Ethereum: general analysis

15 May 2018, 13:01

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 670.00 |

| Take Profit | 625.00, 562.50 |

| Stop Loss | 720.00 |

| Key Levels | 562.50, 625.00, 687.50, 750.00, 812.50, 875.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 760.00 |

| Take Profit | 812.50, 875.00 |

| Stop Loss | 710.00 |

| Key Levels | 562.50, 625.00, 687.50, 750.00, 812.50, 875.00 |

Current trend

At the beginning of the week, Ether price stopped the correctional decrease, and it is now trading around 725.00. The instrument is supported by the news that the American company CME Group in partnership with the British Crypto Facilities intends to provide the clients with a reference Ethereum price, nominated in USD. It will be calculated on a base of trading sessions on cryptoexchanges Kraken (USA) and Bitstamp (Luxembourg). According to the experts, this can be a preparation for a start of Ethereum futures contracts trade. At the end of the last year, CME Group launched a similar Bitcoin futures trade.

In other news, the head of St. Louis FRB James Bullard stated that the main problem of cryptocurrencies is the volatility of prices, which can deter private investors and business.

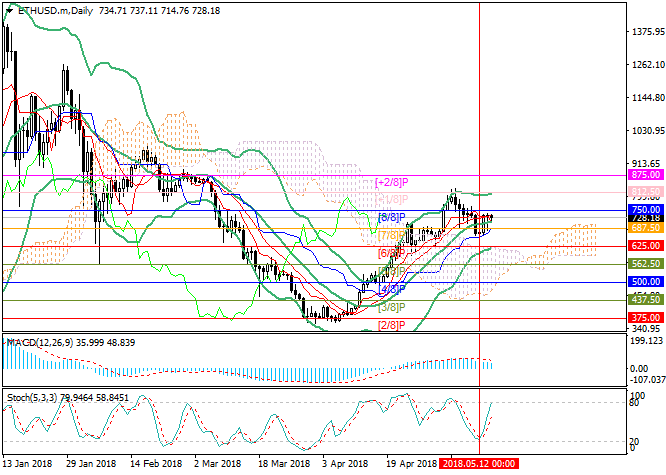

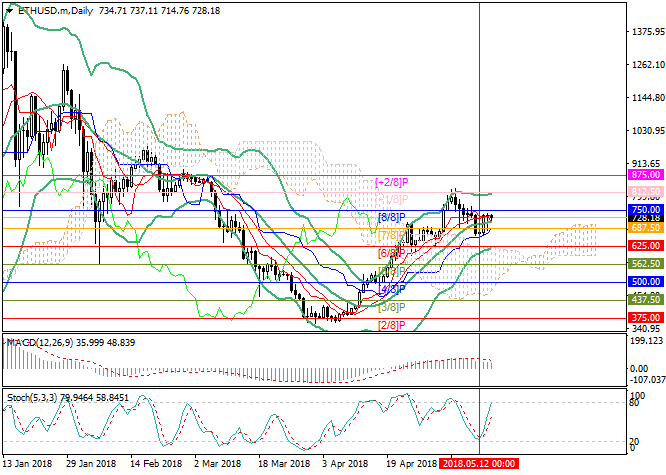

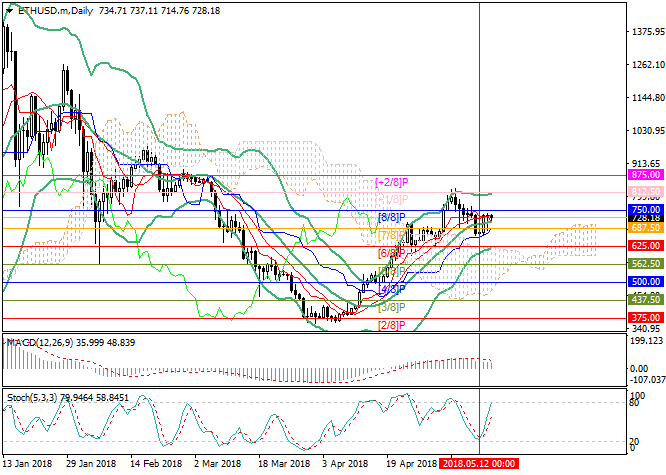

Support and resistance

The key “bullish” level is 750.00 (Murray [8/8]), after the breakout, the price can reach the levels of 812.50 (Murray [+1/8], the upper border of Bollinger Bands) and 875.00 (Murray [+2/8]). However, it is better to treat long positions carefully, as on the daily chart, Stochastic is reaching the overbought area, and on the weekly chart, it is ready to leave it. After the reversal, the “bearish” targets can become the levels of 625.00 (Murray [6/8]) and 562.50 (Murray [5/8]).

Resistance levels: 750.00, 812.50, 875.00.

Support levels: 687.50, 625.00, 562.50.

Trading tips

Short positions can be opened below the level of 687.50 with the targets at 625.00, 562.50 and stop loss around of the level 720.00.

Long positions can be opened above the level of 750.00 with the targets at 812.50, 875.00 and stop loss near the level of 710.00.

Implementation period: 5–7 days.

At the beginning of the week, Ether price stopped the correctional decrease, and it is now trading around 725.00. The instrument is supported by the news that the American company CME Group in partnership with the British Crypto Facilities intends to provide the clients with a reference Ethereum price, nominated in USD. It will be calculated on a base of trading sessions on cryptoexchanges Kraken (USA) and Bitstamp (Luxembourg). According to the experts, this can be a preparation for a start of Ethereum futures contracts trade. At the end of the last year, CME Group launched a similar Bitcoin futures trade.

In other news, the head of St. Louis FRB James Bullard stated that the main problem of cryptocurrencies is the volatility of prices, which can deter private investors and business.

Support and resistance

The key “bullish” level is 750.00 (Murray [8/8]), after the breakout, the price can reach the levels of 812.50 (Murray [+1/8], the upper border of Bollinger Bands) and 875.00 (Murray [+2/8]). However, it is better to treat long positions carefully, as on the daily chart, Stochastic is reaching the overbought area, and on the weekly chart, it is ready to leave it. After the reversal, the “bearish” targets can become the levels of 625.00 (Murray [6/8]) and 562.50 (Murray [5/8]).

Resistance levels: 750.00, 812.50, 875.00.

Support levels: 687.50, 625.00, 562.50.

Trading tips

Short positions can be opened below the level of 687.50 with the targets at 625.00, 562.50 and stop loss around of the level 720.00.

Long positions can be opened above the level of 750.00 with the targets at 812.50, 875.00 and stop loss near the level of 710.00.

Implementation period: 5–7 days.

No comments:

Write comments