Bitcoin: technical analysis

08 August 2018, 12:19

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 6476.76 |

| Take Profit | 6250.00, 5937.50 |

| Stop Loss | 6600.00 |

| Key Levels | 5937.50, 6250.00, 6875.00, 7500.00, 7812.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 6875.10 |

| Take Profit | 7500.00 |

| Stop Loss | 6750.00 |

| Key Levels | 5937.50, 6250.00, 6875.00, 7500.00, 7812.50 |

Current trend

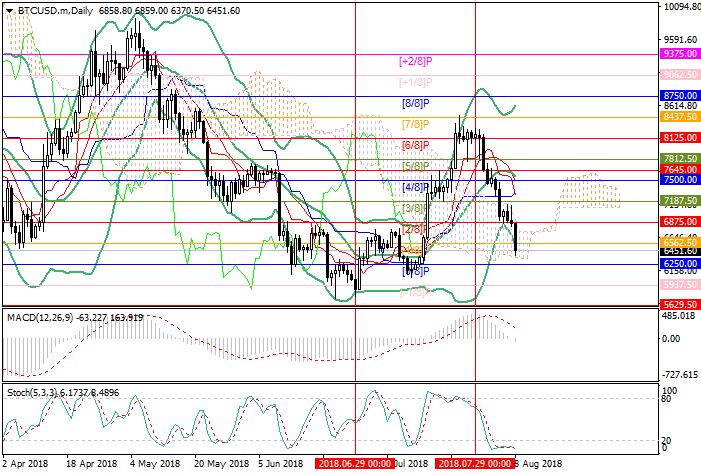

The price of Bitcoin continues to decline.

On Wednesday, the instrument reached the level of 6562.50 (Murrey [1/8]) and is now trying to get further into the area of the June lows. Currently, the targets of the "bears" are the levels of 6250.00 (Murrey [0/8]) and 5937.50 (Murrey [–1/8]). The probability the downward correction development is confirmed by the divergence of Bollinger bands and by the transition of MACD to the negative zone. Stochastic is in the oversold zone and moving sideways. The resumption of growth will be possible in case of a breakout of 6875.00 (Murrey [2/8]). In this case, the instrument can grow the middle line of the Murrey trade range around 7500.00 (Murrey [4/8]), but this option seems less likely.

Support and resistance

Resistance levels: 6875.00, 7500.00, 7812.50.

Support levels: 6250.00, 5937.50.

Trading tips

Short positions can be opened from the current level with the targets at 6250.00, 5937.50 and stop loss around 6600.00.

Long positions can be opened above the level of 6875.00 with the target at 7500.00 and a stop loss around 6750.00.

Implementation period: 3–5 days.

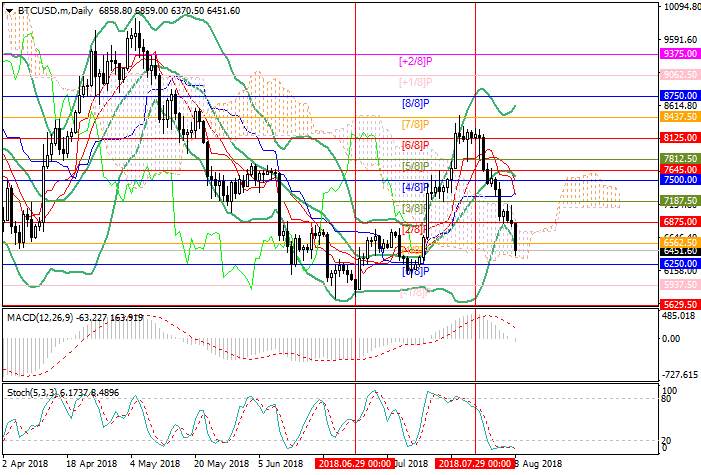

The price of Bitcoin continues to decline.

On Wednesday, the instrument reached the level of 6562.50 (Murrey [1/8]) and is now trying to get further into the area of the June lows. Currently, the targets of the "bears" are the levels of 6250.00 (Murrey [0/8]) and 5937.50 (Murrey [–1/8]). The probability the downward correction development is confirmed by the divergence of Bollinger bands and by the transition of MACD to the negative zone. Stochastic is in the oversold zone and moving sideways. The resumption of growth will be possible in case of a breakout of 6875.00 (Murrey [2/8]). In this case, the instrument can grow the middle line of the Murrey trade range around 7500.00 (Murrey [4/8]), but this option seems less likely.

Support and resistance

Resistance levels: 6875.00, 7500.00, 7812.50.

Support levels: 6250.00, 5937.50.

Trading tips

Short positions can be opened from the current level with the targets at 6250.00, 5937.50 and stop loss around 6600.00.

Long positions can be opened above the level of 6875.00 with the target at 7500.00 and a stop loss around 6750.00.

Implementation period: 3–5 days.

No comments:

Write comments