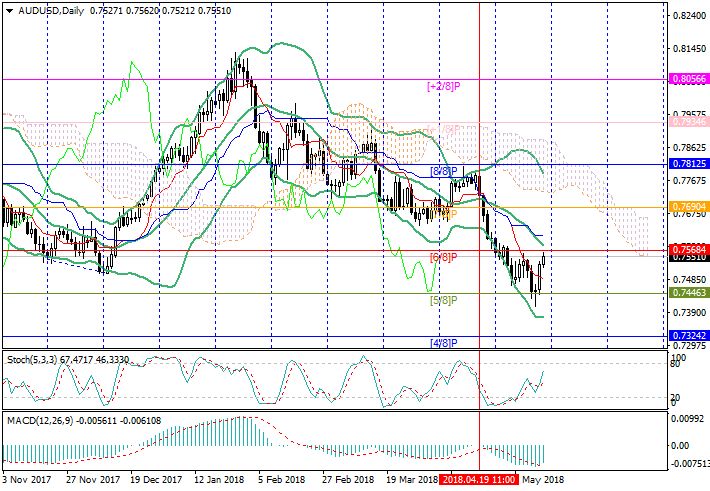

AUD/USD: Murrey analysis

11 May 2018, 15:14

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 0.7580 |

| Take Profit | 0.7690, 0.7812 |

| Stop Loss | 0.7520 |

| Key Levels | 0.7324, 0.7446, 0.7568, 0.7690, 0.7812 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7510 |

| Take Profit | 0.7446, 0.7324 |

| Stop Loss | 0.7560 |

| Key Levels | 0.7324, 0.7446, 0.7568, 0.7690, 0.7812 |

On D1 chart, the instrument rebounded from the 0.7446 mark ([5/8]) and

approaches the level of 0.7568 ([6/8]) near the midline of Bollinger Bands. It

is seen as the key for "bulls", its breakout can lead to an increase to the area

of 0.7690 ([7/8]) and 0.7812 ([8/8]) marks. Otherwise, the price may return to

the May lows in the area of 0.7446 and fall below the level of 0.7324 ([4/8],

the center of the trading range). Technical indicators generally allow growth:

Stochastic is directed upwards, and MACD histogram is reducing in the negative

zone.

Support and resistance

Support levels: 0.7446 ([5/8]), 0.7324 ([4/8]).

Resistance levels: 0.7568 ([6/8]), 0.7690 ([7/8]), 0.7812 ([8/8]).

Trading tips

Long positions may be opened when consolidating above the 0.7568 mark and the midline of Bollinger Bands with targets of 0.7690, 0.7812 and stop-loss at 0.7520.

Short positions may be opened if the instrument is reversed in the area of 0.7568 from the 0.7510 mark with targets at 0.7446, 0.7324 and stop-loss at 0.7560.

Implementation time: 5-7 days.

Support and resistance

Support levels: 0.7446 ([5/8]), 0.7324 ([4/8]).

Resistance levels: 0.7568 ([6/8]), 0.7690 ([7/8]), 0.7812 ([8/8]).

Trading tips

Long positions may be opened when consolidating above the 0.7568 mark and the midline of Bollinger Bands with targets of 0.7690, 0.7812 and stop-loss at 0.7520.

Short positions may be opened if the instrument is reversed in the area of 0.7568 from the 0.7510 mark with targets at 0.7446, 0.7324 and stop-loss at 0.7560.

Implementation time: 5-7 days.

No comments:

Write comments