USD/JPY: Murray analysis

23 May 2018, 13:20

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 109.30 |

| Take Profit | 108.60, 107.81 |

| Stop Loss | 109.80 |

| Key Levels | 107.81, 108.60, 109.37, 110.93, 112.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 110.00 |

| Take Profit | 110.93 |

| Stop Loss | 109.50 |

| Key Levels | 107.81, 108.60, 109.37, 110.93, 112.50 |

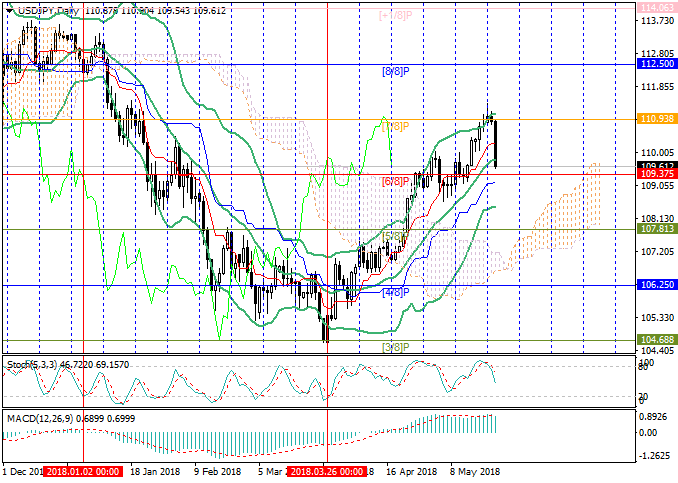

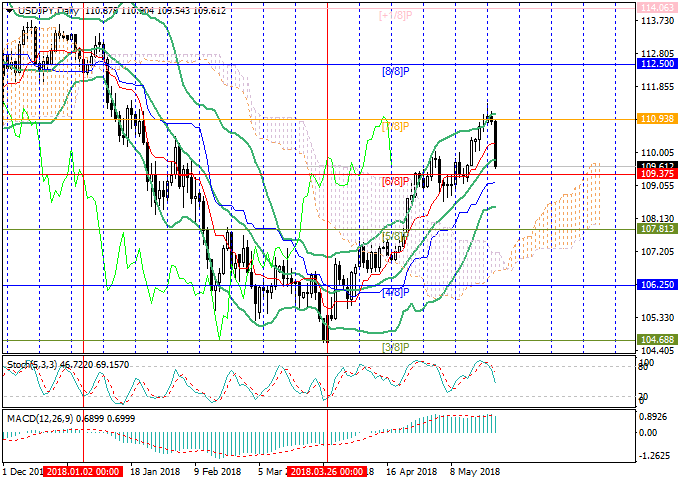

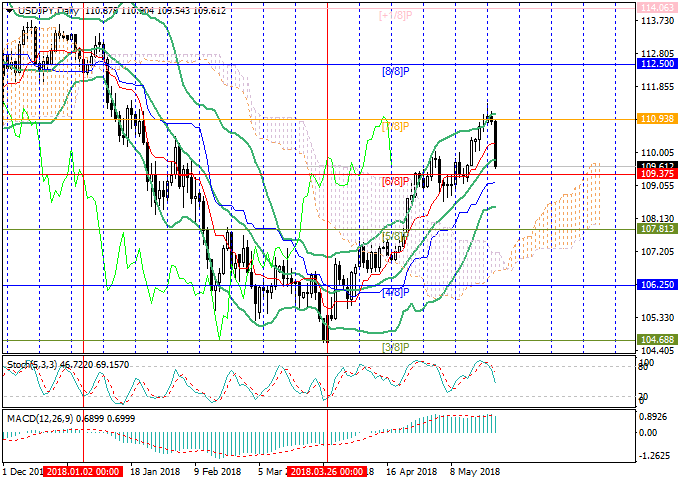

On the daily chart, the price was corrected to the middle line of Bollinger

Bands around 109.70 and can fall to the levels of 109.37 ([6/8]), 108.60

([–2/8], H4) and 107.81 ([5/8]). Otherwise, the instrument can return to the

area of May’s highs at the level of 110.93 ([7/8]). Technical indicators reflect

the fall, Stochastic has left the overbought zone, and MACD is decreasing in the

positive zone. The level of 109.37 is quite strong; the upward reversal is not

excluded there.

Support and resistance

Resistance levels: 110.93 ([7/8]), 112.50 ([8/8]).

Support levels: 109.37 ([6/8]), 108.60 ([–2/8], H4), 107.81 ([5/8]).

Trading tips

Short positions can be opened below the level of 109.37 with the targets at 108.60 and 107.81 and stop loss around 109.80.

Long positions can be opened after the reversal of the price around 109.37 and consolidation above the level of 109.70 with the target at 110.93 and stop loss around the level of 109.50.

Implementation period: 5–7 days.

Support and resistance

Resistance levels: 110.93 ([7/8]), 112.50 ([8/8]).

Support levels: 109.37 ([6/8]), 108.60 ([–2/8], H4), 107.81 ([5/8]).

Trading tips

Short positions can be opened below the level of 109.37 with the targets at 108.60 and 107.81 and stop loss around 109.80.

Long positions can be opened after the reversal of the price around 109.37 and consolidation above the level of 109.70 with the target at 110.93 and stop loss around the level of 109.50.

Implementation period: 5–7 days.

No comments:

Write comments