USD/CHF: the dollar is falling

28 May 2018, 09:44

| Scenario | |

|---|---|

| Timeframe | Intraday |

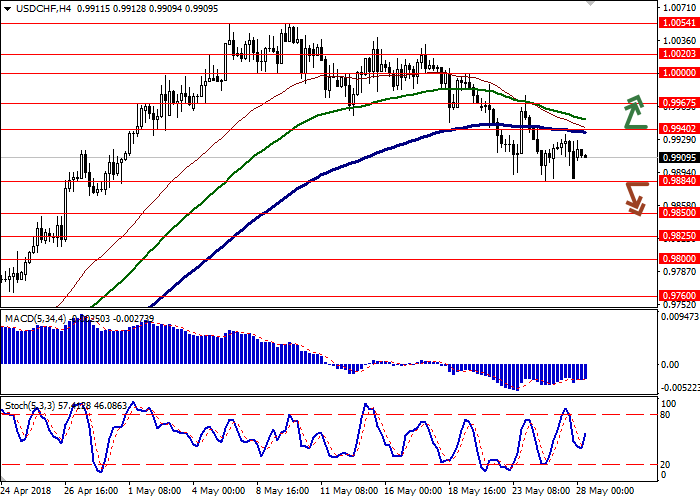

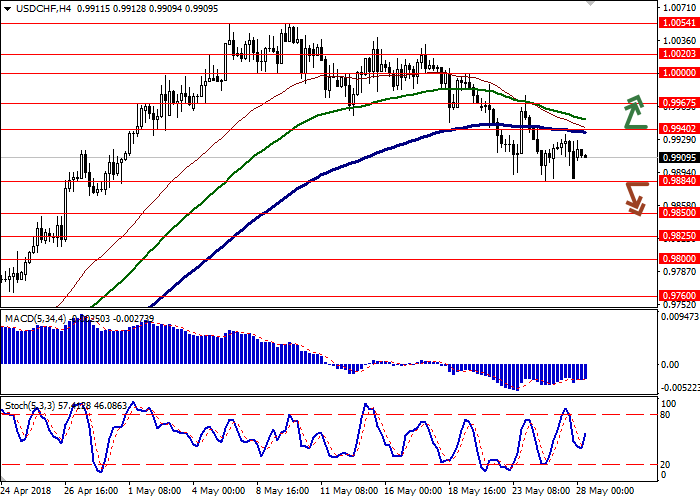

| Recommendation | BUY STOP |

| Entry Point | 0.9945 |

| Take Profit | 1.0000 |

| Stop Loss | 0.9900 |

| Key Levels | 0.9800, 0.9825, 0.9850, 0.9884, 0.9940, 0.9967, 1.0000, 1.0020 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9880 |

| Take Profit | 0.9825, 0.9800 |

| Stop Loss | 0.9915, 0.9920 |

| Key Levels | 0.9800, 0.9825, 0.9850, 0.9884, 0.9940, 0.9967, 1.0000, 1.0020 |

Current trend

On Friday, USD decreased against CHF, reaching the local lows since May 1, due to technical factors and rhetoric of Fed’s representatives Robert Kaplan, Raphael Bostic and Charles Evans.

CHF was moderately supported by positive EU statistics, namely German IFO – Business Climate release. In May, the indicator rose from 102.1 to 102.2 points. The strongest growth was prevented by the political crisis in Italy and Spain. The problem of the new Italian government, which does not intend to comply with the EU budget rules, may be worsened by the Spanish government crisis. The Socialist Party of Spain led by Pedro Sanchez is ready to initiate a vote of no confidence in Prime Minister Mariano Rajoy, Who advisers are of corruption. Partido Popular (People's Party), and Rajoy could be aware of it.

