NZD/USD: the fall will continue

15 May 2018, 14:43

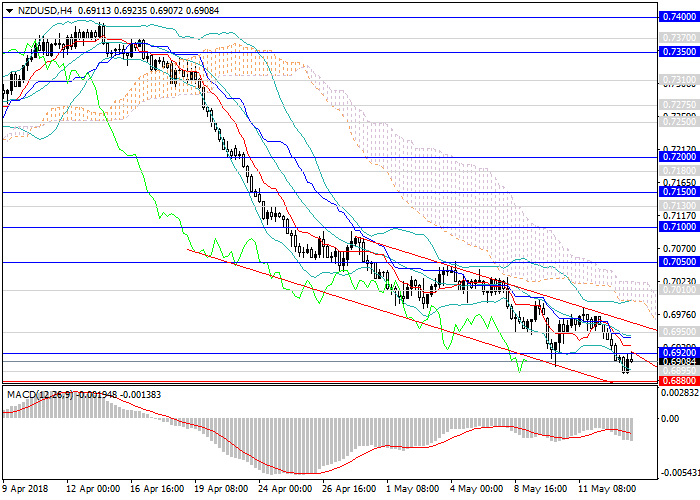

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.6894 |

| Take Profit | 0.6775, 0.6750 |

| Stop Loss | 0.6970 |

| Key Levels | 0.6575, 0.6680, 0.6750, 0.6770, 0.6820, 0.6880, 0.6895, 0.6920, 0.6950, 0.7010, 0.7050, 0.7150 |

Current trend

The New Zealand dollar continues to decline against the US one. The rapid fall of the end of April - the beginning of May slows down but does not stop.

The main catalyst for downward movement remains the significant demand for USD and weak macroeconomic data for the main sectors of the New Zealand economy. Since the beginning of last week, the pair has lost more than 100 points and reached a new local minimum at 0.6895.

RBNZ kept the current rate unchanged, and it became clear from the accompanying statement that the regulator would not change its monetary policy. The United States released multidirectional data on the labor market and major indices, but despite this, the pair could not adjust up, which indicates the weakness of NZD.

Support and resistance

In the future, the downward momentum will continue and the instrument may drop to new local lows of May and November 2017 - 0.6775, 0.6750 marks. Then one can count on a long upward correction, but a change in trend is unlikely: the pair will probably go to the lateral consolidation with a subsequent breakdown, and the long-term target will be the 0.6575 mark.

Technical indicators confirm the fall outlook: MACD indicates the preservation of the high volume of short positions, and Bollinger Bands are directed downwards.

Support levels: 0.6895, 0.6880, 0.6820, 0.6770, 0.6750, 0.6680, 0.6575.

Resistance levels: 0.6920, 0.6950, 0.7010, 0.7050, 0.7150.

Trading tips

In this situation, short positions may be opened from the current level with targets at 0.6775, 0.6750 and stop-loss at 0.6970.

The New Zealand dollar continues to decline against the US one. The rapid fall of the end of April - the beginning of May slows down but does not stop.

The main catalyst for downward movement remains the significant demand for USD and weak macroeconomic data for the main sectors of the New Zealand economy. Since the beginning of last week, the pair has lost more than 100 points and reached a new local minimum at 0.6895.

RBNZ kept the current rate unchanged, and it became clear from the accompanying statement that the regulator would not change its monetary policy. The United States released multidirectional data on the labor market and major indices, but despite this, the pair could not adjust up, which indicates the weakness of NZD.

Support and resistance

In the future, the downward momentum will continue and the instrument may drop to new local lows of May and November 2017 - 0.6775, 0.6750 marks. Then one can count on a long upward correction, but a change in trend is unlikely: the pair will probably go to the lateral consolidation with a subsequent breakdown, and the long-term target will be the 0.6575 mark.

Technical indicators confirm the fall outlook: MACD indicates the preservation of the high volume of short positions, and Bollinger Bands are directed downwards.

Support levels: 0.6895, 0.6880, 0.6820, 0.6770, 0.6750, 0.6680, 0.6575.

Resistance levels: 0.6920, 0.6950, 0.7010, 0.7050, 0.7150.

Trading tips

In this situation, short positions may be opened from the current level with targets at 0.6775, 0.6750 and stop-loss at 0.6970.

No comments:

Write comments