AUD/USD: the pair shows mixed trend

28 May 2018, 09:34

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7595, 0.7610 |

| Take Profit | 0.7638, 0.7667 |

| Stop Loss | 0.7570, 0.7550 |

| Key Levels | 0.7468, 0.7500, 0.7521, 0.7541, 0.7588, 0.7603, 0.7638, 0.7667 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7535 |

| Take Profit | 0.7468, 0.7450 |

| Stop Loss | 0.7570 |

| Key Levels | 0.7468, 0.7500, 0.7521, 0.7541, 0.7588, 0.7603, 0.7638, 0.7667 |

Current trend

AUD fell against USD on May 25, but is again inclined to growth today.

The movement of the instrument last Friday was largely determined by technical factors, because there were no interesting publications from Australia. Monday, probably, will not bring anything new into the movement of the instrument, as the US markets will be closed on the occasion of Memorial Day.

Meanwhile, investors are concerned about the DPRK situation. On Thursday, US President Trump canceled the meeting with Kim Jong-un scheduled for June 12, referring to Pyongyang's hostility. In response, Korea stated that the country was still ready to begin the dialogue as soon as possible. However, it is unknown whether it will be, as, according to The Wall Street Journal, next week the US can imply new sanctions on North Korea.

Support and resistance

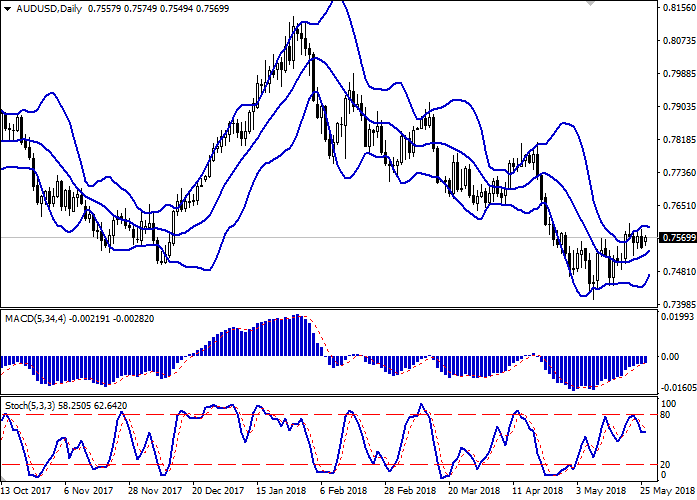

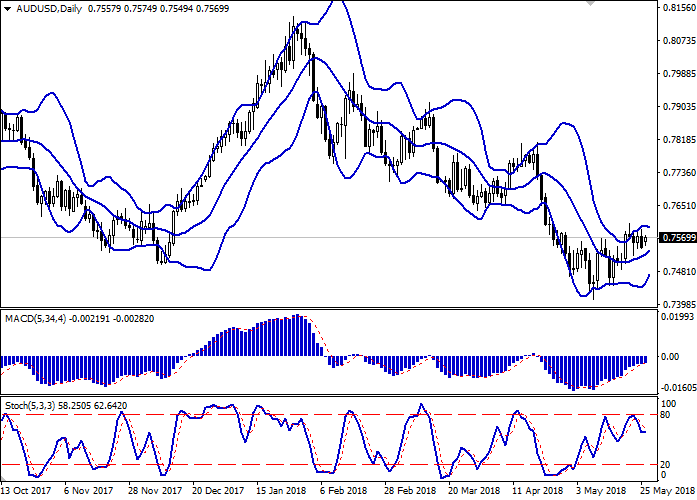

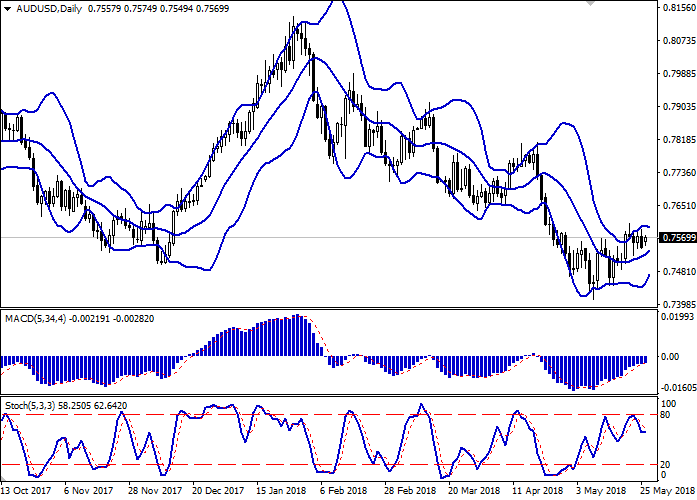

The Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the mixed nature of trading in recent days.

