USD/JPY: Murrey analysis

15 May 2018, 14:36

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 109.30 |

| Take Profit | 107.81, 107.03 |

| Stop Loss | 109.85 |

| Key Levels | 107.03, 107.81, 110.15, 110.93, 112.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 110.20 |

| Take Profit | 110.93, 112.50 |

| Stop Loss | 109.80 |

| Key Levels | 107.03, 107.81, 110.15, 110.93, 112.50 |

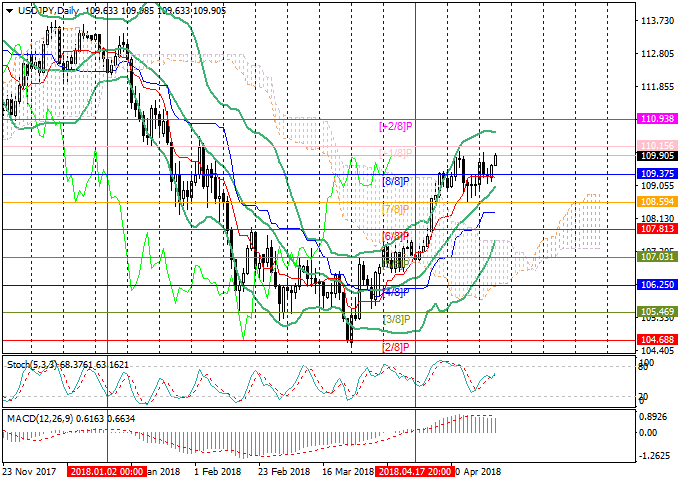

On D1 chart, the price rose above the level of 109.37 ([8/8]) and tends to

110.15 ([+1/8]) mark, which remains unapproachable since the beginning of the

month. If the instrument consolidates above it, the growth may continue to

110.93 ([+2/8]) and 112.50 ([8/8], W1) marks.

However, the price went beyond the main trading range of Murray and is in the zone of a possible reversal. The key mark for the “bears” will be 109.37. If the instrument consolidates below it and the middle line of Bollinger Bands, a downward correction may develop to the levels of 107.81 ([6/8]) and 107.03 ([5/8]).

Technical indicators do not provide a clear signal: Stochastic is directed upwards, and MACD histogram is stable in the positive zone.

Support and resistance

Support levels: 107.81 ([6/8]), 107.03 ([6/8]).

Resistance levels: 110.15 ([+1/8]), 110.93 ([+2/8]), 112.50 ([8/8], W1).

Trading tips

Short positions may be opened below the level of 109.37 and the middle line of Bollinger Bands with targets at 107.81, 107.03 and stop-loss at 109.85.

Long positions may be opened above the level of 110.15 with targets at 110.93, 112.50 and stop-loss at 109.80.

Implementation time: 5-7 days.

However, the price went beyond the main trading range of Murray and is in the zone of a possible reversal. The key mark for the “bears” will be 109.37. If the instrument consolidates below it and the middle line of Bollinger Bands, a downward correction may develop to the levels of 107.81 ([6/8]) and 107.03 ([5/8]).

Technical indicators do not provide a clear signal: Stochastic is directed upwards, and MACD histogram is stable in the positive zone.

Support and resistance

Support levels: 107.81 ([6/8]), 107.03 ([6/8]).

Resistance levels: 110.15 ([+1/8]), 110.93 ([+2/8]), 112.50 ([8/8], W1).

Trading tips

Short positions may be opened below the level of 109.37 and the middle line of Bollinger Bands with targets at 107.81, 107.03 and stop-loss at 109.85.

Long positions may be opened above the level of 110.15 with targets at 110.93, 112.50 and stop-loss at 109.80.

Implementation time: 5-7 days.

No comments:

Write comments