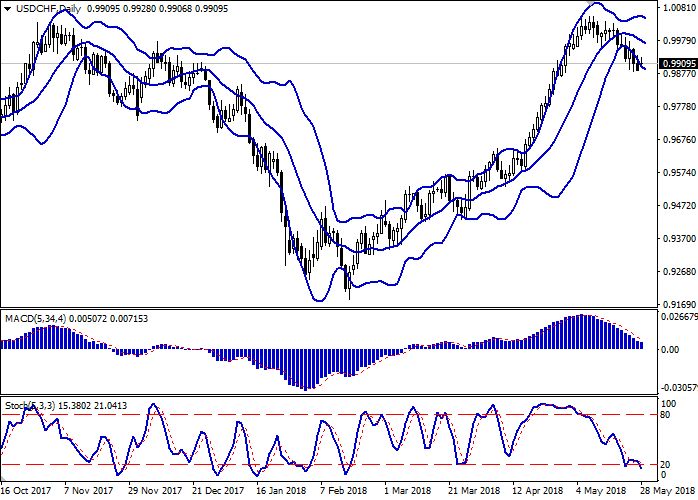

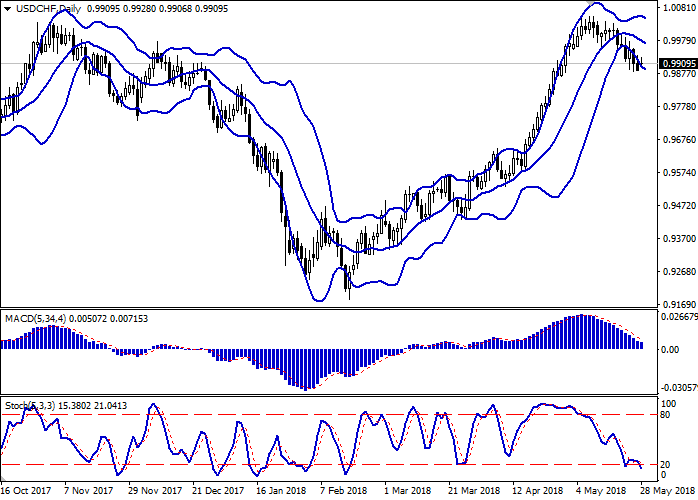

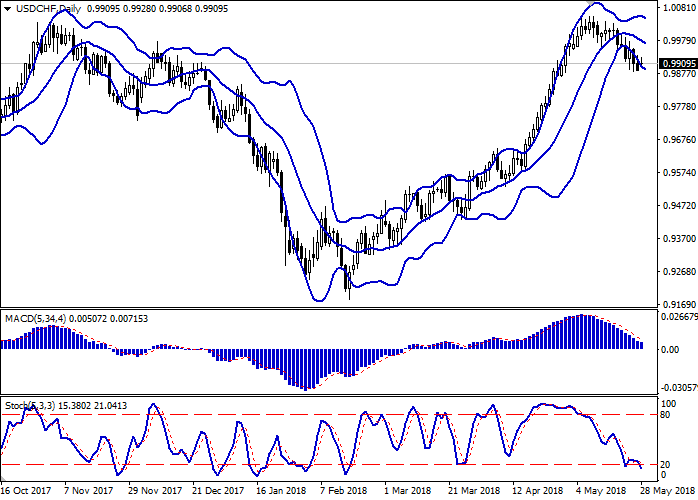

Support and resistance

On the daily chart, Bollinger bands are moderately falling. The price range is widening from below, but not as fast as the "bearish" dynamics is developing. MACD decreases, keeping a strong sell signal (the histogram is below the signal line). Stochastic is pointing down but is reaching its lows, reflecting that USD is oversold in the short term.

It is better to keep part of the current short positions in the short term, but not to open new ones.

Resistance levels: 0.9940, 0.9967, 1.0000, 1.0020.

Support levels: 0.9884, 0.9850, 0.9825, 0.9800.

Trading tips

Long positions can be opened after a breakout of the level of 0.9940 with the target at 1.0000 and stop loss 0.9900.

Short positions can be opened after the breakdown of the level of 0.9884 with the target at 0.9825 or 0.9800 and stop loss 0.9915–0.9920.

Implementation period: 2–3 days.

On Friday, USD decreased against CHF, reaching the local lows since May 1, due to technical factors and rhetoric of Fed’s representatives Robert Kaplan, Raphael Bostic and Charles Evans.

CHF was moderately supported by positive EU statistics, namely German IFO – Business Climate release. In May, the indicator rose from 102.1 to 102.2 points. The strongest growth was prevented by the political crisis in Italy and Spain. The problem of the new Italian government, which does not intend to comply with the EU budget rules, may be worsened by the Spanish government crisis. The Socialist Party of Spain led by Pedro Sanchez is ready to initiate a vote of no confidence in Prime Minister Mariano Rajoy, Who advisers are of corruption. Partido Popular (People's Party), and Rajoy could be aware of it.

Support and resistance

On the daily chart, Bollinger bands are moderately falling. The price range is widening from below, but not as fast as the "bearish" dynamics is developing. MACD decreases, keeping a strong sell signal (the histogram is below the signal line). Stochastic is pointing down but is reaching its lows, reflecting that USD is oversold in the short term.

It is better to keep part of the current short positions in the short term, but not to open new ones.

Resistance levels: 0.9940, 0.9967, 1.0000, 1.0020.

Support levels: 0.9884, 0.9850, 0.9825, 0.9800.

Trading tips

Long positions can be opened after a breakout of the level of 0.9940 with the target at 1.0000 and stop loss 0.9900.

Short positions can be opened after the breakdown of the level of 0.9884 with the target at 0.9825 or 0.9800 and stop loss 0.9915–0.9920.

Implementation period: 2–3 days.

No comments:

Write comments