AUD/USD: general analysis

08 August 2018, 10:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7455 |

| Take Profit | 0.7515, 0.7550 |

| Stop Loss | 0.7425 |

| Key Levels | 0.7314, 0.7356, 0.7404, 0.7445, 0.7489, 0.7534, 0.7572, 0.7621, 0.7660 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7385 |

| Take Profit | 0.7315 |

| Stop Loss | 0.7410 |

| Key Levels | 0.7314, 0.7356, 0.7404, 0.7445, 0.7489, 0.7534, 0.7572, 0.7621, 0.7660 |

Current trend

AUD strengthens against USD after RBA's Governor Philip Lowe Speech.

For the first time in a long while, the head of the regulator spoke about tightening monetary policy. His speech did not differ from yesterday’s RBA Rate Statement, but the currency received a growth momentum. Lowe noted the progress of the Australian economy in general and the labor market in particular. Due to the conditions created in the labor market, the regulator expects wage growth in the country, which will contribute to increased personal expenses, growth in mortgage lending and consumer confidence. In addition, the head of the Australian Central Bank noted the acceleration of inflation.

Today, there is a lack of key statistics from both sides. Tomorrow at 14:30 (GMT+2) market participants expect US labor market and producer prices data publications.

Support and resistance

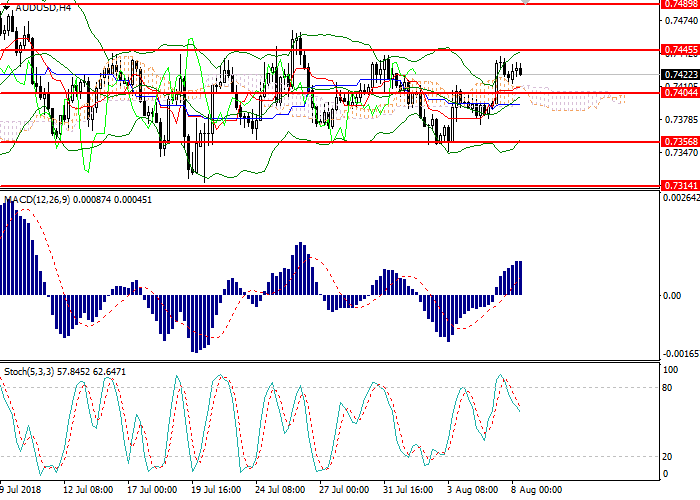

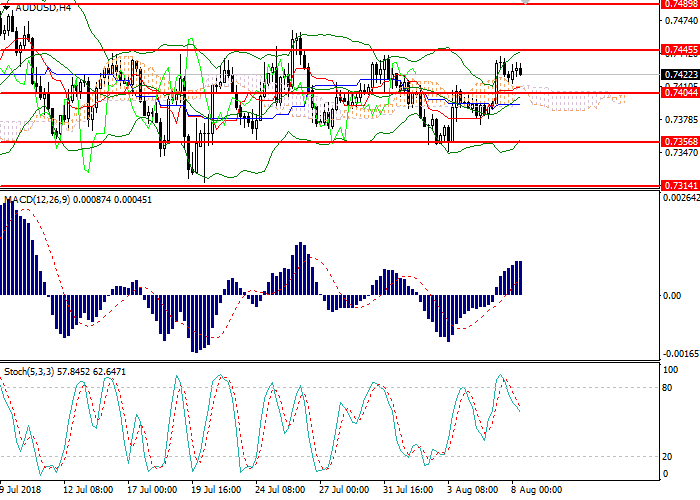

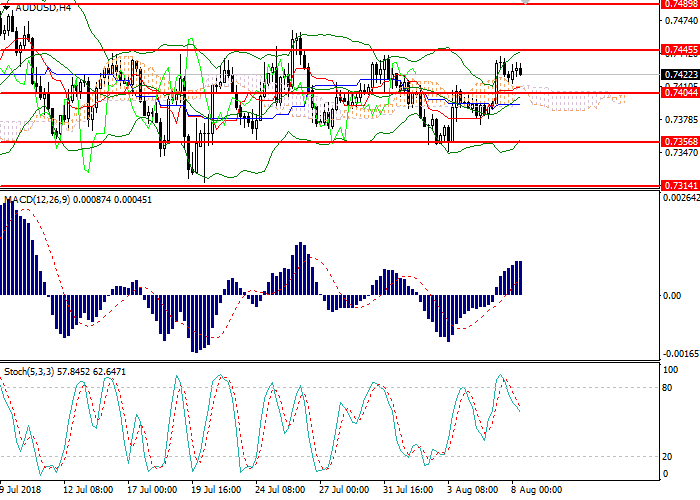

On the 4-hour chart, the instrument is trading at the top of Bollinger bands. The indicator is directed upwards, the price range has expanded, which indicates the preservation of the upward dynamics. The key resistance is the level of 0.7445. MACD histogram is in the positive area, keeping the buy signal. Stochastic left the overbought area, forming a sell signal.

Resistance levels: 0.7445, 0.7489, 0.7534, 0.7572, 0.7621, 0.7660.

Support levels: 0.7314, 0.7356, 0.7404.

Trading tips

Long positions can be opened above the level of 0.7450 with the targets at 0.7515 0.7550 and stop loss 0.7425.

Short positions can be opened below the level of 0.7390 with the target at 0.7315 and stop loss 0.7410.

Implementation period: 1–2 days.

AUD strengthens against USD after RBA's Governor Philip Lowe Speech.

For the first time in a long while, the head of the regulator spoke about tightening monetary policy. His speech did not differ from yesterday’s RBA Rate Statement, but the currency received a growth momentum. Lowe noted the progress of the Australian economy in general and the labor market in particular. Due to the conditions created in the labor market, the regulator expects wage growth in the country, which will contribute to increased personal expenses, growth in mortgage lending and consumer confidence. In addition, the head of the Australian Central Bank noted the acceleration of inflation.

Today, there is a lack of key statistics from both sides. Tomorrow at 14:30 (GMT+2) market participants expect US labor market and producer prices data publications.

Support and resistance

On the 4-hour chart, the instrument is trading at the top of Bollinger bands. The indicator is directed upwards, the price range has expanded, which indicates the preservation of the upward dynamics. The key resistance is the level of 0.7445. MACD histogram is in the positive area, keeping the buy signal. Stochastic left the overbought area, forming a sell signal.

Resistance levels: 0.7445, 0.7489, 0.7534, 0.7572, 0.7621, 0.7660.

Support levels: 0.7314, 0.7356, 0.7404.

Trading tips

Long positions can be opened above the level of 0.7450 with the targets at 0.7515 0.7550 and stop loss 0.7425.

Short positions can be opened below the level of 0.7390 with the target at 0.7315 and stop loss 0.7410.

Implementation period: 1–2 days.

No comments:

Write comments