USD/CAD: the instrument is strengthening

25 May 2018, 10:06

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2910 |

| Take Profit | 1.2950,1.2975, 1.3000 |

| Stop Loss | 1.2860, 1.2850 |

| Key Levels | 1.2700, 1.2744, 1.2800, 1.2860, 1.2900, 1.2947, 1.3000, 1.3045 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2855 |

| Take Profit | 1.2800, 1.2775, 1.2750 |

| Stop Loss | 1.2900 |

| Key Levels | 1.2700, 1.2744, 1.2800, 1.2860, 1.2900, 1.2947, 1.3000, 1.3045 |

Current trend

Yesterday, the US dollar grew moderately against the Canadian currency, renewing local highs since May 15.

Published on Wednesday, FOMC minutes did not clarify this number. Officials only noted that economic forecasts justify another increase in the near future. It was also stated that the excess of the target inflation level of 2.0% cannot be called stable, given the recent years, when it was seriously below this level.

Investors continue to follow the development of US-China trade disputes. The recent agreements on the mutual suspension of duties and of the US trade deficit with the US 200 billion aroused serious criticism in the US Congress. The Donald Trump to declare that the trade agreement with the PRC could be changed since it is difficult to verify its results.

Support and resistance

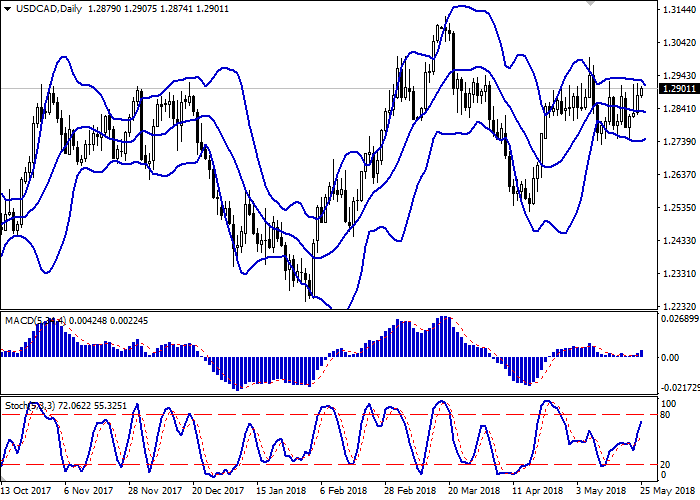

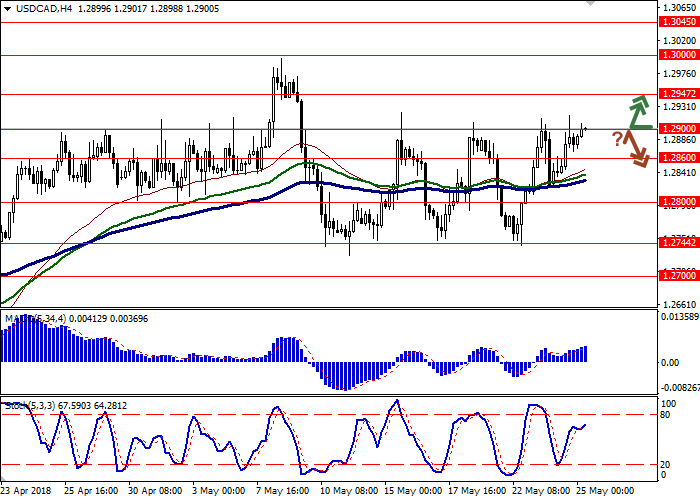

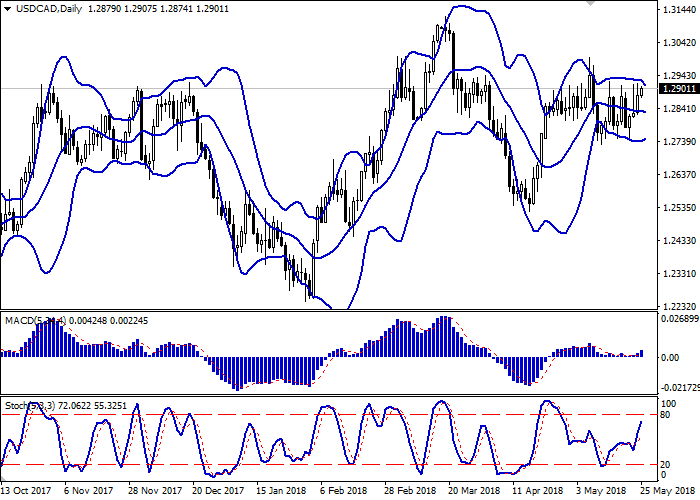

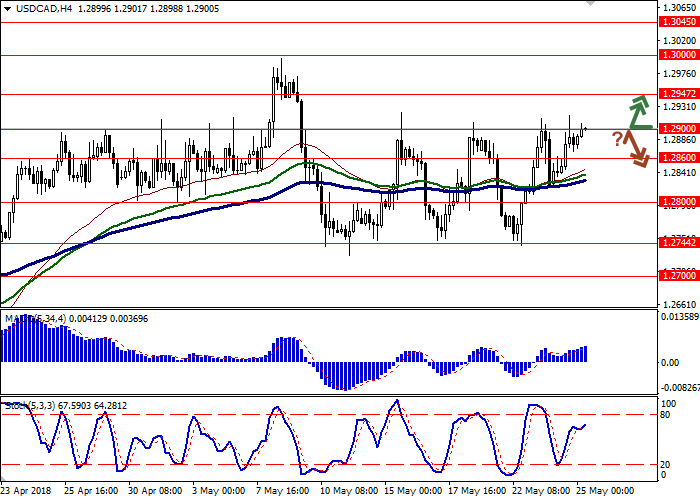

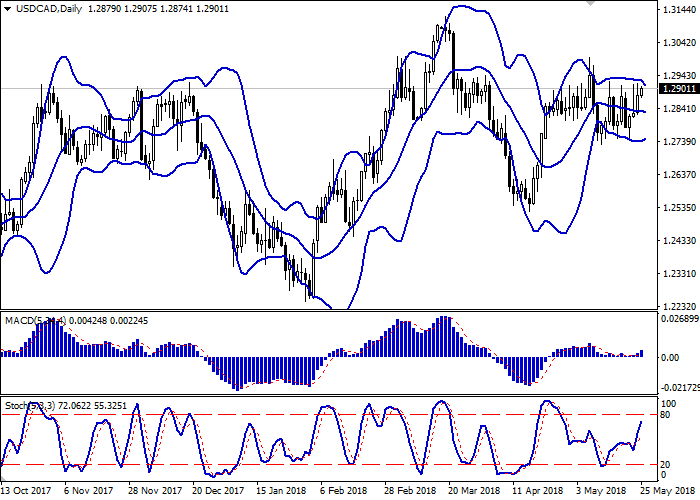

On the daily chart, the Bollinger bands are moving sideways. The price range is actively narrowing, reflecting the mixed nature of recent trade. MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic has reached its highs, reflecting that USD is overbought in the short term.

Indicators do not contradict the further development of the "bullish" trend in the short term.

Resistance levels: 1.2900, 1.2947, 1.3000, 1.3045.

Support levels: 1.2860, 1.2800, 1.2744, 1.2700.

Trading tips

