USD/CHF: USD remains under pressure

23 August 2018, 10:16

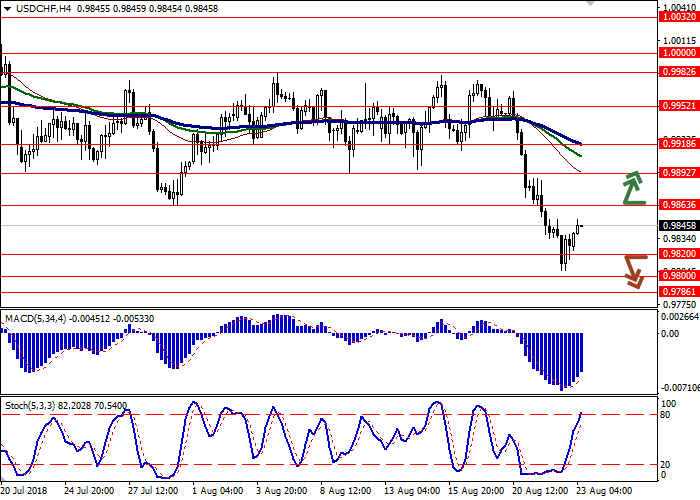

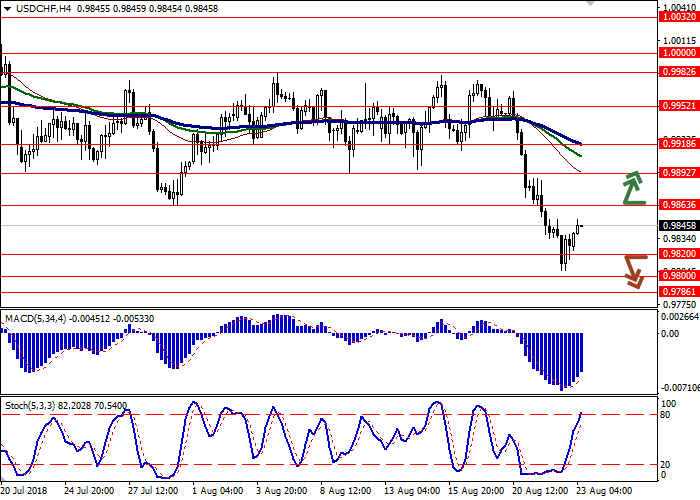

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.9870 |

| Take Profit | 0.9918, 0.9930 |

| Stop Loss | 0.9830 |

| Key Levels | 0.9786, 0.9800, 0.9820, 0.9863, 0.9892, 0.9918, 0.9952 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9810 |

| Take Profit | 0.9786, 0.9760 |

| Stop Loss | 0.9850 |

| Key Levels | 0.9786, 0.9800, 0.9820, 0.9863, 0.9892, 0.9918, 0.9952 |

Current trend

USD showed a decline against CHF on Wednesday, having updated local lows of June 8. Nevertheless, closer to the end of the trading session, the dollar partially corrected having received support from the published minutes of the Fed meeting, which pointed to the possibility of an increase in the rate in September, and continues to grow today.

At the same time, the Fed officials expressed their fears regarding the development of trade conflicts, primarily between the US and China. The regulator noted that trade disputes are a significant source of uncertainty and risks.

Additional pressure on USD was provided by the data from the existing home market. In July, sales decreased by 0.7% MoM, which was even worse than the decrease of 0.6% MoM last month. Analysts had expected growth rate at 0.6% MoM.