MACD indicator is growing keeping a stable buy signal (the histogram is above the signal line). In addition, the indicator is approaching zero mark.

Stochastic, after a short decline, reversed in a horizontal plane, indicating an approximate balance of power in the market.

Existing long positions should be left open for some time. One should wait for clarification of the situation to open new transactions.

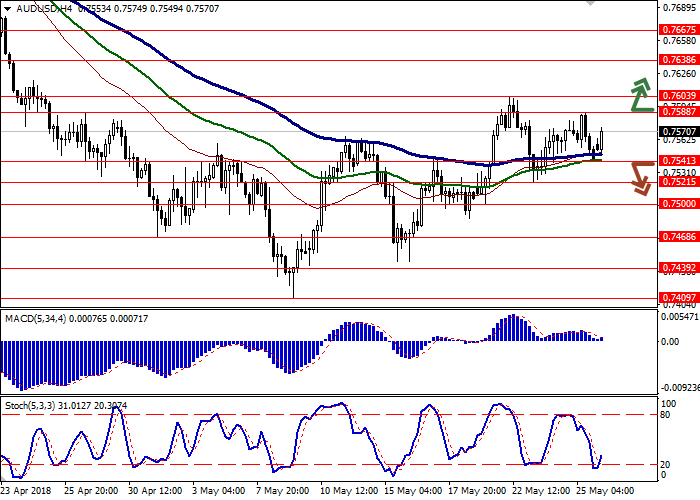

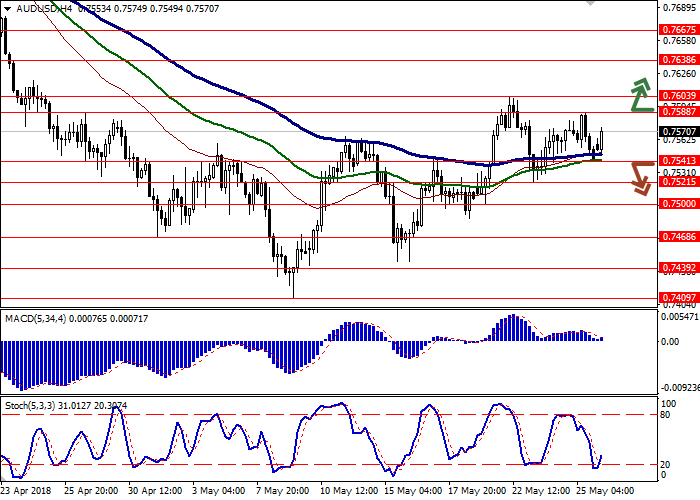

Resistance levels: 0.7588, 0.7603, 0.7638, 0.7667.

Support levels: 0.7541, 0.7521, 0.7500, 0.7468.

Trading tips

To open long positions, one can rely on the breakout of 0.7588 or 0.7603 marks. Take-profit — 0.7638 or 0.7667. Stop-loss — 0.7570, 0.7550.

The return of "bearish" trend with the breakdown of the level of 0.7541 may become a signal for new sales with the targets at 0.7468 or 0.7450. Stop-loss — 0.7570.

Implementation period: 2-3 days.

AUD fell against USD on May 25, but is again inclined to growth today.

The movement of the instrument last Friday was largely determined by technical factors, because there were no interesting publications from Australia. Monday, probably, will not bring anything new into the movement of the instrument, as the US markets will be closed on the occasion of Memorial Day.

Meanwhile, investors are concerned about the DPRK situation. On Thursday, US President Trump canceled the meeting with Kim Jong-un scheduled for June 12, referring to Pyongyang's hostility. In response, Korea stated that the country was still ready to begin the dialogue as soon as possible. However, it is unknown whether it will be, as, according to The Wall Street Journal, next week the US can imply new sanctions on North Korea.

Support and resistance

The Bollinger Bands in D1 chart show moderate growth. The price range is narrowing, reflecting the mixed nature of trading in recent days.

MACD indicator is growing keeping a stable buy signal (the histogram is above the signal line). In addition, the indicator is approaching zero mark.

Stochastic, after a short decline, reversed in a horizontal plane, indicating an approximate balance of power in the market.

Existing long positions should be left open for some time. One should wait for clarification of the situation to open new transactions.

Resistance levels: 0.7588, 0.7603, 0.7638, 0.7667.

Support levels: 0.7541, 0.7521, 0.7500, 0.7468.

Trading tips

To open long positions, one can rely on the breakout of 0.7588 or 0.7603 marks. Take-profit — 0.7638 or 0.7667. Stop-loss — 0.7570, 0.7550.

The return of "bearish" trend with the breakdown of the level of 0.7541 may become a signal for new sales with the targets at 0.7468 or 0.7450. Stop-loss — 0.7570.

Implementation period: 2-3 days.

No comments:

Write comments