Long positions can be opened after the breakdown of the level of 1.2900 with the targets at 1.2950–1.2975 or 1.3000 and stop loss 1.2860–1.2850.

Short positions can be opened after a rebound from the level of 1.2900 and breakdown of the level of 1.2860 with the targets at 1.2800 or 1.2775–1.2750 and stop loss 1.2900.

Implementation period: 2–3 days.

Yesterday, the US dollar grew moderately against the Canadian currency, renewing local highs since May 15.

Published on Wednesday, FOMC minutes did not clarify this number. Officials only noted that economic forecasts justify another increase in the near future. It was also stated that the excess of the target inflation level of 2.0% cannot be called stable, given the recent years, when it was seriously below this level.

Investors continue to follow the development of US-China trade disputes. The recent agreements on the mutual suspension of duties and of the US trade deficit with the US 200 billion aroused serious criticism in the US Congress. The Donald Trump to declare that the trade agreement with the PRC could be changed since it is difficult to verify its results.

Support and resistance

On the daily chart, the Bollinger bands are moving sideways. The price range is actively narrowing, reflecting the mixed nature of recent trade. MACD grows, keeping a moderate buy signal (the histogram is above the signal line). Stochastic has reached its highs, reflecting that USD is overbought in the short term.

Indicators do not contradict the further development of the "bullish" trend in the short term.

Resistance levels: 1.2900, 1.2947, 1.3000, 1.3045.

Support levels: 1.2860, 1.2800, 1.2744, 1.2700.

Trading tips

Long positions can be opened after the breakdown of the level of 1.2900 with the targets at 1.2950–1.2975 or 1.3000 and stop loss 1.2860–1.2850.

Short positions can be opened after a rebound from the level of 1.2900 and breakdown of the level of 1.2860 with the targets at 1.2800 or 1.2775–1.2750 and stop loss 1.2900.

Implementation period: 2–3 days.

No comments:

Write comments