Support and resistance

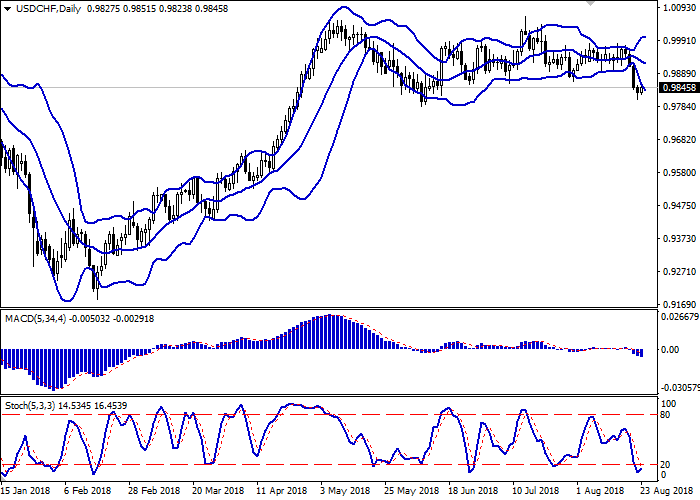

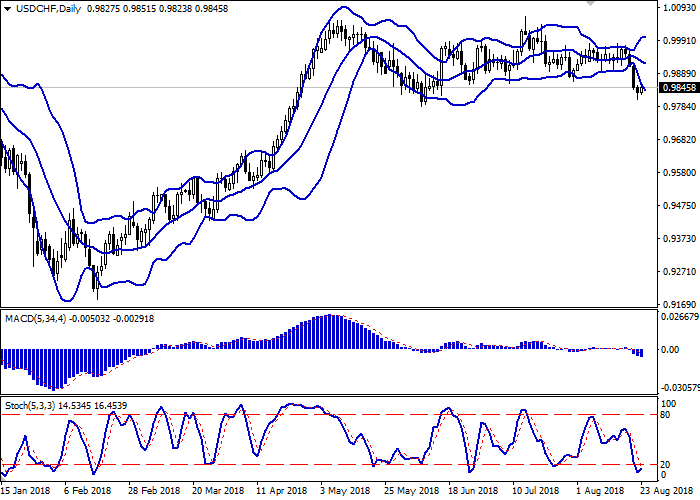

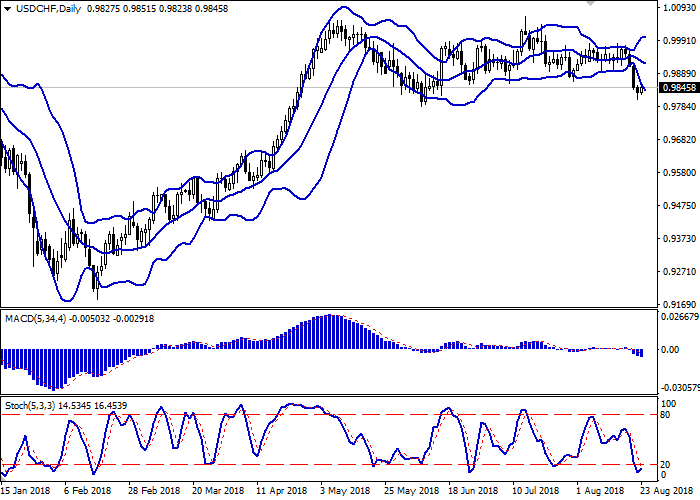

Bollinger Bands in D1 chart demonstrate decrease. The price range is expanding; however, it fails to catch the development of "bearish" sentiments. MACD is going down preserving a moderate sell signal (located below the signal line). Stochastic, approaching its minimum levels, reversed upwards, reacting to the appearance of corrective sentiment closer to the end of the session on August 22.

It is necessary to wait for clarification of the situation. Some of the existing short positions should be kept open for some time.

Resistance levels: 0.9863, 0.9892, 0.9918, 0.9952.

Support levels: 0.9820, 0.9800, 0.9786.

Trading tips

To open long positions, one can rely on the breakout of 0.9863. Take profit — 0.9918 or 0.9930. Stop loss — 0.9830. Implementation period: 2-3 days.

The return of "bearish" trend with the breakdown of 0.9820 may become a signal for new sales with the target at 0.9786 or 0.9760. Stop loss — 0.9850. Implementation period: 1-2 days.

USD showed a decline against CHF on Wednesday, having updated local lows of June 8. Nevertheless, closer to the end of the trading session, the dollar partially corrected having received support from the published minutes of the Fed meeting, which pointed to the possibility of an increase in the rate in September, and continues to grow today.

At the same time, the Fed officials expressed their fears regarding the development of trade conflicts, primarily between the US and China. The regulator noted that trade disputes are a significant source of uncertainty and risks.

Additional pressure on USD was provided by the data from the existing home market. In July, sales decreased by 0.7% MoM, which was even worse than the decrease of 0.6% MoM last month. Analysts had expected growth rate at 0.6% MoM.

Support and resistance

Bollinger Bands in D1 chart demonstrate decrease. The price range is expanding; however, it fails to catch the development of "bearish" sentiments. MACD is going down preserving a moderate sell signal (located below the signal line). Stochastic, approaching its minimum levels, reversed upwards, reacting to the appearance of corrective sentiment closer to the end of the session on August 22.

It is necessary to wait for clarification of the situation. Some of the existing short positions should be kept open for some time.

Resistance levels: 0.9863, 0.9892, 0.9918, 0.9952.

Support levels: 0.9820, 0.9800, 0.9786.

Trading tips

To open long positions, one can rely on the breakout of 0.9863. Take profit — 0.9918 or 0.9930. Stop loss — 0.9830. Implementation period: 2-3 days.

The return of "bearish" trend with the breakdown of 0.9820 may become a signal for new sales with the target at 0.9786 or 0.9760. Stop loss — 0.9850. Implementation period: 1-2 days.

No comments:

Write comments