AUD/USD: the Australian dollar is declining

23 August 2018, 10:10

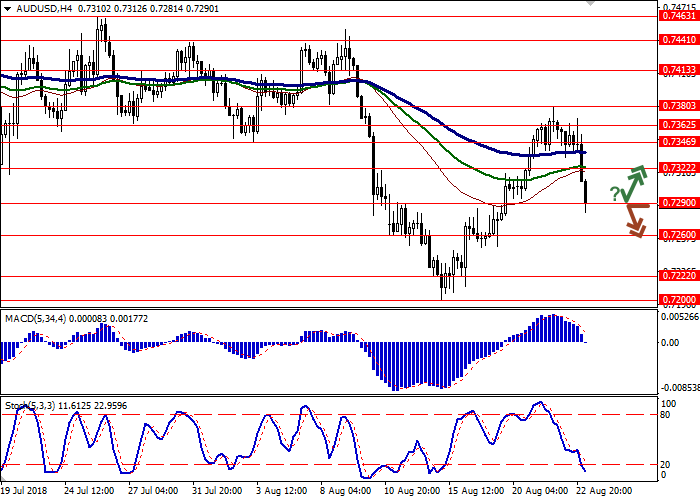

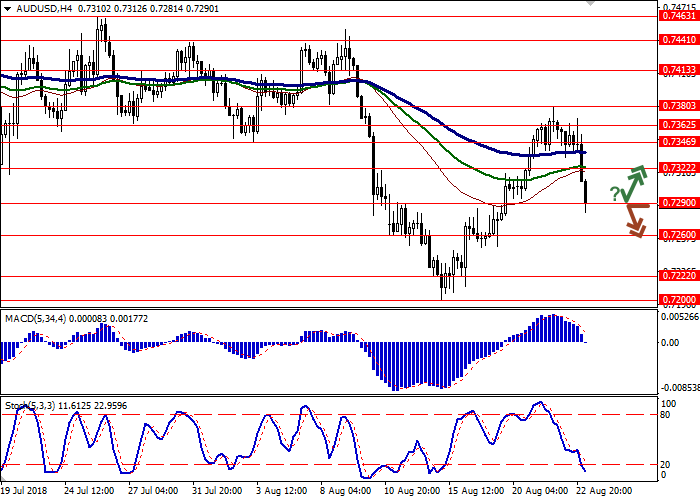

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 0.7290 |

| Take Profit | 0.7346, 0.7362, 0.7380 |

| Stop Loss | 0.7260, 0.7250 |

| Key Levels | 0.7200, 0.7222, 0.7260, 0.7290, 0.7322, 0.7346, 0.7362, 0.7380 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7280 |

| Take Profit | 0.7222, 0.7200 |

| Stop Loss | 0.7322 |

| Key Levels | 0.7200, 0.7222, 0.7260, 0.7290, 0.7322, 0.7346, 0.7362, 0.7380 |

Current trend

Yesterday, AUD slightly decreased against USD, stepping off the local highs, updated earlier.

The traders are focused on Wednesday’s speech of the Deputy Head of the RBA Guy Debelle and on Q2 Construction Work Dore release. The head of the bank noted that the fall of inflation is due to the increase in competition in the retail sector and the slow growth of salaries. Currently, the regulator believes that in the next few years, the consumer price index will reach 2.25% against the backdrop of GDP growth and the average wage in the country. As for Construction Work Dore indicator, it exceeded forecasts and grew by 1.6% after growing by 2.4% in the previous period.

Today, AUD is falling sharply due to a possibility of the resignation of Australian Prime Minister Malcolm Turnbull, as several ministers announced their withdrawal.

Support and resistance

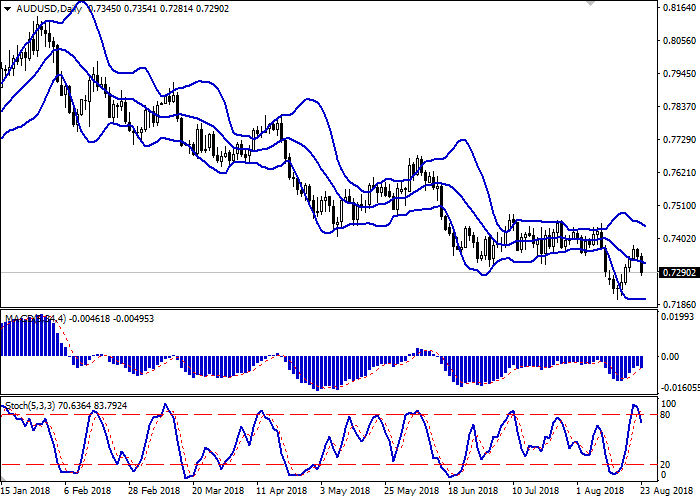

On the daily chart, Bollinger bands are moving flat. The price range narrows from above, reflecting the emergence of mixed trading dynamics. MACD indicator has reversed downwards, keeping the buy signal (the histogram is above the signal line). Stochastic reversed downwards from its highs, signaling that AUD is overbought.

It is possible to further develop the downtrend in the short and/or ultra-short term.

Resistance levels: 0.7322, 0.7346, 0.7362, 0.7380.

Support levels: 0.7290, 0.7260, 0.7222, 0.7200.

Trading tips

Long positions can be opened after a rebound from the level of 0.7290 with the targets at 0.7346–0.7362 or 0.7380 and stop loss 0.7260–0.7250.

Short positions can be opened after the breakdown of the level of 0.7290 with the targets at 0.7222–0.7200. Stop loss is 0.7322.

Implementation period: 2–3 days.

Yesterday, AUD slightly decreased against USD, stepping off the local highs, updated earlier.

The traders are focused on Wednesday’s speech of the Deputy Head of the RBA Guy Debelle and on Q2 Construction Work Dore release. The head of the bank noted that the fall of inflation is due to the increase in competition in the retail sector and the slow growth of salaries. Currently, the regulator believes that in the next few years, the consumer price index will reach 2.25% against the backdrop of GDP growth and the average wage in the country. As for Construction Work Dore indicator, it exceeded forecasts and grew by 1.6% after growing by 2.4% in the previous period.

Today, AUD is falling sharply due to a possibility of the resignation of Australian Prime Minister Malcolm Turnbull, as several ministers announced their withdrawal.

Support and resistance

On the daily chart, Bollinger bands are moving flat. The price range narrows from above, reflecting the emergence of mixed trading dynamics. MACD indicator has reversed downwards, keeping the buy signal (the histogram is above the signal line). Stochastic reversed downwards from its highs, signaling that AUD is overbought.

It is possible to further develop the downtrend in the short and/or ultra-short term.

Resistance levels: 0.7322, 0.7346, 0.7362, 0.7380.

Support levels: 0.7290, 0.7260, 0.7222, 0.7200.

Trading tips

Long positions can be opened after a rebound from the level of 0.7290 with the targets at 0.7346–0.7362 or 0.7380 and stop loss 0.7260–0.7250.

Short positions can be opened after the breakdown of the level of 0.7290 with the targets at 0.7222–0.7200. Stop loss is 0.7322.

Implementation period: 2–3 days.

No comments:

Write comments