Brent Сrude Oil: technical analysis

11 May 2018, 12:20

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 75.70 |

| Take Profit | 77.65, 80.00 |

| Stop Loss | 74.60 |

| Key Levels | 72.15, 74.60, 75.70, 77.65, 80.00, 82.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 74.60 |

| Take Profit | 72.15 |

| Stop Loss | 75.70 |

| Key Levels | 72.15, 74.60, 75.70, 77.65, 80.00, 82.25 |

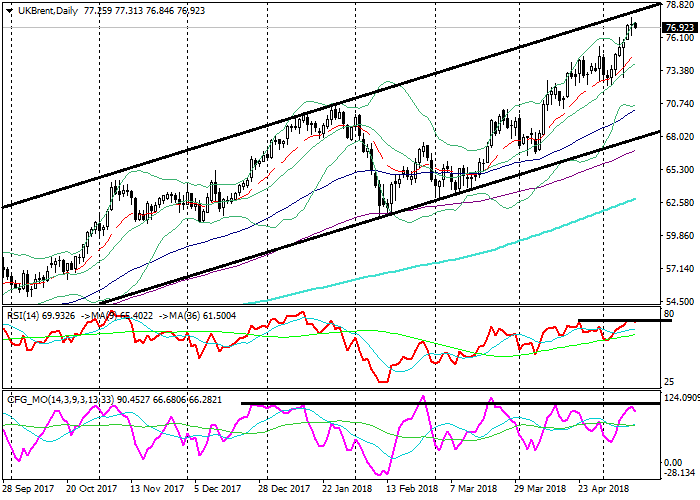

Brent, D1

On the daily chart, the instrument is trading on the upper line of the Bollinger Bands. The price remains above its moving averages that are directed up. The RSI is testing the border of the overbought zone. The Composite is testing its quite strong resistance as well.

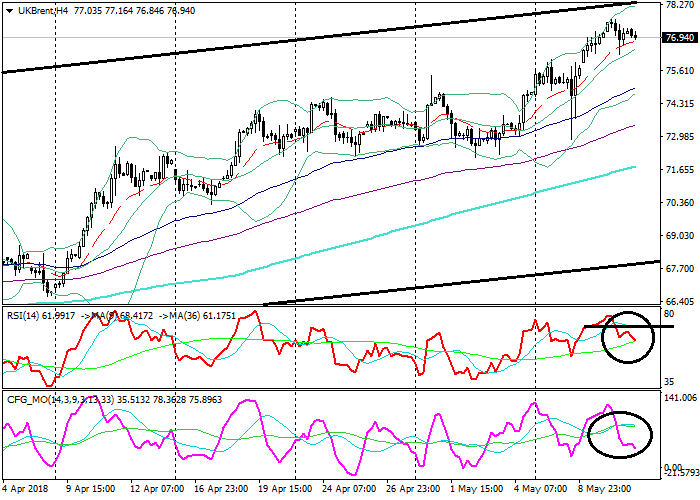

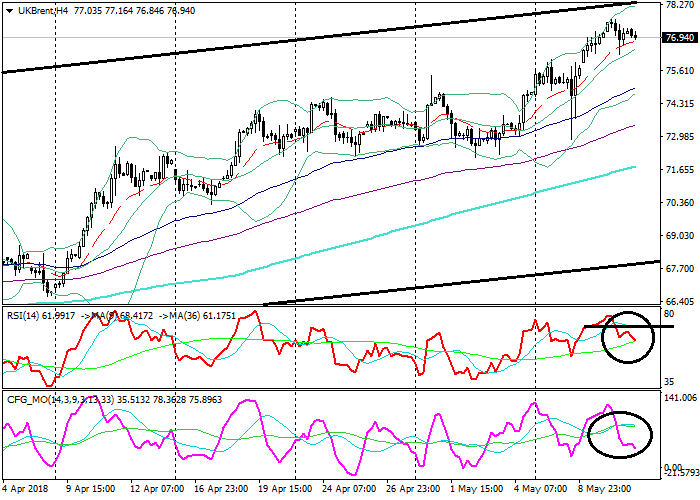

Brent, H4

On the 4-hour chart, the instrument is trading in the upper Bollinger band. The price remains above its moving averages that are directed up. The RSI is testing from above its longer MA, having left the overbought zone. The Composite is falling, having broken down its longer MA.

Key levels

Support levels: 75.70 (local lows), 74.60 (local lows), 72.15 (local lows).

Resistance levels: 77.65 (local highs), 80.00 (October 2009 highs), 82.25 (January 2010 highs).

Trading tips

The price is approaching the upper border of its ascending channel. There is a chance of a short-term downward correction.

Long positions can be opened from the level of 75.70 with targets at 77.65, 80.00 and stop-loss at 74.60. Validity – 3-5 days.

Short positions can be opened from the level of 74.60 with the target at 72.15 and stop-loss at 75.70. Validity – 3-5 days.

On the daily chart, the instrument is trading on the upper line of the Bollinger Bands. The price remains above its moving averages that are directed up. The RSI is testing the border of the overbought zone. The Composite is testing its quite strong resistance as well.

Brent, H4

On the 4-hour chart, the instrument is trading in the upper Bollinger band. The price remains above its moving averages that are directed up. The RSI is testing from above its longer MA, having left the overbought zone. The Composite is falling, having broken down its longer MA.

Key levels

Support levels: 75.70 (local lows), 74.60 (local lows), 72.15 (local lows).

Resistance levels: 77.65 (local highs), 80.00 (October 2009 highs), 82.25 (January 2010 highs).

Trading tips

The price is approaching the upper border of its ascending channel. There is a chance of a short-term downward correction.

Long positions can be opened from the level of 75.70 with targets at 77.65, 80.00 and stop-loss at 74.60. Validity – 3-5 days.

Short positions can be opened from the level of 74.60 with the target at 72.15 and stop-loss at 75.70. Validity – 3-5 days.

No comments:

Write comments