USD/CHF: technical analysis

11 May 2018, 12:31

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 1.0014 |

| Take Profit | 1.0095 |

| Stop Loss | 0.9960 |

| Key Levels | 0.9842, 0.9876, 0.9912, 0.9963, 1.0001, 1.0020, 1.0145, 1.0096, 1.0050 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9950 |

| Take Profit | 0.9875 |

| Stop Loss | 1.0005 |

| Key Levels | 0.9842, 0.9876, 0.9912, 0.9963, 1.0001, 1.0020, 1.0145, 1.0096, 1.0050 |

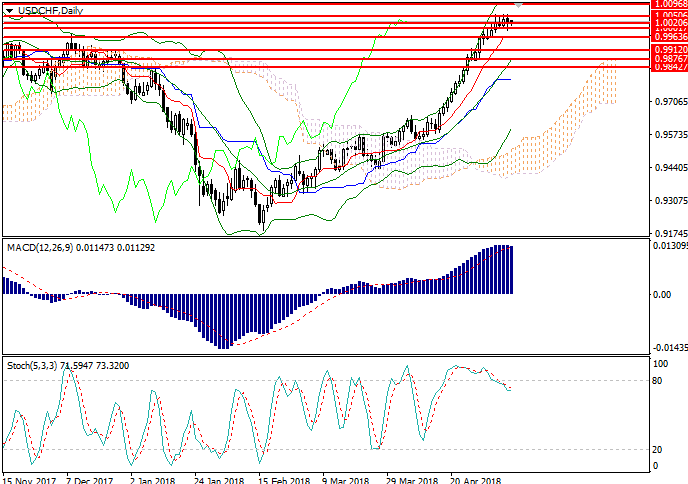

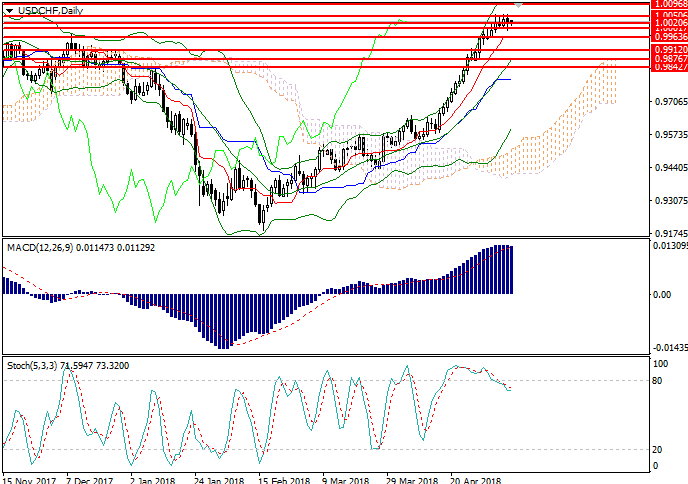

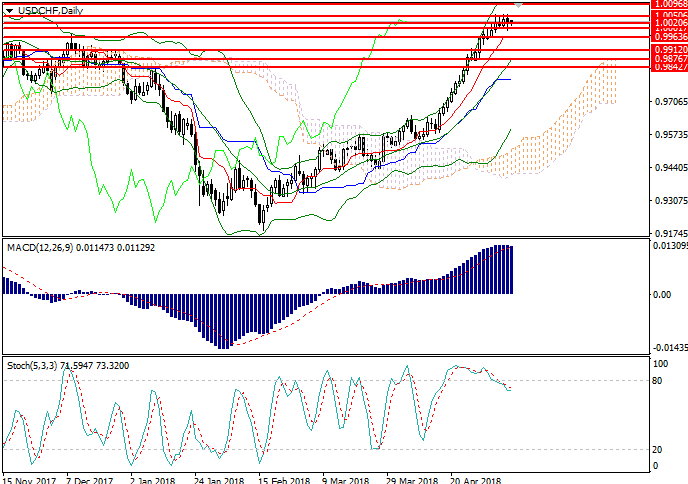

USD/CHF, D1

On the daily chart, the instrument is strengthening along the upper border of Bollinger Bands. The indicator is pointed upwards, as the price range is widening, which reflects the further growth of the pair. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic has left the oversold area, forming a strong sell signal.

