SPX: general review

11 May 2018, 12:51

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY LIMIT |

| Entry Point | 2714.8 |

| Take Profit | 2734.4 |

| Stop Loss | 2705.5 |

| Key Levels | 2695.3, 2714.8, 2734.4, 2755.5 |

Current trend

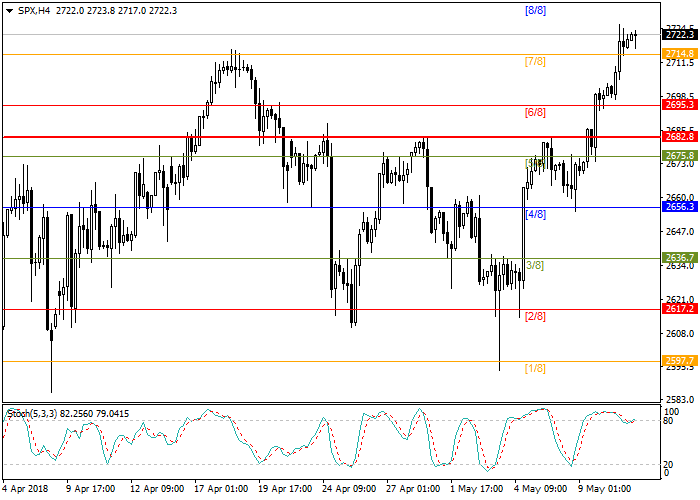

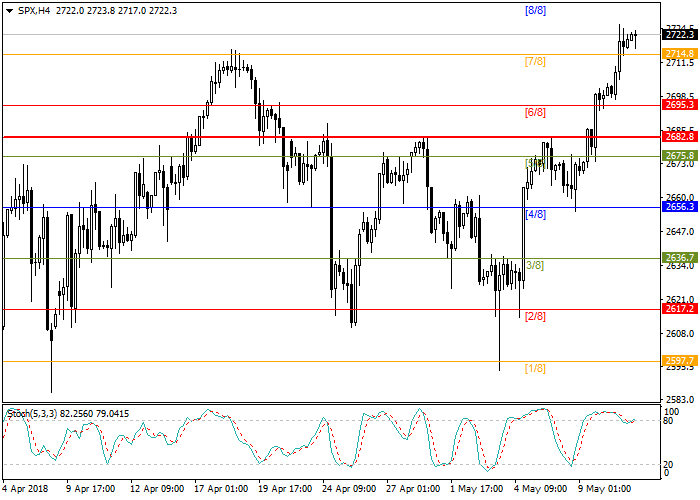

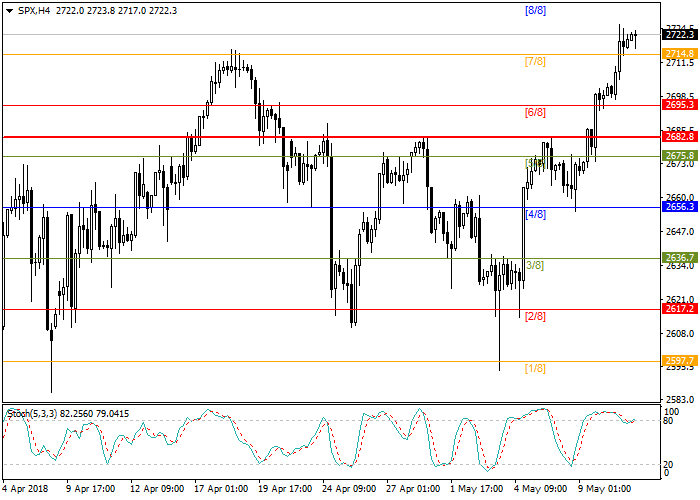

Yesterday, S&P500 index broke the important resistance level of 2741.8 and is currently traded at 2723.0 mark. The next target is level 2734.4 or 8/8 Murray.

The growth of the index was caused by the positive news: China and the US are ready to continue the dialogue on the protectionist policy in order to find an acceptable solution for both countries. The authorities of the Celestial Empire are ready to increase purchases of American goods in order to reduce trade imbalances. In the coming days, this issue will be discussed in Washington. The second factor, which has also supported the stock market, was inflation data: consumer price index amounted to 2.1% against expectations of 2.2%. Against this background, USD fell, as did the premium on 10-year bonds, strengthening the demand for stock assets.

Today, the consumer sentiment index and the import price index will be published. Regarding the latest indicators, the external background is still positive for the market.

Support and resistance

Stochastic is at the level of 85 points and indicates the possible correction.

Resistance levels: 2734.4, 2755.5.

Support levels: 2714.8, 2695.3.

Trading tips

Long positions may be opened from the level of 2714.8 with take-profit at 2734.4 and stop-loss at 2705.5.

Yesterday, S&P500 index broke the important resistance level of 2741.8 and is currently traded at 2723.0 mark. The next target is level 2734.4 or 8/8 Murray.

The growth of the index was caused by the positive news: China and the US are ready to continue the dialogue on the protectionist policy in order to find an acceptable solution for both countries. The authorities of the Celestial Empire are ready to increase purchases of American goods in order to reduce trade imbalances. In the coming days, this issue will be discussed in Washington. The second factor, which has also supported the stock market, was inflation data: consumer price index amounted to 2.1% against expectations of 2.2%. Against this background, USD fell, as did the premium on 10-year bonds, strengthening the demand for stock assets.

Today, the consumer sentiment index and the import price index will be published. Regarding the latest indicators, the external background is still positive for the market.

Support and resistance

Stochastic is at the level of 85 points and indicates the possible correction.

Resistance levels: 2734.4, 2755.5.

Support levels: 2714.8, 2695.3.

Trading tips

Long positions may be opened from the level of 2714.8 with take-profit at 2734.4 and stop-loss at 2705.5.

No comments:

Write comments