EUR/USD: general review

08 May 2018, 15:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

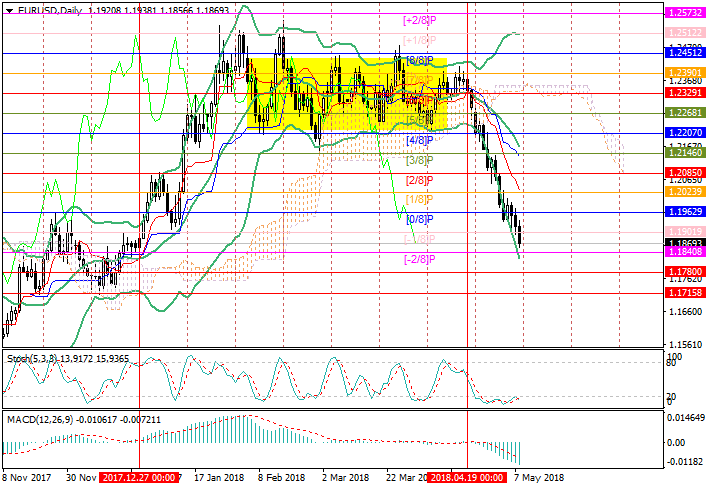

| Recommendation | SELL STOP |

| Entry Point | 1.1835 |

| Take Profit | 1.1780, 1.1715 |

| Stop Loss | 1.1880 |

| Key Levels | 1.1715, 1.1780, 1.1840, 1.1962, 1.2023, 1.2085 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1910 |

| Take Profit | 1.1962, 1.2023 |

| Stop Loss | 1.1870 |

| Key Levels | 1.1715, 1.1780, 1.1840, 1.1962, 1.2023, 1.2085 |

Current trend

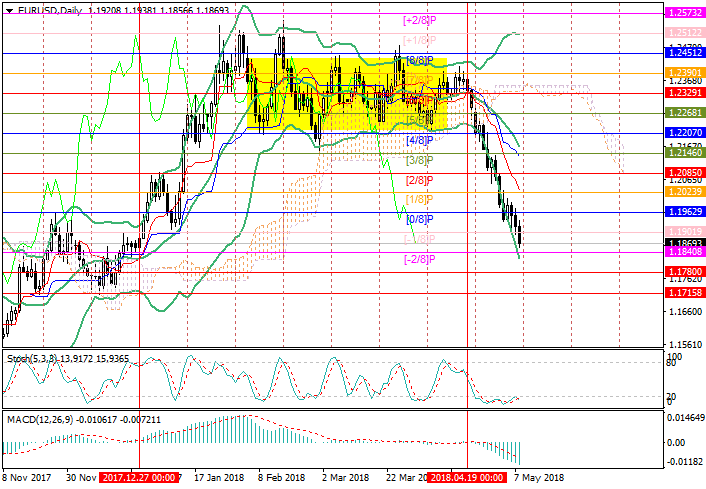

The pair continues to decline for the third consecutive week and today has reached its lowest level since December at 1.1870 mark.

EUR is crushed by weak data on GDP, inflation, and retail sales in the Eurozone. USD is supported by the expectation that the Fed will continue to raise the interest rate.

Today, the market is focused on the statements of American politicians. At the conference in Switzerland, the Fed head Jerome Powell noted that the market has already received a signal about intention to increase rates and should no longer be surprised at these actions. In the evening, President Trump should announce his decision on the Iranian nuclear deal. Experts believe that the US will withdraw from the agreement. Then, new sanctions may be introduced or the parties may try to conclude a new treaty. Other participants - France, Britain, and Iran - are strongly opposed to unilateral actions by the US, and Iranian President Hassan Rouhani said that the termination of the agreement would be a historical mistake. Breaking the deal could put pressure on USD and substantially support oil prices.

Support and resistance

The instrument tends to 1.1840 mark (Murray [-2/8]) and, in its breakdown, can continue the decline to 1.1780 (Murray [1/8], H4) and 1.1715 (Murray [8/8], W1) marks. With a reverse breakout of 1.1900 mark (Murray [-1/8]), an upward correction 1.1962 (Murray [0/8]) 1.2023 (Murray [1/8]) and 1.2085 (Murray [2/8]) marks is likely to develop.

Support levels: 1.1840, 1.1780, 1.1715.

Resistance levels: 1.1962, 1.2023, 1.2085.

Trading tips

Short positions may be opened below 1.1840 with targets at 1.1780, 1.1715 and stop-loss at 1.1880.

Long positions may be opened from the level of 1.1910 with targets at 1.1962, 1.2023 and the stop-loss at 1.1870.

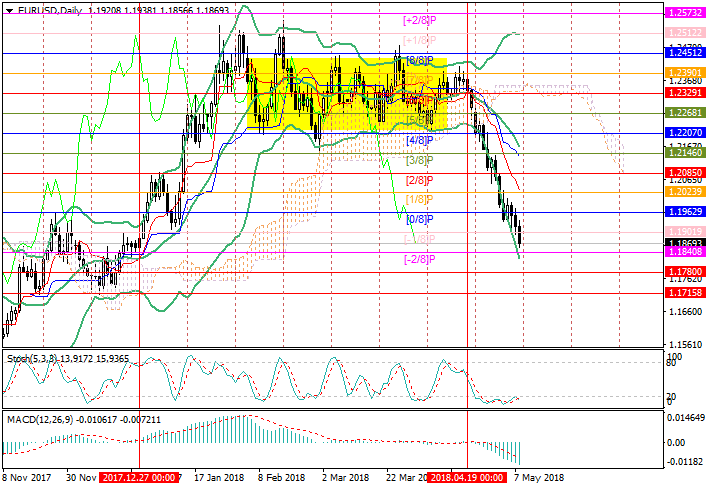

The pair continues to decline for the third consecutive week and today has reached its lowest level since December at 1.1870 mark.

EUR is crushed by weak data on GDP, inflation, and retail sales in the Eurozone. USD is supported by the expectation that the Fed will continue to raise the interest rate.

Today, the market is focused on the statements of American politicians. At the conference in Switzerland, the Fed head Jerome Powell noted that the market has already received a signal about intention to increase rates and should no longer be surprised at these actions. In the evening, President Trump should announce his decision on the Iranian nuclear deal. Experts believe that the US will withdraw from the agreement. Then, new sanctions may be introduced or the parties may try to conclude a new treaty. Other participants - France, Britain, and Iran - are strongly opposed to unilateral actions by the US, and Iranian President Hassan Rouhani said that the termination of the agreement would be a historical mistake. Breaking the deal could put pressure on USD and substantially support oil prices.

Support and resistance

The instrument tends to 1.1840 mark (Murray [-2/8]) and, in its breakdown, can continue the decline to 1.1780 (Murray [1/8], H4) and 1.1715 (Murray [8/8], W1) marks. With a reverse breakout of 1.1900 mark (Murray [-1/8]), an upward correction 1.1962 (Murray [0/8]) 1.2023 (Murray [1/8]) and 1.2085 (Murray [2/8]) marks is likely to develop.

Support levels: 1.1840, 1.1780, 1.1715.

Resistance levels: 1.1962, 1.2023, 1.2085.

Trading tips

Short positions may be opened below 1.1840 with targets at 1.1780, 1.1715 and stop-loss at 1.1880.

Long positions may be opened from the level of 1.1910 with targets at 1.1962, 1.2023 and the stop-loss at 1.1870.

No comments:

Write comments