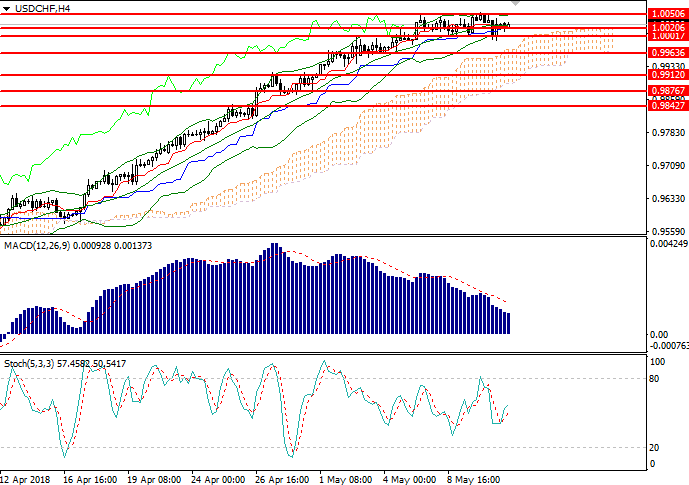

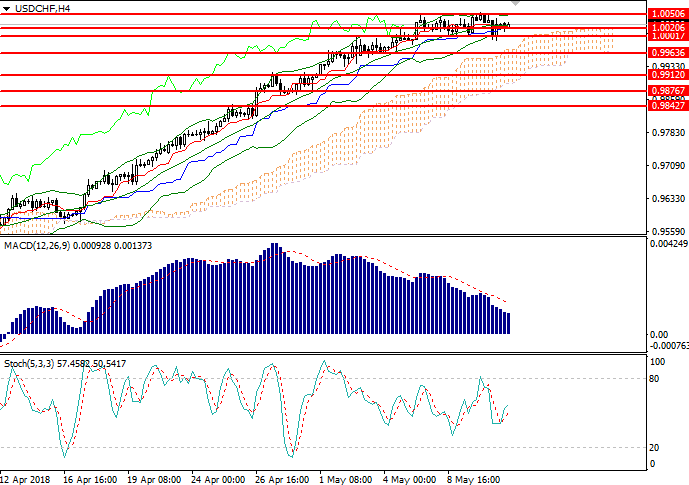

USD/CHF, H4

On the 4-hour chart, the instrument is moving within the range of 1.0000–10050. Bollinger Bands are pointed horizontally, as the price range has narrowed, which reflects the development of the correction. MACD histogram is in the positive zone, its volumes have insignificantly decreased, and the buy signal is relevant. Stochastic is in the neutral zone, giving no signal to enter the market.

Key levels

Resistance levels: 1.0050, 1.0096, 1.0145.

Support levels: 0.9842, 0.9876, 0.9912, 0.9963, 1.0001, 1.0020.

Trading tips

Long positions can be opened at the current level with the target at 1.0095 and stop loss 0.9960. Implementation period: 1–3 days

Short positions can be opened below the level of 0.9960 with the target at 0.9875 and stop loss 1.0005. Implementation period: 1–2 days.

On the daily chart, the instrument is strengthening along the upper border of Bollinger Bands. The indicator is pointed upwards, as the price range is widening, which reflects the further growth of the pair. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic has left the oversold area, forming a strong sell signal.

USD/CHF, H4

On the 4-hour chart, the instrument is moving within the range of 1.0000–10050. Bollinger Bands are pointed horizontally, as the price range has narrowed, which reflects the development of the correction. MACD histogram is in the positive zone, its volumes have insignificantly decreased, and the buy signal is relevant. Stochastic is in the neutral zone, giving no signal to enter the market.

Key levels

Resistance levels: 1.0050, 1.0096, 1.0145.

Support levels: 0.9842, 0.9876, 0.9912, 0.9963, 1.0001, 1.0020.

Trading tips

Long positions can be opened at the current level with the target at 1.0095 and stop loss 0.9960. Implementation period: 1–3 days

Short positions can be opened below the level of 0.9960 with the target at 0.9875 and stop loss 1.0005. Implementation period: 1–2 days.

No comments:

Write comments