Brent Crude Oil: general analysis

15 May 2018, 14:40

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 78.12 |

| Take Profit | 79.25 |

| Stop Loss | 77.65 |

| Key Levels | 77.65, 78.12, 79.00, 79.25 |

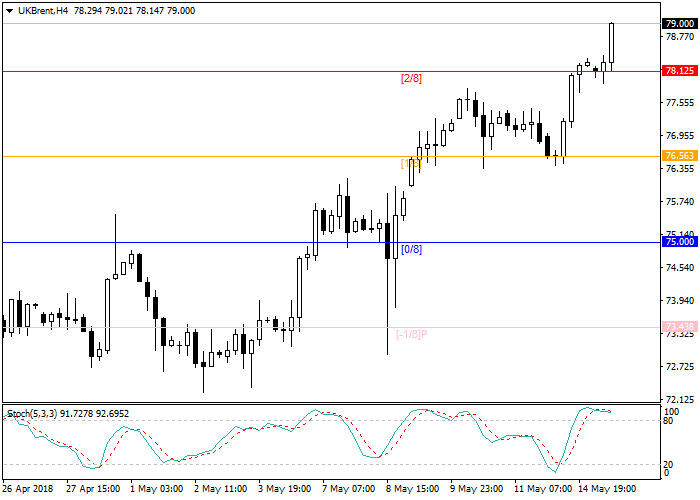

Current trend

Oil is trading within the upward trend; the nearest key support level is 78.12 or 2/8 Murray. The demand on the energy source is due to the tightening of the situation with Iran: the US President stated that the country is ready to decrease the volume of oil purchase and thus increase the economic pressure. If the situation gets worse, the price can reach the key level of 100 USD.

According to OPEC report, worldwide consumption growth by 0.025 million barrel per day is expected. On the other hand, the production of US shale oil will increase, too, thus, the total demand can be balanced. Preliminary estimated, in June, shale oil companies can build on the indicator to 7.178 million barrel per day due to high prices and favorable conditions. In general, the background is positive, so the prices will grow.

Support and resistance

Stochastic is at the level of 98 points and reflects the possibility of a correction.

Resistance levels: 79.00, 79.25.

Support levels: 78.12, 77.65.

Trading tips

Long positions can be opened at the level 78.12 with the target at 79.25 and stop loss 77.65.

Oil is trading within the upward trend; the nearest key support level is 78.12 or 2/8 Murray. The demand on the energy source is due to the tightening of the situation with Iran: the US President stated that the country is ready to decrease the volume of oil purchase and thus increase the economic pressure. If the situation gets worse, the price can reach the key level of 100 USD.

According to OPEC report, worldwide consumption growth by 0.025 million barrel per day is expected. On the other hand, the production of US shale oil will increase, too, thus, the total demand can be balanced. Preliminary estimated, in June, shale oil companies can build on the indicator to 7.178 million barrel per day due to high prices and favorable conditions. In general, the background is positive, so the prices will grow.

Support and resistance

Stochastic is at the level of 98 points and reflects the possibility of a correction.

Resistance levels: 79.00, 79.25.

Support levels: 78.12, 77.65.

Trading tips

Long positions can be opened at the level 78.12 with the target at 79.25 and stop loss 77.65.

No comments:

Write comments