1400, 1.1446, 1.1473, 1.1500 |

Current trend

At the end of last week, EUR fell significantly against USD, updating its year’s lows.

On Friday, EUR stayed under pressure due to the financial crisis development in Turkey. According to the Financial Times and Bloomberg, the ECB's management is concerned that due to a significant drop in lira, Turkish borrowers will not be able to pay off loans at the time. Thus, the Turkish crisis may affect several large European banks. In early August, geopolitical complications between the US and Turkey and the introduction by the US administration of sanctions against Turkish ministers led to a record drop in the lira against the entire market.

Today, the instrument is trading sideways, and investors are waiting for a correction formation. As there is a lack of macroeconomic news today, trading activity will stay moderate.

Support and resistance

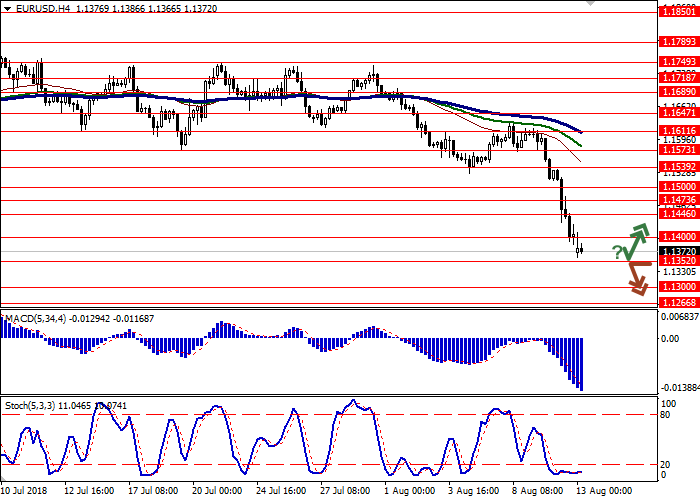

On the daily chart, Bollinger bands fall. The price range is actively expanding, but not as fast at the "bearish" dynamics develops. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic is directed downwards but is close to its lows, which reflects that a corrective growth can develop in the short term.

It is better to wait until the situation is clear and keep some of current short positions should for some time.

Resistance levels: 1.1400, 1.1446, 1.1473, 1.1500.

Support levels: 1.1352, 1.1300, 1.1266.

Trading tips

Long positions can be opened after the rebound from 1.1352 and breakout of the level of 1.1400 with the target at 1.1500 and stop loss 1.1352–1.1345. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 1.1352 with the targets at 1.1266–1.1250. Stop loss is 1.1400. Implementation period: 1–2 days.

At the end of last week, EUR fell significantly against USD, updating its year’s lows.

On Friday, EUR stayed under pressure due to the financial crisis development in Turkey. According to the Financial Times and Bloomberg, the ECB's management is concerned that due to a significant drop in lira, Turkish borrowers will not be able to pay off loans at the time. Thus, the Turkish crisis may affect several large European banks. In early August, geopolitical complications between the US and Turkey and the introduction by the US administration of sanctions against Turkish ministers led to a record drop in the lira against the entire market.

Today, the instrument is trading sideways, and investors are waiting for a correction formation. As there is a lack of macroeconomic news today, trading activity will stay moderate.

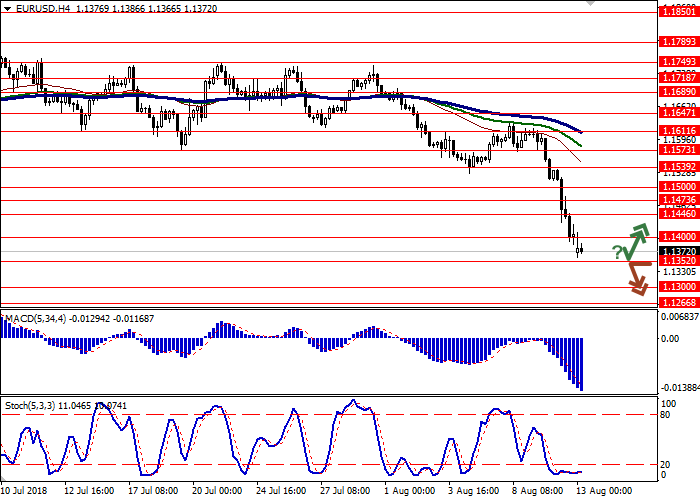

Support and resistance

On the daily chart, Bollinger bands fall. The price range is actively expanding, but not as fast at the "bearish" dynamics develops. MACD falls, keeping a strong sell signal (the histogram is below the signal line). Stochastic is directed downwards but is close to its lows, which reflects that a corrective growth can develop in the short term.

It is better to wait until the situation is clear and keep some of current short positions should for some time.

Resistance levels: 1.1400, 1.1446, 1.1473, 1.1500.

Support levels: 1.1352, 1.1300, 1.1266.

Trading tips

Long positions can be opened after the rebound from 1.1352 and breakout of the level of 1.1400 with the target at 1.1500 and stop loss 1.1352–1.1345. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 1.1352 with the targets at 1.1266–1.1250. Stop loss is 1.1400. Implementation period: 1–2 days.

No comments:

Write comments