WTI Crude Oil: the price grows

08 May 2018, 14:19

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 69.68 |

| Take Profit | 75.00 |

| Stop Loss | 65.20 |

| Key Levels | 60.75, 63.25, 64.10, 66.55, 67.00, 68.00, 68.75, 70.10, 70.70, 71.50, 72.65, 74.00, 75.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 67.00, 66.55 |

| Take Profit | 75.00 |

| Stop Loss | 65.20 |

| Key Levels | 60.75, 63.25, 64.10, 66.55, 67.00, 68.00, 68.75, 70.10, 70.70, 71.50, 72.65, 74.00, 75.00 |

Current trend

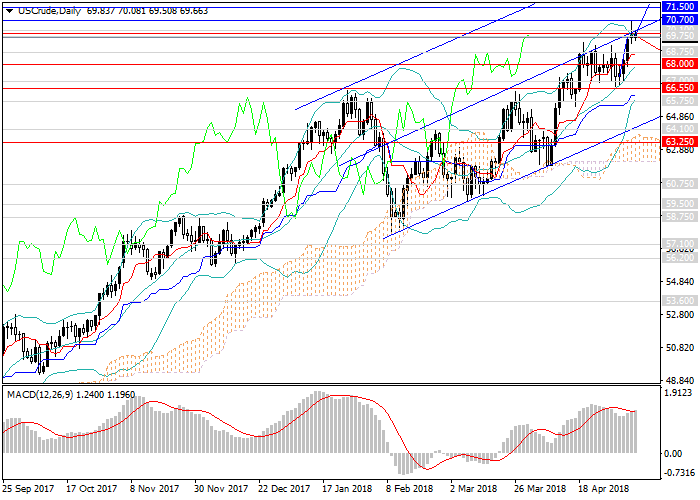

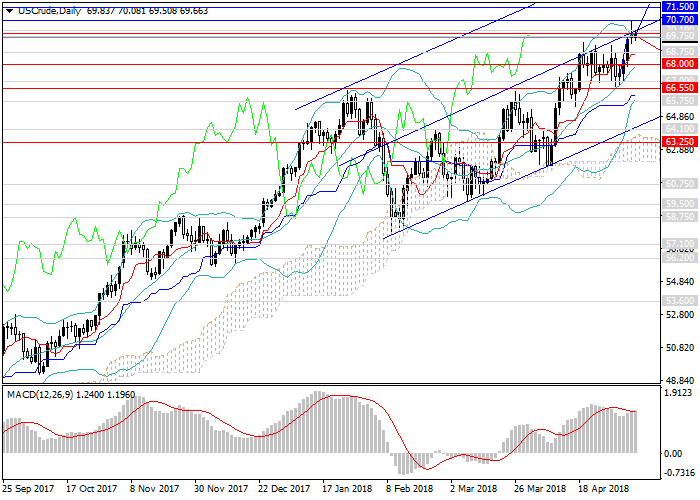

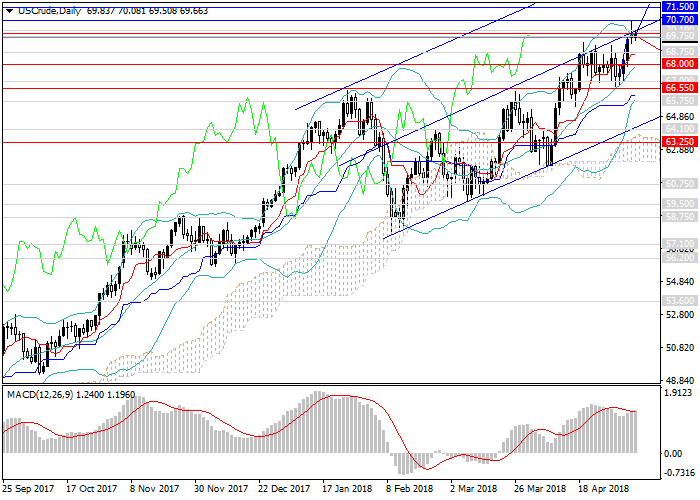

Oil prices are growing rapidly. Yesterday, it reached the key resistance level and the upper border of the upward channel at the level of 70.70 USD per barrel, despite the significant strengthening of American currency and increase in rigs number and production volumes in the USA. The main growth catalyst is OPEC+ oil production limitation agreement and a gradual increase in demand for the source of energy. The “black gold” market is restoring and returning to the price balance.

In the second half of the week, a number of key releases will be published in the USA, which can support USD, so oil prices can be corrected downwards.

Support and resistance

The price stays within the upward trend. The further growth is possible in the long term. In the short term, a slight decrease to the lower border of the channel (67.00, 65.55) is possible, after which the upward momentum will be restored. In case of the breakout of the level of 70.70, the upward impulse will strengthen, and the price will test new local highs of 72.65, 74.00, and 75.00. The consolidation above the level of 75 USD per barrel is possible in the middle of summer.

Technical indicators confirm the growth forecast, MACD long positions’ volumes stay high, Bollinger Bands are pointed downwards.

Resistance levels: 70.10, 70.70, 71.50, 72.65, 74.00, 75.00.

Support levels: 68.75, 68.00, 67.00, 66.55, 64.10, 63.25, 60.75.

Trading tips

It is relevant to increase the volumes of long positions at the current level and open pending long positions from the levels of 67.00, 66.55 with the target at 75.00 and stop loss 65.20.

Oil prices are growing rapidly. Yesterday, it reached the key resistance level and the upper border of the upward channel at the level of 70.70 USD per barrel, despite the significant strengthening of American currency and increase in rigs number and production volumes in the USA. The main growth catalyst is OPEC+ oil production limitation agreement and a gradual increase in demand for the source of energy. The “black gold” market is restoring and returning to the price balance.

In the second half of the week, a number of key releases will be published in the USA, which can support USD, so oil prices can be corrected downwards.

Support and resistance

The price stays within the upward trend. The further growth is possible in the long term. In the short term, a slight decrease to the lower border of the channel (67.00, 65.55) is possible, after which the upward momentum will be restored. In case of the breakout of the level of 70.70, the upward impulse will strengthen, and the price will test new local highs of 72.65, 74.00, and 75.00. The consolidation above the level of 75 USD per barrel is possible in the middle of summer.

Technical indicators confirm the growth forecast, MACD long positions’ volumes stay high, Bollinger Bands are pointed downwards.

Resistance levels: 70.10, 70.70, 71.50, 72.65, 74.00, 75.00.

Support levels: 68.75, 68.00, 67.00, 66.55, 64.10, 63.25, 60.75.

Trading tips

It is relevant to increase the volumes of long positions at the current level and open pending long positions from the levels of 67.00, 66.55 with the target at 75.00 and stop loss 65.20.

No comments:

Write comments